NetFlix 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

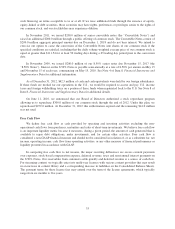

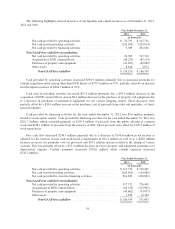

The following highlights selected measures of our liquidity and capital resources as of December 31, 2012,

2011 and 2010:

Year Ended December 31,

2012 2011

(in thousands)

Net cash provided by operating activities ....................... $ 22,765 $ 317,712

Net cash used in investing activities ............................ (245,919) (265,814)

Net cash provided by financing activities ....................... 5,589 261,656

Non-GAAP free cash flow reconciliation:

Net cash provided by operating activities ....................... 22,765 317,712

Acquisition of DVD content library ............................ (48,275) (85,154)

Purchases of property and equipment ........................... (41,457) (49,682)

Other assets ............................................... 8,816 3,674

Non-GAAP free cash flow .............................. $ (58,151) $ 186,550

Cash provided by operating activities decreased $294.9 million, primarily due to increased payments for

content acquisition and licensing other than DVD library of $779.5 million or 59%, partially offset by an increase

in subscription revenues of $404.7 million or 13%.

Cash used in investing activities decreased $19.9 million primarily due a $36.9 million decrease in the

acquisition of DVD content library and an $8.2 million decrease in the purchase of property and equipment due

to a decrease in purchases of automation equipment for our various shipping centers. These decreases were

partially offset by a $30.4 million increase in the purchases, net of proceeds from sales and maturities, of short-

term investments.

Cash provided by financing activities for the year ended December 31, 2012 was $5.6 million primarily

related to stock option activity. Cash provided by financing activities for the year ended December 31, 2011 was

$261.7 million, which consisted primarily of $199.9 million of proceeds from the public offering of common

stock and $198.1 million of proceeds from the issuance of debt. These proceeds were offset by $199.7 million of

stock repurchases.

Free cash flow decreased $244.7 million primarily due to a decrease of $196.6 million in net income as

adjusted for the increase in non-cash stock-based compensation of $12.4 million as well as to a $28.6 million

increase in excess tax payments over tax provision and $34.1 million increase related to the timing of various

accruals. This was partially offset by a $13.0 million decrease in excess property and equipment payments over

depreciation expense. Content payments increased $742.6 million while content expenses increased

$745.2 million.

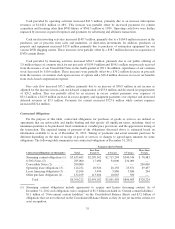

Year Ended December 31,

2011 2010

(in thousands)

Net cash provided by operating activities ....................... $317,712 $ 276,401

Net cash used in investing activities ............................ (265,814) (116,081)

Net cash provided by (used in) financing activities ................ 261,656 (100,045)

Non-GAAP free cash flow reconciliation:

Net cash provided by operating activities ....................... 317,712 276,401

Acquisitions of DVD content library ........................... (85,154) (123,901)

Purchases of property and equipment ........................... (49,682) (33,837)

Other assets ............................................... 3,674 12,344

Non-GAAP free cash flow .............................. $186,550 131,007

34