NetFlix 2012 Annual Report Download - page 29

Download and view the complete annual report

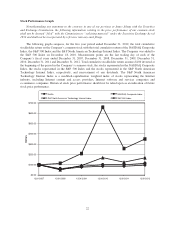

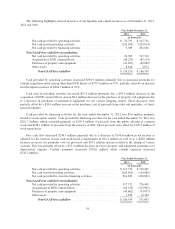

Please find page 29 of the 2012 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Free cash flow for the year ended December 31, 2012 decreased $244.7 million as compared to 2011 to

negative $58.2 million. Significant uses of cash in the year were cash payments for content (in excess of the

expense), and cash payments related to income taxes. These uses of cash were partially offset by net income

excluding the impact of non-cash stock compensation and deferred revenue. We expect excess content payments

over expense to continue to fluctuate over time both domestically and internationally. Payment terms for certain

streaming licenses, especially programming that initially airs in the applicable territory on our service (“original

programming”) or that is considered output content, will typically require more up-front cash payments than

other licensing agreements. Due to the expected receipt timing of original programming content, content cash

payments in excess of expense and free cash flow will be materially more negative in the first quarter of 2013 as

compared to the fourth quarter of 2012, but free cash flow is expected to improve in subsequent quarters.

Prior to July 2011, in the U.S., our streaming and DVDs-by-mail operations were combined and subscribers

could receive both streaming content and DVDs under a single “hybrid” plan. In July 2011, we introduced DVD

only plans and separated the combined plans, making it necessary for subscribers who wish to receive both

streaming services and DVDs-by-mail to have two separate subscription plans. As subscribers were able to

receive both streaming and DVDs-by-mail under a single hybrid plan prior to the fourth quarter of 2011, it is

impracticable to allocate revenues and expenses to the Domestic streaming and Domestic DVD segments prior to

the fourth quarter of 2011.

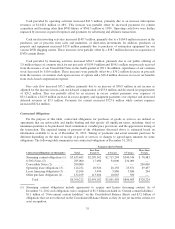

Our core strategy is to grow a streaming subscription business domestically and internationally. We are

continuously improving the customer experience, with a focus on expanding our streaming content, enhancing

our user interface and extending our streaming service to even more Internet-connected devices, while staying

within the parameters of our consolidated net income (loss) and operating segment contribution profit (loss)

targets. As we grow our streaming subscription segments, we have shifted spending away from the Domestic

DVD segment to invest more in streaming content and marketing our streaming services.

• We define contribution profit as revenues less cost of revenues and marketing expenses. We believe this

is an important measure of our operating segment performance.

• For the Domestic and International streaming segments, content licensing expenses, which includes the

amortization of the streaming content library and other expenses associated with the licensing of

streaming content, represent the vast majority of cost of revenues. Streaming content rights are generally

specific to a geographic region and accordingly our international expansion will require us to obtain

additional streaming content licenses to support new international markets. Other cost of revenues such

as content delivery expenses, customer service and payment card fees tend to be lower as a percentage of

total cost of revenues. We utilize both our own and third-party content delivery networks to help us

efficiently stream content in high volume to our subscribers over the Internet. Content delivery expenses

therefore also include equipment costs related to Open Connect and all third-party costs associated with

delivering streaming content over the Internet. Cost of revenues in the Domestic DVD segment consists

primarily of expenses related to the acquisition of content including amortization of DVD content library

and revenue sharing expenses, content delivery and other expenses associated with our DVD processing

and customer service centers. Content delivery expenses for the Domestic DVD segment consist of the

postage costs to mail DVDs to and from our paying subscribers and the packaging and label costs for the

mailers.

• For the Domestic and International streaming segments, marketing expenses consist primarily of

advertising expenses and payments made to our affiliates and consumer electronics partners and also

include payroll related expenses. Advertising expenses include promotional activities such as television

and online advertising as well as allocated costs of revenues relating to free trial periods. Payments to our

affiliates and consumer electronics partners may be in the form of a fixed fee or may be a revenue

sharing payment. Marketing costs as a percentage of revenues are higher for the Domestic and

International streaming segments given our focus on building consumer awareness of the streaming

offerings. Marketing costs are immaterial for the Domestic DVD segment.

25