NetFlix 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

months. Employees could invest up to 15% of their gross compensation through payroll deductions. In no event was an

employee permitted to purchase more than 8,334 shares of common stock during any six-month purchase period.

As of December 31, 2012, there were 2,785,721 shares available for future issuance under the 2002

Employee Stock Purchase Plan. The Company’s ESPP was suspended in 2011 and there were no offerings in

2011 or 2012.

During the year ended December 31, 2010 employees purchased approximately 46,112 shares at an average

price of $58.41 per share. Cash received from purchases under the ESPP for the year ended December 31, 2010

was $2.7 million.

Stock-Based Compensation

Vested stock options granted before June 30, 2004 can be exercised up to three months following

termination of employment. Vested stock options granted after June 30, 2004 and before January 1, 2007 can be

exercised up to one year following termination of employment. Vested stock options granted after January 2007

will remain exercisable for the full ten years contractual term regardless of employment status. The following

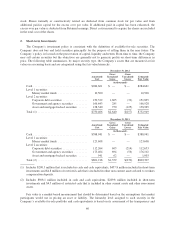

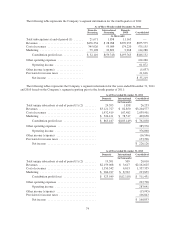

table summarizes the assumptions used to value option grants using the lattice-binomial model:

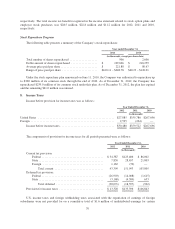

Year Ended December 31,

2012 2011 2010

Dividend yield ................. —% —% —%

Expected volatility ............. 55%–65% 51%–65% 46%–54%

Risk-free interest rate ........... 1.61% – 2.01% 2.05% – 3.42% 2.65% – 3.67%

Suboptimal exercise factor ....... 2.26 – 3.65 2.17 – 3.64 1.78 – 3.28

The Company bifurcates its option grants into two employee groupings (executive and non-executive) based

on exercise behavior and considers several factors in determining the estimate of expected term for each group,

including the historical option exercise behavior, the terms and vesting periods of the options granted.

The assumptions used in the Black-Scholes option pricing model to value the shares under the ESPP in 2010

was a 0% dividend yield, 45% expected volatility, 0.24% risk-free interest rate, and 0.5 expected life in years.

The Company estimates expected volatility based on a blend of historical volatility of the Company’s

common stock and implied volatility of tradable forward call options to purchase shares of its common stock.

The Company believes that implied volatility of publicly traded options in its common stock is expected to be

more reflective of market conditions and, therefore, can reasonably be expected to be a better indicator of

expected volatility than historical volatility of its common stock. The Company includes historical volatility in its

computation due to low trade volume of its tradable forward call options in certain periods, there by precluding

sole reliance on implied volatility.

In valuing shares issued under the Company’s employee stock option plans, the Company bases the risk-free

interest rate on U.S. Treasury zero-coupon issues with terms similar to the contractual term of the options. In

valuing shares issued under the Company’s ESPP, the Company bases the risk-free interest rate on U.S. Treasury

zero-coupon issues with terms similar to the expected term of the shares. The Company does not anticipate

paying any cash dividends in the foreseeable future and therefore uses an expected dividend yield of zero in the

option valuation model. The Company does not use a post-vesting termination rate as options are fully vested

upon grant date. The weighted-average fair value of employee stock options granted during 2012, 2011 and 2010

was $41.00, $84.94 and $49.31 per share, respectively. The weighted-average fair value of shares granted under

the ESPP during 2010 was $21.27 per share.

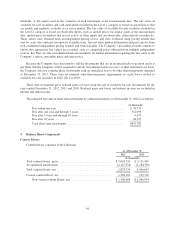

Stock-based compensation expense related to stock option plans and employee stock purchases was

$73.9 million, $61.6 million and $28.0 million for the years ended December 31, 2012, 2011 and 2010,

69