Nordstrom 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the business ofFASH ION

NORDSTROM, INC. ANNUAL REPORT 2006

Table of contents

-

Page 1

the business of FASHION NORDSTROM, INC. ANNUAL REPORT 2006 -

Page 2

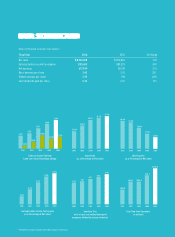

... 2002 2003 2004 2005 2006 Earnings before Income Tax Expense (as a Percentage of Net Sales)1 Inventory Turn (cost of sales and related buying and occupancy divided by average inventory) Cash Flow from Operations (in millions) 1 See Note 5 on page 12 regarding the 2002 change in accounting -

Page 3

For Nordstrom, FASHION IS PERSONAL We don't dictate. We suggest, collaborate, teach, inspire and engage. We're the matchmaker, guiding our customer to discover 'the one.' We don't just sell clothes on a hanger. We're in the business of making people feel great. -

Page 4

-

Page 5

-

Page 6

-

Page 7

-

Page 8

-

Page 9

-

Page 10

-

Page 11

-

Page 12

... $8.6 billion - our fifth consecutive year of same-store sales gains. • Improving store productivity translated to a return on investment (ROIC) of over 20%, and sales of $388 per square foot on a 52-week basis. • Our Gross Profit rate was 37.5%, which topped last year's record of 36.7%. • Our... -

Page 13

...last few years, we've taken great strides in better understanding our customer. We've found that there's a great deal of opportunity to grow our sales in existing stores simply by earning a greater share of our customers' business across multiple product categories. Our new systems and merchandising... -

Page 14

...we'll have four stores there in the next four years. Also opening this fall will be new stores at Twelve Oaks Mall in Novi, Michigan; Cherry Creek Shopping Center in Denver, Colorado; and a new Nordstrom Rack at Southcenter Square in Tukwila, Washington. Growth opportunities are a direct outcome of... -

Page 15

... tenth time by Fortune magazine as one of the "100 Best Places to Work" and for the second year in a row as the number-one "Most Admired Company" in its industry category. Last year, Nordstrom also was named one of the "100 Best Corporate Citizens" by Business Ethics; named one of the "Top Employers... -

Page 16

-

Page 17

FINANCIALS 2006 -

Page 18

[This page intentionally left blank.] 2 -

Page 19

... period from_____ to _____ Commission file number 001-15059 NORDSTROM, INC. (Exact name of Registrant as specified in its charter) Washington (State or other jurisdiction of incorporation or organization) 1617 Sixth Avenue, Seattle, Washington (Address of principal executive offices) Registrant... -

Page 20

[This page intentionally left blank.] 2 -

Page 21

... Other Information. Directors, Executive Officers and Corporate Governance of the Registrant. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters. Certain Relationships and Related Transactions. Principal Accountant Fees and Services... -

Page 22

... Direct generates revenues from sales of high-quality apparel, shoes, cosmetics and accessories by serving our customers on the Web at www.nordstrom.com and through our catalogs. Most of the Direct segment's sales are shipped via third-party carriers from our fulfillment center in Cedar Rapids, Iowa... -

Page 23

...Web site. CORPORATE GOVERNANCE We have a long-standing commitment to upholding a high level of ethical standards. In addition, as required by the listing standards of the New York Stock Exchange ("NYSE") and the rules of the SEC, we have adopted Codes of Business Conduct and Ethics for our employees... -

Page 24

... capital to maximize our overall long-term returns. This includes spending on inventory, capital projects and expenses, managing debt levels, managing accounts receivable through our credit business, and returning value to our shareholders through dividends and share repurchases. To a large degree... -

Page 25

... by the Retail Stores segment. The Direct segment utilizes one fulfillment center in Cedar Rapids, Iowa, which is owned on leased land. Our administrative offices in Seattle, Washington are a combination of leased and owned space. For one of our corporate office buildings in Seattle, we own a 49... -

