NetFlix 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

respectively. The total income tax benefit recognized in the income statement related to stock option plans and

employee stock purchases was $28.5 million, $22.8 million and $11.2 million for 2012, 2011 and 2010,

respectively.

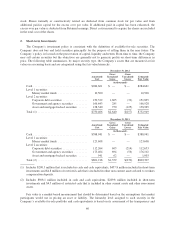

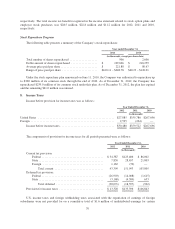

Stock Repurchase Program

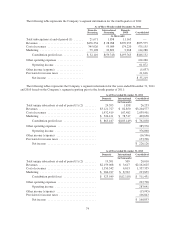

The following table presents a summary of the Company’s stock repurchases:

Year ended December 31,

2011 2010

(in thousands, except per share data)

Total number of shares repurchased ................... 900 2,606

Dollar amount of shares repurchased .................. $ 199,666 $ 210,259

Average price paid per share ......................... $ 221.88 $ 80.67

Range of price paid per share ........................ $160.11 – $248.78 $60.23 – $126.01

Under the stock repurchase plan announced on June 11, 2010, the Company was authorized to repurchase up

to $300 million of its common stock through the end of 2012. As of December 31, 2012, the Company has

repurchased $259.0 million of its common stock under this plan. As of December 31, 2012, the plan has expired

and the remaining $41.0 million was unused.

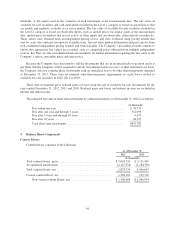

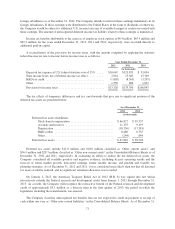

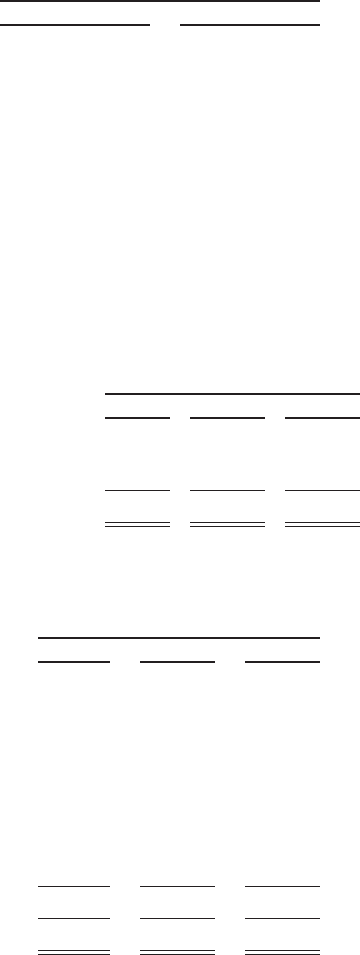

8. Income Taxes

Income before provision for income taxes was as follows:

Year Ended December 31,

2012 2011 2010

(in thousands)

United States .................................................... $27,885 $359,786 $267,696

Foreign ......................................................... 2,595 (264) —

Income before income taxes ..................................... $30,480 $359,522 $267,696

The components of provision for income taxes for all periods presented were as follows:

Year Ended December 31,

2012 2011 2010

(in thousands)

Current tax provision:

Federal .......................................... $34,387 $123,406 $ 86,002

State ............................................ 7,850 28,657 21,803

Foreign ......................................... 1,162 (70) —

Total current ................................. 43,399 151,993 107,805

Deferred tax provision:

Federal .......................................... (26,903) (14,008) (1,615)

State ............................................ (3,168) (4,589) 653

Total deferred ................................ (30,071) (18,597) (962)

Provision for income taxes .............................. $13,328 $133,396 $106,843

U.S. income taxes and foreign withholding taxes associated with the repatriation of earnings of foreign

subsidiaries were not provided for on a cumulative total of $1.6 million of undistributed earnings for certain

70