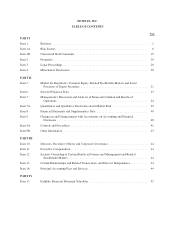

NetFlix 2012 Annual Report Download - page 11

Download and view the complete annual report

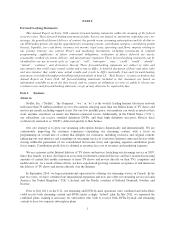

Please find page 11 of the 2012 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The increasingly long-term and fixed cost nature of our content acquisition licenses may limit our

operating flexibility and could adversely affect our liquidity and results of operation.

In connection with obtaining streaming content, we typically enter into multi-year licenses with studios and

other content providers, the payment terms of which are not tied to subscriber usage or the size of our subscriber

base (“fixed cost”) but which may be tied to such factors as titles licensed and/or theatrical exhibition receipt.

Such contractual commitments are included in the Contractual Obligations section of Item 7 Management’s

Discussion and Analysis of Financial Condition and Results of Operations. Given the multiple-year duration and

largely fixed cost nature of content licenses, if subscriber acquisition and retention do not meet our expectations,

our margins may be adversely impacted. Payment terms for streaming licenses, especially programming that

initially airs in the applicable territory on our service (“original programming”) or that is considered output

content, will typically require more up-front cash payments than other licensing agreements. To the extent

subscriber and/or revenue growth do not meet our expectations, our liquidity and results of operations could be

adversely affected as a result of content licensing commitments and accelerated payment requirements of certain

licenses. In addition, the long-term and fixed cost nature of our streaming licenses may limit our flexibility in

planning for, or reacting to changes in our business and the market segments in which we operate. As we expand

internationally, we must license content in advance of entering into a new geographical market. If we license

content that is not favorably received by consumers in the applicable territory, acquisition and retention may be

adversely impacted and given the long-term and fixed cost nature of our commitments, we may not be able to

adjust our content offering quickly and our results of operation may be adversely impacted.

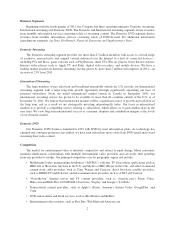

Changes in consumer viewing habits, including more widespread usage of TV Everywhere or other similar

on demand methods of entertainment video consumption could adversely affect our business.

The manner in which consumers view entertainment video is changing rapidly. Digital cable, wireless and

Internet content providers are continuing to improve technologies, content offerings, user interface, and business

models that allow consumers to access on demand entertainment with interactive capabilities including start, stop

and rewind. The devices through which entertainment video can be consumed are also changing rapidly. Today,

content from MVPDs may be viewed on laptops and content from Internet content providers may be viewed on

TVs. Although we provide our own Internet-based delivery of content allowing our subscribers to stream certain

TV shows and movies to their Internet-connected televisions and other devices, if other providers of

entertainment video address the changes in consumer viewing habits in a manner that is better able to meet

content distributor and consumer needs and expectations, our business could be adversely affected.

If we are not able to manage change and growth, our business could be adversely affected.

We are currently engaged in an effort to expand our operations internationally, scale our streaming service

to effectively and reliably handle anticipated growth in both subscribers and features related to our service, as

well as continue to operate our DVD service within the U.S. As we expand internationally, we are managing our

business to address varied content offerings, consumer customs and practices, in particular those dealing with

e-commerce and Internet video, as well as differing legal and regulatory environments. As we scale our

streaming service, we are developing technology and utilizing relatively new third-party Internet-based or

“cloud” computing services. We have also chosen to separate the technology that operates our DVD-by-mail

service from that which runs our streaming operations. If we are not able to manage the growing complexity of

our business, including maintaining our DVD operations, and improving, refining or revising our systems and

operational practices related to our streaming operations, our business may be adversely affected.

If the market segment for online subscription-based entertainment video saturates, our business will be

adversely affected.

The market segment for online subscription-based entertainment video has grown significantly. Much of the

increasing growth can be attributed to the ability of our subscribers to stream TV shows and movies on their TVs,

computers and mobile devices. As we face more competition in our market segment, our rate of growth relative

7