Page 26

... Viejo Montclair Plaza Stanford Shopping Center Stoneridge Mall South Bay Galleria The Galleria at Tyler in Riverside Galleria at Roseville Arden Fair Fashion Valley Horton Plaza University Towne Center San Francisco Centre Stonestown Galleria Valley Fair Hillsdale Shopping Center MainPlace/Santa... -

Page 27

...Great Northwest Rack Factoria Mall Rack Golde Creek Plaza Rack Downtown Seattle Rack NorthTown Mall Rack Square Footage Year Store Opened Providence Place 206,000 1999 Barton Creek Square Galleria Dallas NorthPark Center Stonebriar Centre Houston Galleria NorthEast Mall The Shops at La Cantera... -

Page 28

... to a Vote of Security Holders. None. PART II Item 5. Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities. MARKET, SHAREHOLDER, AND DIVIDEND INFORMATION Our common stock, without par value, is traded on the New York Stock Exchange under the... -

Page 29

... The actual amount and timing of future share repurchases will be subject to market conditions and applicable SEC rules. STOCK PRICE PERFORMANCE The following graph compares, for each of the last five fiscal years, ending February 3, 2007, the cumulative total return of Nordstrom, Inc. common stock... -

Page 30

... share Dividends per share Return on average shareholders' equity Sales per square foot Financial Position (at year end) Customer accounts receivable, net Investment in asset backed securities Merchandise inventories Current assets Current liabilities Land, buildings and equipment, net Long-term... -

Page 31

... share Dividends per share Return on average shareholders' equity Sales per square foot Financial Position (at year end) Customer accounts receivable, net Investment in asset backed securities Merchandise inventories Current assets Current liabilities Land, buildings and equipment, net Long-term... -

Page 32

... high-quality apparel, shoes, cosmetics and accessories for women, men and children. We offer a wide selection of brand name and private label merchandise. We offer our products through multiple retail channels including our Full-Line 'Nordstrom' stores, our discount 'Nordstrom Rack' stores, our... -

Page 33

... of last year's result of 5.4%. Some other retailers who combine an offering of high-end merchandise and customer service continued to experience positive sales growth in 2006. Our largest same-store sales increases came from our accessories, cosmetics and men's apparel merchandise categories. Women... -

Page 34

...regular price merchandise sales. Our women's apparel category experienced significant rate expansion in the second half of the year due to strategy changes that brought a sharper focus to our merchandise offering. For the first time, this year our buying and occupancy costs included expenses related... -

Page 35

... CHARGES, NET Other income including finance charges, net increased $23.4, due to earnings growth in the Nordstrom fsb co-branded VISA credit card program and our gift card breakage income of $8.0. The principal balances of receivables in the VISA credit card, which are held by a separate trust... -

Page 36

...the quarter and a successful holiday season resulted in same-store sales growth above our overall sales plan. Our designer apparel, accessories, men's apparel, and cosmetics merchandise categories experienced the largest same-store sales increases. As it did in the third quarter, our women's apparel... -

Page 37

...past two years, we have incorporated Return on Invested Capital (ROIC) into our key financial metrics, and since 2005 have used it as an executive incentive measure. Overall performance as measured by ROIC correlates directly to shareholders' return over the long term. For the 12 fiscal months ended... -

Page 38

... our co-branded VISA program, we earn interchange and finance charge income and we offer card holders merchandise certificates, which can be redeemed in our stores, similar to a gift certificate. In the course of negotiating for store locations, some developers offer up-front cash payments to defray... -

Page 39

... Nordstrom VISA credit card receivables had an average gross yield of 16.8% and average annual credit losses of 2.8%. The weighted average interest rate on the third-party notes was 5.3%. Following the repayment of the VISA Trust's $200.0 notes in April 2007, we plan to merge the private label... -

Page 40

...the eight month repayment period. Following the recognition of the $7.0 yield reduction in the first quarter and the $16.0 of other adjustments through the remainder of 2007, the private label charge card receivables and the co-branded VISA credit card receivables will be recorded at historical cost... -

