Nordstrom 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 21

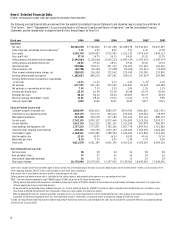

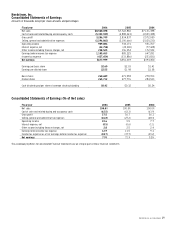

Financing Activities (Dollars in Millions)

Over the past three years, our net operating cash inflows have exceeded our net investing cash outflows, and we used this excess cash flow to repay

long-term debt, pay dividends, and to repurchase our common stock. Over this three-year period, the price of our common stock has increased, which

spurred stock option exercises that also increased our net cash.

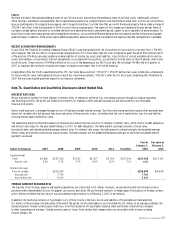

DEBT RETIREMENT

The following table outlines our debt retirement activity:

Fiscal year

2006

2005

2004

Principal repaid or retired:

Private Label Securitization, 4.82%, due 2006

$300.0

—

—

Senior notes, 8.95%, due 2005

—

—

$196.8

Notes payable, 6.7%, due 2005

—

$96.0

$1.5

Total

$300.0

$96.0

$198.3

Total cash payment

$300.0

$96.0

$220.1

We retired the $300.0, 4.82% Private Label Securitization debt when it matured in October 2006. We repaid the remaining $96.0 of our 6.7%

medium-term notes when they matured in 2005. The cash payments in 2004 that exceeded the principal retired represent early

prepayment premiums.

SHARE REPURCHASE

In August 2004, our Board of Directors authorized $300.0 of share repurchases, replacing a previous share repurchase authorization. By the end

of 2004, we purchased 13.8 million shares in the open market for the entire authorized amount of $300.0 at an average price of $21.71 per share.

In February 2005, our Board of Directors authorized an additional $500.0 of share repurchases. Overall for 2005, we purchased 8.5 million shares

for $287.1 at an average price of $33.80 per share. We utilized the remaining authorization of $212.9 in February and March of 2006, purchasing

5.4 million shares at an average price of $39.27 per share.

Our Board of Directors authorized an additional $1,000.0 of share repurchases in May 2006. During the remainder of the year we repurchased 11.1

million shares for $408.6 at an average price of $36.74. As of February 3, 2007 the unused authorization was $591.4. The actual amount and timing

of future share repurchases will be subject to market conditions and applicable SEC rules.

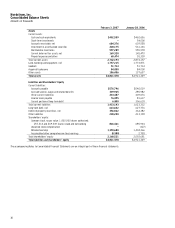

Debt-to-Capital Ratio

Our recent favorable operating results increased our shareholders’ equity and allowed us to reduce our long-term debt, which contributed to a decrease

in our debt-to-capital ratio from 36.5% at the end of 2004 to 22.5% at the end of 2006. In the third quarter of 2006, we repaid $300.0 of long-term debt

by selling a portion of our interest in the co-branded Nordstrom VISA receivable trust. This arrangement put us below our target debt-to-capital range of

25% to 40%. In the first quarter of 2007, we will be increasing our debt and asset levels as a result of a new co-branded Nordstrom VISA securitization

transaction. Both the co-branded Nordstrom VISA receivables and the debt backed by those receivables will be recorded on our balance sheet. In

anticipation of this new securitization structure, we are adjusting our target debt-to-capital ratio range to 30% to 45% going forward.

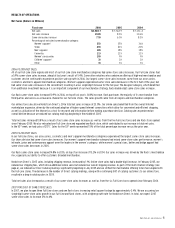

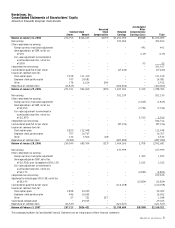

Off-Balance Sheet Financing (Dollars in Millions)

Through our wholly owned federal savings bank, Nordstrom fsb, we offer a private label charge card and two co-branded Nordstrom VISA credit cards.

The private label charge card receivables are held in a trust, which may issue third-party debt that is securitized by the private label receivables; the

private label program is treated as ‘on-balance sheet’, with the receivables, net of bad debt allowance, and debt, if any, recorded on our balance sheet,

the finance charge income recorded in other income including finance charges, net, and the bad debt expense recorded in selling, general and

administrative expenses.

The co-branded Nordstrom VISA credit card receivables are held in a separate trust (the VISA Trust), which may issue third-party debt that is

securitized by the co-branded Nordstrom VISA credit card receivables. The co-branded Nordstrom VISA credit card program is treated as ‘off-balance

sheet.’ We record the fair value of our interest in the VISA Trust on our balance sheet, gains on the sale of receivables to the VISA Trust and our share

of the VISA Trust’s finance income in other income including finance charges, net. As of February 3, 2007, the VISA Trust had co-branded Nordstrom

VISA credit card receivables with a total face amount of $908.0 and had outstanding two series of notes held by third-parties: $200.0 of 2002 Class

A&B notes that mature in April 2007, and $350.0 of 2004-2 variable funding notes that may be renewed in August 2007. In fiscal 2006, the co-

branded Nordstrom VISA credit card receivables had an average gross yield of 16.8% and average annual credit losses of 2.8%. The weighted average

interest rate on the third-party notes was 5.3%.

Following the repayment of the VISA Trust’s $200.0 notes in April 2007, we plan to merge the private label charge card and co-branded VISA

programs into one securitization program. The advantage of a combined program is that it will provide us with greater borrowing flexibility as we will

be able to borrow funds based on the outstanding balance of the combined receivables, it will lower our administrative costs, and will give us one

method of accounting for these similar programs – ‘on-balance sheet.’

When we combine these programs, we plan to also increase our borrowing against these combined receivables to a range of $800.0 to $900.0.