Nordstrom 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in thousands except per share and per option amounts

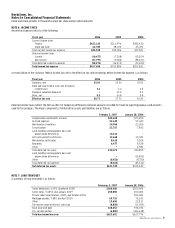

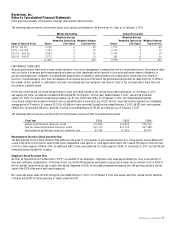

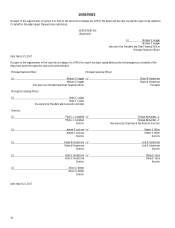

NOTE 13: ACCUMULATED OTHER COMPREHENSIVE EARNINGS

The following table shows the components of accumulated other comprehensive earnings, net of tax:

February 3, 2007

January 28, 2006

January 29, 2005

Foreign currency translation

$15,770

$14,461

$16,276

Fair value adjustment to asset

backed securities

4,982

7,787

4,857

Unrecognized loss on SERP, prior to

adoption of SFAS 158

(16,508)

(19,540)

(11,798)

Adjustment to initially apply SFAS 158

(12,824)

—

—

Total accumulated other

comprehensive earnings

$(8,580)

$2,708

$9,335

Included in our adjustment to initially apply SFAS 158 is our SERP, discussed in Note 10, and our employee retiree medical plan. Adoption of SFAS 158 had

a $(3,195) (net of tax of $2,042) impact to accumulated other comprehensive earnings for the retiree medical plan.

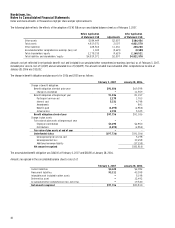

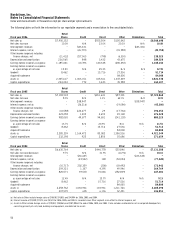

NOTE 14: EARNINGS PER SHARE

Earnings per basic share is computed using the weighted average number of common shares outstanding during the year. Earnings per diluted share

uses the weighted average number of common shares outstanding during the year plus dilutive common stock equivalents, primarily stock options

and performance share units.

Options and other equity instruments totaling 1,883 shares in 2006 and 144 shares in 2005 were excluded from earnings per diluted share because

their impact was anti-dilutive. There were no anti-dilutive options or other equity instruments in 2004.

Since the beginning of 2004, 16,899 shares have been issued upon the exercise of stock options; we repurchased 38,857 shares in 2006, 2005,

and 2004.

The computation of earnings per share is as follows:

Fiscal year

2006

2005

2004

Net earnings

$677,999

$551,339

$393,450

Basic shares

260,689

271,958

278,993

Dilutive effect of stock options and performance

share units

5,023

5,818

5,540

Diluted shares

265,712

277,776

284,533

Earnings per basic share

$2.60

$2.03

$1.41

Earnings per diluted share

$2.55

$1.98

$1.38

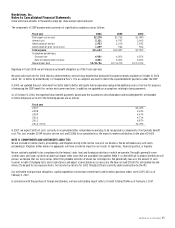

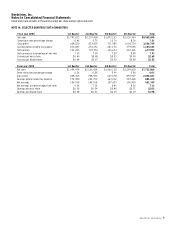

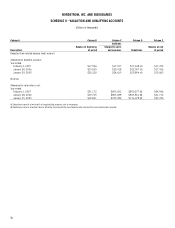

NOTE 15: SEGMENT REPORTING

We offer three channels through which our customers can shop: Full-Line and Rack retail stores and Nordstrom Direct (online and catalog). Our goal

is to create an integrated, consistent merchandise offering for our customers regardless of which channel they choose. These three channels meet

the aggregation criteria set forth in Statement No. 131,

Disclosures about Segments of an Enterprise and Related Information

(“SFAS 131”) with the

exception of “distribution method.” Nordstrom Direct sells merchandise via our online store and the catalog as opposed to in a retail store. As such,

we aggregate our Full-Line and Rack stores into the Retail Stores segment and report Direct as a separate segment.

The Credit segment earns finance charges and securitization gains and losses through operation of the Nordstrom private label and co-branded VISA

credit cards. Intersegment revenues consist of interchange fees charged to our other segments.

The Other segment includes our Façonnable stores, our product development group, which coordinates the design and production of private label

merchandise sold in our retail stores, and our distribution network. This segment also includes our corporate center operations.

Beginning in September 2005, we changed our internal method for recognizing returns of Direct sales at Retail Stores. Previously, these returns were

recognized in the Direct segment and now they are recognized in the Retail Stores segment. We have adjusted our previously disclosed segment

information for 2005 and 2004 to present those years consistent with the 2006 method.