NetFlix 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

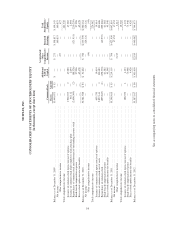

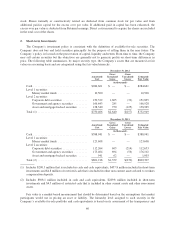

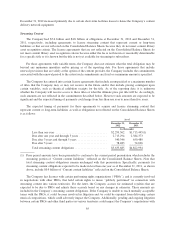

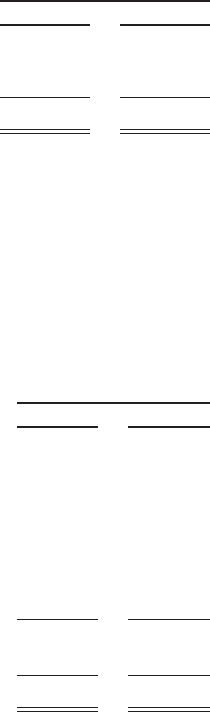

Content Liabilities

Content liabilities consisted of the following:

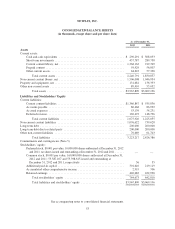

As of December 31,

2012 2011

(in thousands)

Current content liabilities .............................. $1,366,847 $ 935,036

Non-current content liabilities ........................... 1,076,622 739,628

Total content liabilities ................................ $2,443,469 $1,674,664

The Company typically enters into multi-year licenses with various content providers that may result in an

increase in the streaming content library and a corresponding increase in the streaming content liabilities. The

payment terms for these streaming license fees may extend over the term of the license agreement, which

typically ranges from six months to five years.

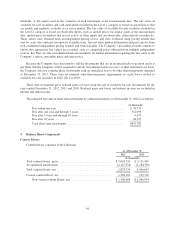

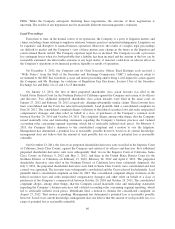

Property and Equipment, Net

Property and equipment and accumulated depreciation consisted of the following:

As of December 31,

2012 2011

(in thousands)

Computer equipment ................... 3years $ 84,193 $ 67,090

Operations and other equipment .......... 5years 100,207 100,306

Software ............................ 3years 39,073 35,356

Furniture and fixtures .................. 3years 18,208 17,310

Building ............................ 30years 40,681 40,681

Leasehold improvements ............... Over life of lease 45,393 44,473

Capital work-in-progress ................................ 8,282 822

Property and equipment, gross ............................ 336,037 306,038

Less: Accumulated depreciation ........................... (204,356) (169,685)

Property and equipment, net .............................. $131,681 $ 136,353

Property and equipment, gross increased $30.0 million or 10% due primarily to increased investments in our

streaming content delivery network (“Open Connect”).

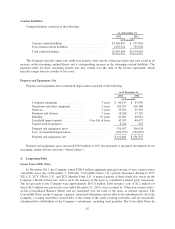

4. Long-term Debt

Senior Convertible Notes

In November 2011, the Company issued $200.0 million aggregate principal amount of zero coupon senior

convertible notes due on December 1, 2018 (the “Convertible Notes”) in a private placement offering to TCV

VII, L.P., TCV VII(A), L.P., and TCV Member Fund, L.P. A general partner of these funds also serves on the

Company’s Board of Directors, and as such, the issuance of the notes is considered a related party transaction.

The net proceeds to the Company were approximately $197.8 million. Debt issuance costs of $2.2 million (of

which $0.3 million was paid in the year ended December 31, 2012) were recorded in “Other non-current assets”

on the Consolidated Balance Sheets and are amortized over the term of the notes as interest expense. The

Convertible Notes are the Company’s general, unsecured obligations and are effectively subordinated to all of the

Company’s existing and future secured debt, to the extent of the assets securing such debt, and are structurally

subordinated to all liabilities of the Company’s subsidiaries, including trade payables. The Convertible Notes do

62