NetFlix 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

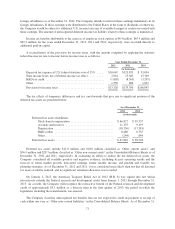

foreign subsidiaries as of December 31, 2012. The Company intends to reinvest these earnings indefinitely in its

foreign subsidiaries. If these earnings were distributed to the United States in the form of dividends or otherwise,

the Company would be subject to additional U.S. income taxes net of available foreign tax credits associated with

these earnings. The amount of unrecognized deferred income tax liability related to these earnings is immaterial.

Income tax benefits attributable to the exercise of employee stock options at $4.4 million, $45.5 million and

$62.2 million for the years ended December 31, 2012, 2011 and 2010, respectively, were recorded directly to

additional paid-in-capital.

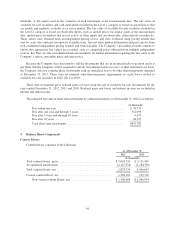

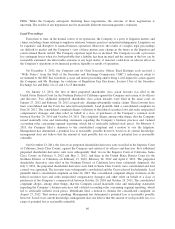

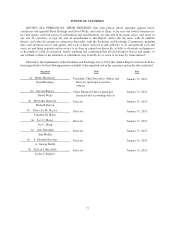

A reconciliation of the provision for income taxes, with the amount computed by applying the statutory

federal income tax rate to income before income taxes is as follows:

Year Ended December 31,

2012 2011 2010

(in thousands)

Expected tax expense at U.S. federal statutory rate of 35% ..... $10,667 $125,833 $ 93,694

State income taxes, net of Federal income tax effect ........... 2,914 15,042 15,349

R&D tax credit ........................................ (1,803) (8,365) (3,207)

Other ................................................ 1,550 886 1,007

Provision for income taxes ............................... $13,328 $133,396 $106,843

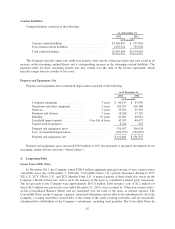

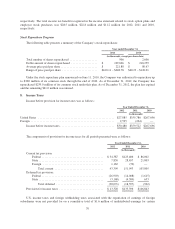

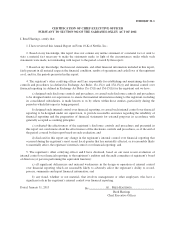

The tax effects of temporary differences and tax carryforwards that give rise to significant portions of the

deferred tax assets are presented below:

As of December 31,

2012 2011

(in thousands)

Deferred tax assets (liabilities):

Stock-based compensation ............................. $66,827 $ 39,337

Accruals and reserves ................................. 11,155 9,193

Depreciation ........................................ (18,356) (17,381)

R&D credits ........................................ 8,480 6,335

Other .............................................. (244) 844

Deferred tax assets ....................................... $67,862 $ 38,328

Deferred tax assets include $11.0 million and $10.0 million classified as “Other current assets” and

$56.9 million and $28.3 million classified as “Other non-current assets” in the Consolidated Balance Sheets as of

December 31, 2012 and 2011, respectively. In evaluating its ability to realize the net deferred tax assets, the

Company considered all available positive and negative evidence, including its past operating results and the

forecast of future market growth, forecasted earnings, future taxable income, and prudent and feasible tax

planning strategies. As of December 31, 2012 and 2011, it was considered more likely than not that all deferred

tax assets would be realized, and no significant valuation allowance was recorded.

On January 2, 2013, the American Taxpayer Relief Act of 2012 (H.R. 8) was signed into law which

retroactively extends the Federal research and development credit from January 1, 2012 through December 31,

2013. As a result, the Company will recognize the retroactive benefit of the Federal research and development

credit of approximately $3.1 million as a discrete item in the first quarter of 2013, the period in which the

legislation, including the reinstatement, was enacted.

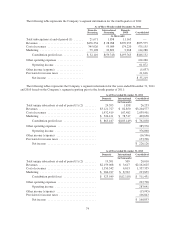

The Company classifies unrecognized tax benefits that are not expected to result in payment or receipt of

cash within one year as “Other non-current liabilities” in the Consolidated Balance Sheets. As of December 31,

71