Page 41

... need for short-term borrowings. We believe that our operating cash flows, existing cash and available credit facilities are sufficient to finance our cash requirements for the next 12 months. Over the long term, we manage our cash and capital structure to maximize shareholder return, strengthen our... -

Page 42

...of high-quality men's, women's and boys' apparel and accessories. In February 2007, we announced that we are exploring strategic options that would benefit both Nordstrom and Façonnable, including a possible sale of the brand. CRITICAL ACCOUNTING POLICIES The preparation of our financial statements... -

Page 43

... operating and financing activities. We do not use financial instruments for trading or other speculative purposes and are not party to any leveraged financial instruments. Interest rate exposure is managed through our mix of fixed and variable rate borrowings. Short-term borrowing and investing... -

Page 44

...consolidated financial statements and management's assessment of the effectiveness of the Company's internal control over financial reporting. Its accompanying reports are based on audits conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States). The... -

Page 45

... Commission. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements and financial statement schedule as of and for the fiscal year ended February 3, 2007 of the Company and our report dated... -

Page 46

... accompanying consolidated balance sheets of Nordstrom, Inc. and subsidiaries (the "Company") as of February 3, 2007 and January 28, 2006, and the related consolidated statements of earnings, shareholders' equity, and cash flows for each of the three fiscal years in the period ended February 3, 2007... -

Page 47

...year Net sales Cost of sales and related buying and occupancy costs Gross profit Selling, general and administrative expenses Operating income Interest expense, net Other income including finance charges, net Earnings before income tax expense Income tax expense Net earnings Earnings per basic share... -

Page 48

...current assets Land, buildings and equipment, net Goodwill Acquired tradename Other assets Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Accrued salaries, wages and related benefits Other current liabilities Income taxes payable Current portion of long- term... -

Page 49

...of $2,173 Comprehensive net earnings Adjustment to initially apply SFAS 158, net of tax of $8,199 Cash dividends paid ($0.42 per share) Issuance of common stock for: Stock option plans Employee stock purchase plan Other Stock- based compensation Repurchase of common stock Balance at February 3, 2007... -

Page 50

... investments Sales of short- term investments Other, net Net cash used in investing activities Financing Activities Principal payments on long-term debt (Decrease) increase in cash book overdrafts Proceeds from exercise of stock options Proceeds from employee stock purchase plan Excess tax benefit... -

Page 51

... high-quality apparel, shoes, cosmetics and accessories for women, men and children. We offer a wide selection of brand name and private label merchandise. We offer our products through multiple retail channels, including 98 Full-Line 'Nordstrom' stores, 50 discount 'Nordstrom Rack' stores, four... -

Page 52

...Compensation At the start of 2006, we adopted Statement of Financial Accounting Standard No. 123(R), Share-Based Payment ("SFAS 123(R)"), which requires us to measure the cost of employee and director services received in exchange for an award of equity instruments based on the grant-date fair value... -

Page 53

... earnings. The cost of securities sold was based on the specific identification method. Securitization of Accounts Receivable We offer Nordstrom private label cards and co-branded Nordstrom VISA credit cards to our customers. Substantially all of the receivables related to both credit cards... -

Page 54

... consist primarily of our Nordstrom private label receivables that back an unused variable funding note that is discussed in Note 7: Long-term Debt. We record the face value of the principal, plus any earned finance charges, late fees, or cash advance fees. We report accounts receivable net of an... -

Page 55

... on the balance sheet date, while income and expense accounts are translated at the average rates in effect during the year. The resulting translation adjustments are recorded in accumulated other comprehensive earnings. Income Taxes We use the asset and liability method of accounting for income... -

Page 56

... advertising programs, cosmetic selling expenses, and vendor sponsored contests. Purchase price adjustments are recorded as a reduction of cost of sales at the point they have been earned and the related merchandise has been sold. Allowances for cooperative advertising and promotion programs and... -

