NetFlix 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(1) A subscription is defined as the right to receive either the Netflix streaming service or Netflix DVD service.

In connection with the Company’s subscription services, the Company offers free-trial memberships to new

and certain rejoining members. A method of payment is required to be provided even during the free-trial

period for the membership to be defined as a subscription and included in the above metrics. Total unique

subscribers and total subscriptions include those subscribers who are on a free-trial. A subscription would

cease to be reflected in the above metrics as of the effective cancellation date. Voluntary cancellations

become effective at the end of the monthly subscription period, while involuntary cancellation of the

service, as a result of a failed method of payment, becomes effective immediately.

(2) For purposes of determining the number of unique subscribers, domestic subscribers who have elected both

a DVD and a streaming subscription plan are considered a single unique subscriber.

11. Subsequent Event

On January 29, 2013, the Company announced the pricing of an offering of $500 million aggregate principal

amount of 5.375% senior notes due 2021 (the “5.375% Notes”). The notes are expected to be issued at par on

February 1, 2013 and are senior unsecured obligations of the Company. Interest is payable semi-annually at a rate

of 5.375% per annum on February 1 and August 1 of each year, commencing on August 1, 2013. The 5.375%

Notes are repayable in whole or in part upon the occurrence of a change of control, at the option of the holders, at

a purchase price in cash equal to 101% of the principal plus accrued interest. The Company may redeem the

5.375% Notes prior to maturity in whole or in part at a redemption price of 100% of the principal plus an

applicable premium as of, and accrued and unpaid interest, if any, to the applicable redemption date.

The 5.375% Notes include, among other terms and conditions, limitations on the Company’s ability to

create, incur or allow certain liens; enter into sale and lease-back transactions; create, assume, incur or guarantee

additional indebtedness of the Company’s subsidiaries; and consolidate or merge with, or convey, transfer or

lease all or substantially all of the Company’s and its subsidiaries assets, to another person.

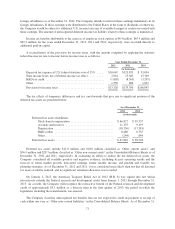

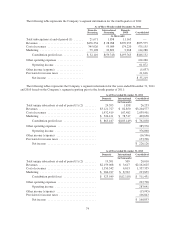

12. Selected Quarterly Financial Data (Unaudited)

December 31 September 30 June 30 March 31

(in thousands, except for per share data)

2012

Total revenues ...................................... $945,239 $905,089 $889,163 $869,791

Gross profit ........................................ 249,372 242,451 245,735 245,858

Net income (loss) ................................... 7,897 7,675 6,164 (4,584)

Earnings (loss) per share:

Basic ......................................... $ 0.14 $ 0.14 $ 0.11 $ (0.08)

Diluted ....................................... 0.13 0.13 0.11 (0.08)

2011

Total revenues ...................................... $875,575 $821,839 $788,610 $718,553

Gross profit ........................................ 300,420 285,222 298,632 280,402

Net income (1) ..................................... 35,219 62,460 68,214 60,233

Earnings per share:

Basic ......................................... $ 0.66 $ 1.19 $ 1.30 $ 1.14

Diluted ....................................... 0.64 1.16 1.26 1.11

(1) Net income for the three months ended December 31, 2011 includes $9.0 million of expense related to a

legal settlement and $9.5 million of expense related to termination benefits associated with the Company’s

retraction of plans to separate and rebrand the DVD-by-mail service.

75