NetFlix 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

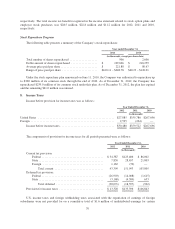

stock. Shares formally or constructively retired are deducted from common stock for par value and from

additional paid-in capital for the excess over par value. If additional paid in capital has been exhausted, the

excess over par value is deducted from Retained earnings. Direct costs incurred to acquire the shares are included

in the total cost of the shares.

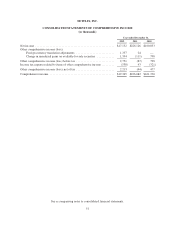

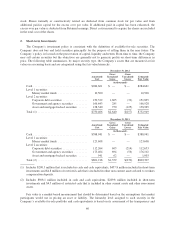

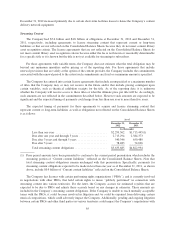

2. Short-term Investments

The Company’s investment policy is consistent with the definition of available-for-sale securities. The

Company does not buy and hold securities principally for the purpose of selling them in the near future. The

Company’s policy is focused on the preservation of capital, liquidity and return. From time to time, the Company

may sell certain securities but the objectives are generally not to generate profits on short-term differences in

price. The following table summarizes, by major security type, the Company’s assets that are measured at fair

value on a recurring basis and are categorized using the fair value hierarchy.

December 31, 2012

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

(in thousands)

Cash ..................................... $284,661 $ — $ — $284,661

Level 1 securities:

Money market funds .................... 10,500 — — 10,500

Level 2 securities:

Corporate debt securities ................. 150,322 1,605 (32) 151,895

Government and agency securities ......... 166,643 285 — 166,928

Asset and mortgage-backed securities ...... 138,340 750 (125) 138,965

Total (1) .................................. $750,466 $2,640 $(157) $752,949

December 31, 2011

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

(in thousands)

Cash ..................................... $388,941 $ — $ — $388,941

Level 1 securities:

Money market funds .................... 123,608 — — 123,608

Level 2 securities:

Corporate debt securities ................. 112,264 603 (214) 112,653

Government and agency securities ......... 175,464 694 (56) 176,102

Asset and mortgage-backed securities ...... 941 62 — 1,003

Total (2) .................................. $801,218 $1,359 $(270) $802,307

(1) Includes $290.3 million that is included in cash and cash equivalents, $457.8 million included in short-term

investments and $4.8 million of restricted cash that is included in other non-current assets related to workers

compensation deposits.

(2) Includes $508.1 million included in cash and cash equivalents, $289.8 million included in short-term

investments and $4.5 million of restricted cash that is included in other current assets and other non-current

assets.

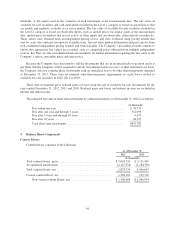

Fair value is a market-based measurement that should be determined based on the assumptions that market

participants would use in pricing an asset or liability. The hierarchy level assigned to each security in the

Company’s available-for-sale portfolio and cash equivalents is based on its assessment of the transparency and

60