NetFlix 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

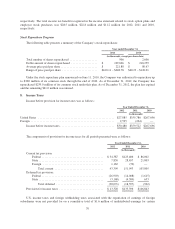

December 31, 2012 increased primarily due to certain short-term facilities leases to house the Company’s content

delivery network equipment.

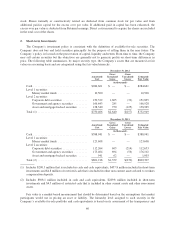

Streaming Content

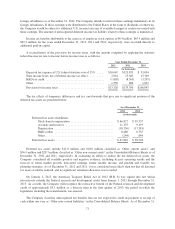

The Company had $5.6 billion and $4.8 billion of obligations at December 31, 2012 and December 31,

2011, respectively, including agreements to license streaming content that represent current or long-term

liabilities or that are not reflected on the Consolidated Balance Sheets because they do not meet content library

asset recognition criteria. The license agreements that are not reflected on the Consolidated Balance Sheets do

not meet content library asset recognition criteria because either the fee is not known or reasonably determinable

for a specific title or it is known but the title is not yet available for streaming to subscribers.

For those agreements with variable terms, the Company does not estimate what the total obligation may be

beyond any minimum quantities and/or pricing as of the reporting date. For those agreements that include

renewal provisions that are solely at the option of the content provider, the Company includes the commitments

associated with the renewal period to the extent such commitments are fixed or a minimum amount is specified.

The Company has entered into certain license agreements that include an unspecified or a maximum number

of titles that the Company may or may not receive in the future and/or that include pricing contingent upon

certain variables, such as theatrical exhibition receipts for the title. As of the reporting date, it is unknown

whether the Company will receive access to these titles or what the ultimate price per title will be. Accordingly,

such amounts are not reflected in the commitments described below. However such amounts are expected to be

significant and the expected timing of payments could range from less than one year to more than five years.

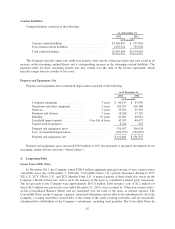

The expected timing of payments for these agreements to acquire and license streaming content that

represent current or long-term liabilities as well as obligations not reflected on the Consolidated Balance Sheets

is as follows:

As of

December 31,

2012

December 31,

2011

(in thousands)

Less than one year ................................... $2,299,562 $1,713,445(1)

Due after one year and through 3 years ................... 2,715,294 2,384,373

Due after 3 years and through 5 years .................... 540,346 650,480

Due after 5 years .................................... 78,483 74,696

Total streaming content obligations ...................... $5,633,685 $4,822,994

(1) Prior period amounts have been presented to conform to the current period presentation which includes the

streaming portion of “Current content liabilities” reflected on the Consolidated Balance Sheets. Note that

total streaming content obligations remain unchanged with this presentation. Specifically, payments for

streaming content obligations expected to be made in less than one year as of December 31, 2011, as shown

above, include $0.9 billion of “Current content liabilities” reflected on the Consolidated Balance Sheets.

The Company has licenses with certain performing rights organizations (“PROs”), and is currently involved

in negotiations with other PROs, that hold certain rights to music “publicly performed” in connection with

streaming content into various territories. For the latter, the Company accrues for estimated royalties that are

expected to be due to PROs and adjusts these accruals based on any changes in estimates. These amounts are

included in the Company’s streaming content obligations. If the Company is unable to reach mutually acceptable

terms with the PROs, it could become involved in litigation and /or could be enjoined from delivering certain

musical compositions, which could adversely impact the Company. Additionally, pending and ongoing litigation

between certain PROs and other third parties in various territories could impact the Company’s negotiations with

65