NetFlix 2012 Annual Report Download - page 62

Download and view the complete annual report

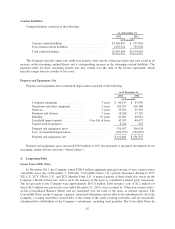

Please find page 62 of the 2012 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Revenue Recognition

Subscription revenues are recognized ratably over each subscriber’s monthly subscription period. Revenues

are presented net of the taxes that are collected from customers and remitted to governmental authorities.

Deferred revenue consists of subscriptions revenues billed to subscribers that have not been recognized and gift

subscriptions that have not been redeemed.

Marketing

Marketing expenses consist primarily of advertising expenses and also include payments made to the

Company’s affiliates and consumer electronics partners and payroll related expenses. Advertising expenses

include promotional activities such as television and online advertising, as well as allocated costs of revenues

relating to free trial periods. Advertising costs are expensed as incurred. Advertising expense totaled

approximately $377.2 million, $299.1 million and $212.4 million in 2012, 2011 and 2010, respectively.

Income Taxes

The Company records a tax provision for the anticipated tax consequences of the reported results of

operations using the asset and liability method. Deferred income taxes are recognized by applying enacted

statutory tax rates applicable to future years to differences between the financial statement carrying amounts of

existing assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards. The

effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that

includes the enactment date. The measurement of deferred tax assets is reduced, if necessary, by a valuation

allowance for any tax benefits for which future realization is uncertain. There was no significant valuation

allowance as of December 31, 2012 or 2011.

The Company did not recognize certain tax benefits from uncertain tax positions within the provision for

income taxes. The Company recognizes a tax benefit from an uncertain tax position only if it is more likely than

not the tax position will be sustained on examination by the taxing authorities, based on the technical merits of

the position. The tax benefits recognized in the financial statements from such positions are then measured based

on the largest benefit that has a greater than 50% likelihood of being realized upon settlement. The Company

recognizes interest and penalties related to uncertain tax positions in income tax expense. See Note 8 to the

consolidated financial statements for further information regarding income taxes.

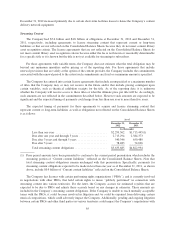

Foreign Currency

The Company translates the assets and liabilities of its non-U.S. dollar functional currency subsidiaries into

U.S. dollars using exchange rates in effect at the end of each period. Revenues and expenses for these

subsidiaries are translated using rates that approximate those in effect during the period. Gains and losses from

these translations are recognized in cumulative translation adjustment included in accumulated other

comprehensive income in stockholders’ equity. The cumulative translation adjustment as of December 31, 2012

was $1.4 million. There was no material cumulative translation adjustments as of December 31, 2011 or 2010.

The amount of income tax allocated to cumulative translation adjustments is immaterial for each of the years

ended December 31, 2012, 2011, and 2010.

For transactions that are not denominated in the functional currency, the Company remeasures monetary

assets and liabilities at exchange rates in effect at the end of each period. Gains and losses from these

remeasurements are recognized in interest and other income (expense). Foreign currency transactions resulted in

losses of $4.0 million for the year ended December 31, 2012. The gains (losses) from foreign currency

transactions were immaterial for each of the years ended December 31, 2011 and 2010. The effect of exchange

rate changes on cash and cash equivalents were immaterial for each of the years ended December 31, 2012, 2011,

and 2010.

58