Page 57

... 3, 2007 Assumptions used to estimate the fair value of the investment in asset backed securities: Weighted average remaining life (in months) Average annual credit losses Average gross yield Weighted average coupon on issued securities Average monthly payment rates Discount rate on investment in... -

Page 58

... end of 2006 and 2005, with related accumulated amortization of $16,595 and $16,089. The amortization of capitalized leased buildings and equipment of $506, $830, and $1,238 in 2006, 2005, and 2004 was recorded in depreciation expense. NOTE 5: EMPLOYEE BENEFITS We provide a 401(k) and profit sharing... -

Page 59

...,776 Nordstrom, Inc. and subsidiaries Senior debentures, 6.95%, due March 2028 Senior notes, 5.625%, due January 2009 Private Label Securitization, 4.82%, due October 2006 Mortgage payable, 7.68%, due April 2020 Other Fair market value of interest rate swap Total long-term debt Less current portion... -

Page 60

...a fixed rate of 5.63% and pay a variable rate based on LIBOR plus a margin of 2.3% set at six-month intervals (7.70% at February 3, 2007). The fair value of long-term debt, including current maturities, using quoted market prices of the same or similar issues, was $667,191 and $963,092 at the end of... -

Page 61

... Executive Retirement Plan ("SERP"), which provides retirement benefits to certain officers and select employees. This plan is non-qualified and does not have a minimum funding requirement. We adopted Statement No. 158, Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans... -

Page 62

... service cost Interest cost Amendments Benefits paid Actuarial loss Benefit obligation at end of year Change in plan assets: Fair value of plan assets at beginning of year Employer contribution Distributions Fair value of plan assets at end of year Underfunded status Unrecognized prior service cost... -

Page 63

... new hires. In addition, we updated our assumptions relating to bonus payments. As of October 31, 2006, the expected future benefit payments based upon the assumptions described above and including benefits attributable to future employee service for the following periods are as follows: Fiscal year... -

Page 64

... market conditions and applicable SEC rules. Dividends In 2006, we paid dividends of $0.42 per share, the tenth consecutive year that our annual dividends increased. We paid dividends of $0.32 and $0.24 in 2005 and 2004. Stock Option Plans In 2004, our shareholders approved the 2004 Equity Incentive... -

Page 65

... an Employee Stock Purchase Plan ("ESPP") as a benefit to our employees. Employees may make payroll deductions of up to ten percent of their base and bonus compensation. At the end of each six-month offering period, participants may purchase shares of our common stock at 90% of the fair market value... -

Page 66

...-Line and Rack stores into the Retail Stores segment and report Direct as a separate segment. The Credit segment earns finance charges and securitization gains and losses through operation of the Nordstrom private label and co-branded VISA credit cards. Intersegment revenues consist of interchange... -

Page 67

Nordstrom, Inc. Notes to Consolidated Financial Statements Dollar and share amounts in thousands except per share and per option amounts The following table summarizes the net sales by merchandise category: Fiscal year Women's apparel Shoes Men's apparel Cosmetics Women's accessories Children's ... -

Page 68

... information for our reportable segments and a reconciliation to the consolidated totals: Fiscal year 2006 Net sales (a) Net sales increase Intersegment revenues Interest expense, net (b) Other income (expense) including finance charges, net Depreciation and amortization Earnings before income tax... -

Page 69

Nordstrom, Inc. Notes to Consolidated Financial Statements Dollar and share amounts in thousands except per share and per option amounts NOTE 16: SELECTED QUARTERLY DATA (UNAUDITED) Fiscal year 2006 Net sales Same-store sales percentage change Gross profit Earnings before income tax expense Net ... -

Page 70

... our Proxy Statement for our 2007 Annual Meeting of Shareholders, which sections are incorporated by reference herein and will be filed within 120 days after the end of our fiscal year: Executive Officers Election of Directors Board Committees Director Nominating Process Web site Access to Corporate... -

