Nordstrom 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 41

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in thousands except per share and per option amounts

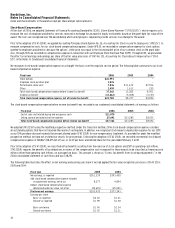

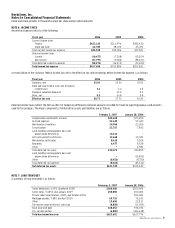

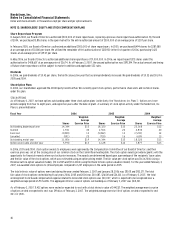

NOTE 6: INCOME TAXES

Income tax expense consists of the following:

Fiscal year

2006

2005

2004

Current income taxes:

Federal

$423,143

$311,996

$282,430

State and local

62,785

38,100

45,091

Total current income tax expense

485,928

350,096

327,521

Deferred income taxes:

Current

(10,477)

(7,208)

(15,259)

Non-current

(47,797)

(9,002)

(58,431)

Total deferred income tax benefit

(58,274)

(16,210)

(73,690)

Total income tax expense

$427,654

$333,886

$253,831

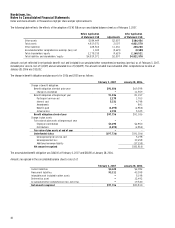

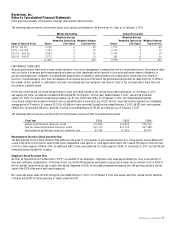

A reconciliation of the statutory Federal income tax rate to the effective tax rate on earnings before income tax expense is as follows:

Fiscal year

2006

2005

2004

Statutory rate

35.0%

35.0%

35.0%

State and local income taxes, net of federal

income taxes

3.2

3.2

3.5

Change in valuation allowance

—

(0.1)

0.3

Other, net

0.5

(0.4)

0.4

Effective tax rate

38.7%

37.7%

39.2%

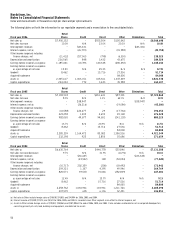

Deferred income taxes reflect the net tax effect of temporary differences between amounts recorded for financial reporting purposes and amounts

used for tax purposes. The major components of deferred tax assets and liabilities are as follows:

February 3, 2007

January 28, 2006

Compensation and benefits accruals

$85,638

$70,454

Accrued expenses

52,630

53,629

Merchandise inventories

24,964

23,206

Securitization

23,767

7,892

Land, buildings and equipment basis and

depreciation differences

14,613

—

Gift cards and gift certificates

13,668

13,041

Merchandise certificates

8,615

5,524

Bad debts

6,477

5,528

Other

—

1,581

Total deferred tax assets

230,372

180,855

Land, buildings and equipment basis and

depreciation differences

—

(16,892)

Other

(8,423)

(8,720)

Total deferred tax liabilities

(8,423)

(25,612)

Net deferred tax assets

$221,949

$155,243

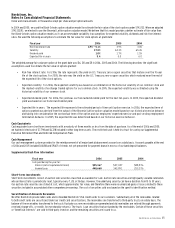

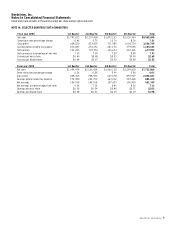

NOTE 7: LONG-TERM DEBT

A summary of long-term debt is as follows:

Februarys 3, 2007

January 28, 2006

Senior debentures, 6.95%, due March 2028

$300,000

$300,000

Senior notes, 5.625%, due January 2009

250,000

250,000

Private Label Securitization, 4.82%, due October 2006

—

300,000

Mortgage payable, 7.68%, due April 2020

69,710

72,633

Other

19,600

22,811

Fair market value of interest rate swap

(8,858)

(11,050)

Total long–term debt

630,452

934,394

Less current portion

(6,800)

(306,618)

Total due beyond one year

$623,652

$627,776