NetFlix 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

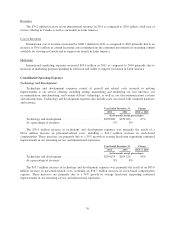

2011 Domestic Segment Results

Revenues

The $962.7 million increase in our domestic revenues in 2011 as compared to 2010 was primarily due to the

49% growth in the domestic average number of unique paying subscribers driven by new streaming

subscriptions. This increase was offset in part by a 3% decline in domestic average monthly revenue per unique

paying subscriber, resulting from the popularity of the streaming subscription plans (introduced in November

2010) and a decline in the percentage of unique paying subscribers electing both a streaming and a DVD

subscription following the pricing changes announced in July 2011.

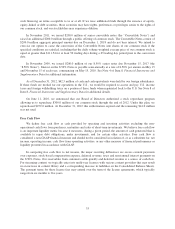

Cost of Revenues

The $581.9 million increase in domestic cost of revenues in 2011 as compared to 2010 was due to the

following factors:

• Content acquisition and licensing expenses increased by $584.3 million. This increase was primarily

attributable to continued investments in streaming content resulting in an increase in the streaming

content available for viewing to our domestic subscribers as compared to the prior year.

• Content delivery expenses decreased $41.8 million primarily due to a 14% decrease in the number of

DVDs mailed to paying subscribers. The decrease in the number of DVDs mailed was driven by a 22%

decline in monthly DVD rentals per average paying DVD subscriber primarily attributed to the migration

of our DVD subscribers toward lower priced plans. The decrease in DVD delivery expenses was partially

offset by an increase in costs associated with our use of third-party delivery networks resulting from an

increase in the total number of hours of streaming content viewed by our subscribers.

• Other costs increased due to a $28.9 million increase in credit card fees as a result of the growth in

revenues, and a $19.1 million increase in costs associated with customer service call centers to support

our growing subscriber population. These increases were partially offset by an $8.6 million decrease in

expenses related to content processing due primarily to the 14% decrease in the number of DVDs mailed

to paying subscribers.

Marketing

Marketing expenses increased $39.2 million in 2011 as compared to 2010 primarily due to an increase in

marketing program spending in television, radio and online advertising coupled with an increase in payments to

our affiliates. These increases were partially offset by a decrease in direct mail and inserts, and payments made to

our consumer electronic partners. The increase in marketing program spending was partially offset by decreases

in the costs of free trials.

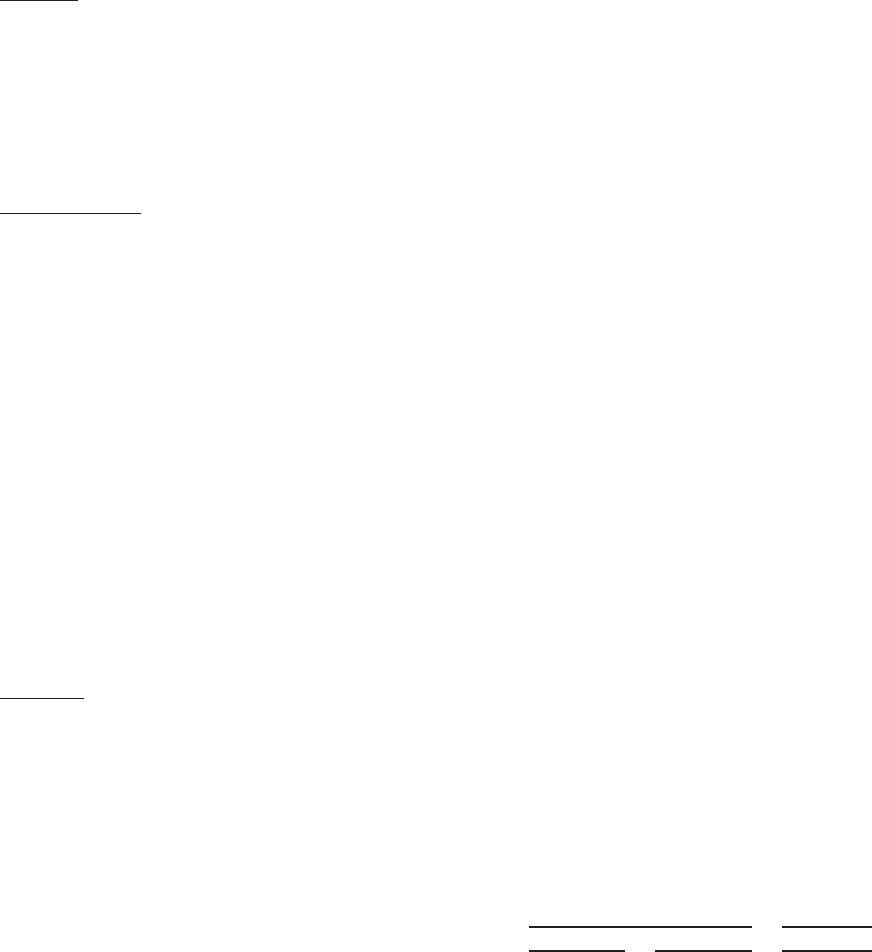

International Streaming Segment

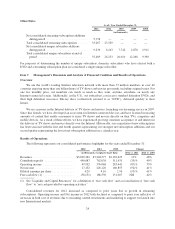

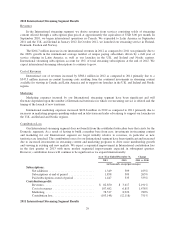

As of /Year Ended December 31, Change

2012 2011 2012 vs. 2011

(in thousands, except percentages)

Subscriptions:

Net additions ............................... 4,263 1,349 216%

Subscriptions at end of period ................. 6,121 1,858 229%

Paid subscriptions at end of period .............. 4,892 1,447 238%

Contribution profit:

Revenues .................................. $287,542 $ 82,850 247%

Cost of revenues ............................ 475,570 107,482 342%

Marketing ................................. 201,283 78,517 156%

Contribution loss ............................ (389,311) (103,149) 277%

28