NetFlix 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Interest expense was relatively flat as compared to the prior year. Interest expense in 2011 consists primarily

of $17.0 million of interest due on our 8.50% Notes.

Provision for Income Taxes

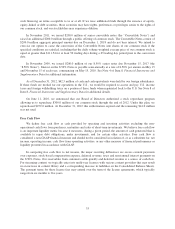

Year Ended December 31, Change

2012 2011 2012 vs. 2011

(in thousands, except percentages)

Provision for income taxes ......................... $13,328 $133,396 (90)%

Effective tax rate ................................ 44% 37%

In 2012, our effective tax rate differed from the federal statutory rate of 35% by $2.7 million primarily due

to state income taxes and nondeductible expenses partially offset by the California research and development

(“R&D”) credit. The increase in our effective tax rate for the year ended December 31, 2012 as compared to the

year ended December 31, 2011 was primarily attributable to the expiration of the Federal R&D credit on

December 31, 2011.

On January 2, 2013, the American Taxpayer Relief Act of 2012 (H.R. 8) was signed into law which

retroactively extends the Federal R&D credit from January 1, 2012 through December 31, 2013. As a result, we

will recognize the retroactive benefit of the 2012 Federal R&D credit of approximately $3.1 million as a discrete

item in the first quarter of 2013, the period in which the legislation, including the reinstatement, was enacted.

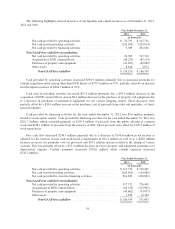

Year Ended December 31, Change

2011 2010 2011 vs. 2010

(in thousands, except percentages)

Provision for income taxes ........................ $133,396 $106,843 25%

Effective tax rate ............................... 37% 40%

In 2011, our effective tax rate differed from the federal statutory rate of 35% primarily due to state income

taxes of $15.0 million or 4.2% of income before income tax. This was partially offset by the expiration of a

statute of limitations for years 1997 through 2007 resulting in a discrete benefit of $3.5 million in the third

quarter of 2011 and Federal and California R&D credits of $5.1 million. The decrease in our effective tax rate for

the year ended December 31, 2011 as compared to the year ended December 31, 2010 was attributable to the

discrete benefit of $3.5 million, higher R&D tax credits and a lower effective tax rate for California.

Liquidity and Capital Resources

Cash, cash equivalents and short-term investments were $748.1 million and $797.8 million at December 31,

2012 and 2011, respectively. Our primary uses of cash include the acquisition and licensing of content, content

delivery expenses, marketing and payroll related expenses. We expect to continue to make significant

investments to license streaming content both domestically and internationally and expect to obtain more original

programs in 2013. These investments will impact our liquidity and we expect to have negative operating cash

flows and/or use of cash in future periods.

On January 29, 2013 we announced the pricing of an offering of $500 million aggregate principal amount of

5.375% senior notes due 2021 (the “5.375% Notes”). We expect the sale of the 5.375% Notes to close on

February 1, 2013 and we intend to use approximately $225 million of the net proceeds to redeem our 8.50%

Notes. Although we currently anticipate that the remaining proceeds from the 5.375% Notes together with our

available funds will be sufficient to meet our cash needs for the foreseeable future, we may be required or choose

to obtain additional financing. Our ability to obtain additional financing will depend on, among other things, our

development efforts, business plans, operating performance, current and projected compliance with our debt

covenants, and the condition of the capital markets at the time we seek financing. We may not be able to obtain

32