Nordstrom 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in thousands except per share and per option amounts

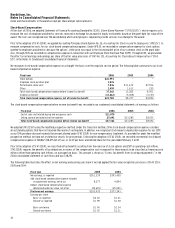

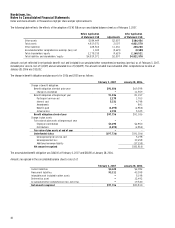

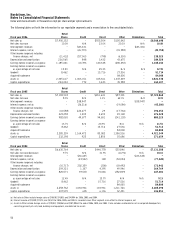

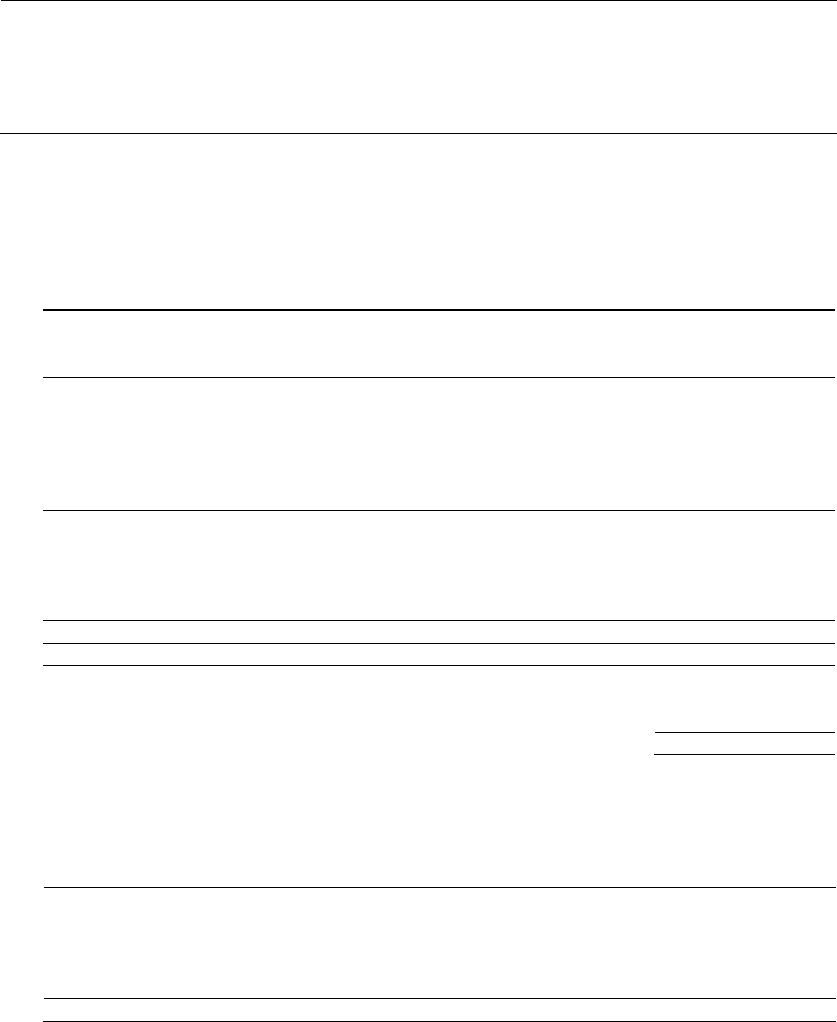

The following table reflects the effects of the adoption of SFAS 158 on our consolidated balance sheet as of February 3, 2007.

Before Application

After Application

of Statement 158

Adjustments

of Statement 158

Other assets

$184,449

$2,007

$186,456

Total assets

4,819,571

2,007

4,821,578

Other liabilities

228,564

11,636

240,200

Accumulated other comprehensive earnings (loss), net

1,049

(9,629)

(8,580)

Total shareholders’ equity

2,178,150

(9,629)

2,168,521

Total liabilities and shareholders’ equity

$4,819,571

$2,007

$4,821,578

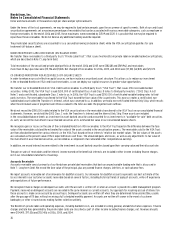

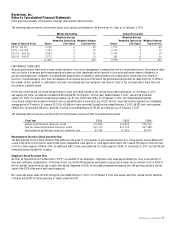

Amounts not yet reflected in net periodic benefit cost and included in accumulated other comprehensive earnings (pre-tax) as of February 3, 2007,

included prior service cost of $(4,149) and accumulated loss of $(38,699). The amount included in accumulated other comprehensive income at

January 28, 2006 was $32,032.

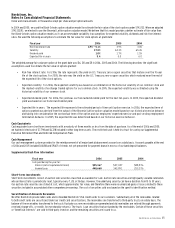

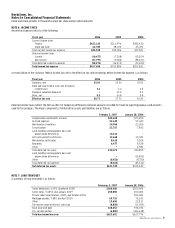

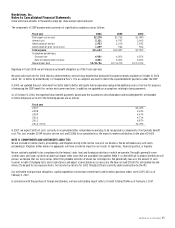

The change in benefit obligation and plan assets for 2006 and 2005 are as follows:

February 3, 2007

January 28, 2006

Change in benefit obligation:

Benefit obligation at end of prior year

$91,036

$69,598

Change in assumption

—

11,559

Benefit obligation at beginning of year

91,036

81,157

Participant service cost

2,270

1,763

Interest cost

5,331

4,748

Amendments

—

893

Benefits paid

(3,295)

(2,850)

Actuarial loss

2,394

5,325

Benefit obligation at end of year

$97,736

$91,036

Change in plan assets:

Fair value of plan assets at beginning of year

—

—

Employer contribution

$3,295

$2,850

Distributions

(3,295)

(2,850)

Fair value of plan assets at end of year

—

—

Underfunded status

$(97,736)

$(91,036)

Unrecognized prior service cost

5,198

Unrecognized net loss

39,258

Additional minimum liability

(37,230)

Net amount recognized

$(83,810)

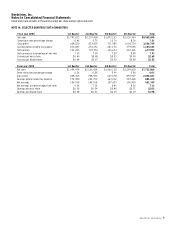

The accumulated benefit obligation was $86,100 at February 3, 2007 and $83,810 at January 28, 2006.

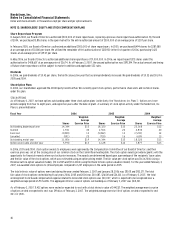

Amounts recognized in the consolidated balance sheets consist of:

February 3, 2007

January 28, 2006

Current liabilities

$4,425

$2,982

Noncurrent liabilities

93,311

43,598

Intangible asset included in other assets

—

5,198

Deferred tax asset

—

12,492

Accumulated other comprehensive loss, net of tax

—

19,540

Net amount recognized

$97,736

$83,810