Page 71

...end of our fiscal year: Security Ownership of Certain Beneficial Owners and Management Equity Compensation Plans Item 13. Certain Relationships and Related Transactions. The information required under this item is included in the following sections of our Proxy Statement for our 2007 Annual Meeting... -

Page 72

... and on the date indicated. Principal Financial Officer: /s/ Principal Executive Officer: Blake W. Nordstrom Blake W. Nordstrom President /s/ Michael G. Koppel /s/ Michael G. Koppel Executive Vice President and Chief Financial Officer Principal Accounting Officer: /s/ Peter F. Collins Peter... -

Page 73

... compensation upon adoption of Statement of Financial Accounting Standards No. 123(R), Share-Based Payment), and management's report on the effectiveness of internal control over financial reporting, appearing in this Annual Report on Form 10-K of Nordstrom, Inc. for the fiscal year ended February... -

Page 74

... in thousands) Column A Column B Balance at beginning of period Description Deducted from related balance sheet account Allowance for doubtful accounts: Year ended: February 3, 2007 January 28, 2006 January 29, 2005 Reserves Allowance for sales return, net: Year ended: February 3, 2007 January 28... -

Page 75

[This page intentionally left blank.] Nordstrom, Inc. and subsidiaries 57 -

Page 76

... Securities, Inc. Commercial Paper Agreement dated October 2, 1997 between Registrant and Credit Suisse First Boston Corporation 10.5 10.6 10.7 10.8 10.9 10.10 Issuing and Paying Agency Agreement dated October 2, 1997 between Registrant and First Trust of New York, N.A. 10.11 Share Purchase... -

Page 77

... Private Label Receivables, LLC, Nordstrom fsb, Falcon Asset Securitization Corporation, and JP Morgan Chase Bank NA (successorby-merger to Bank One, NA (Main Office Chicago)) as agent, dated December 16, 2004 Incorporated by reference from Registrant's Annual Report on Form 10-K for the year ended... -

Page 78

... Agreement dated April 18, 2002 between Registrant, New York Life Insurance Company and Life Investors Insurance Company of America 10.39 The 2002 Nonemployee Director Stock Incentive Plan Incorporated by reference from Nordstrom Credit, Inc.'s Quarterly Report on Form 10-Q for the quarter ended... -

Page 79

... Company, as trustee 10.59 Note Purchase Agreement dated December 4, 2001 between Nordstrom Private Label Receivables, LLC, Nordstrom fsb, Falcon Asset Securitization Corporation, and Bank One NA (incorporated by reference from Nordstrom Credit, Inc.'s Annual Report on Form 10-K for the year ended... -

Page 80

....1 23.1 31.1 31.2 32.1 Subsidiaries of the Registrant Consent of Independent Registered Public Accounting Firm Certification of President required by Section 302(a) of the SarbanesOxley Act of 2002 Certification of Chief Financial Officer required by Section 302(a) of the Sarbanes-Oxley Act of 2002... -

Page 81

SHAREHOLDER ınformation -

Page 82

... President, Finance, Full-Line Stores Paul F. Favaro, 48 Executive Vice President, Strategy and Development Linda Toschi Finn, 59 Executive Vice President, Marketing Kevin T. Knight, 51 Executive Vice President, Chairman and Chief Executive Officer of Nordstrom fsb, President, Nordstrom Credit, Inc... -

Page 83

... Washington Peter E. Nordstrom, 45 Executive Vice President and President of Merchandising Nordstrom, Inc. Seattle, Washington Philip G. Satre, 57 Private Equity Investor Reno, Nevada Alison A. Winter, 60 Retired President Northeast Personal Financial Services, The Northern Trust Corporation Chicago... -

Page 84

... Nordstrom Downtown Seattle Store John W. Nordstrom Room, fifth floor 1617 Sixth Avenue Seattle, Washington 98101-1742 Form 10-K The Company's annual report on Form 10-K for the year ended February 3, 2007 will be provided to shareholders upon request to: Nordstrom, Inc. Investor Relations P. O. Box... -

Page 85

-

Page 86

PLEASE RECYCLE