NetFlix 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.such financing on terms acceptable to us or at all. If we raise additional funds through the issuance of equity,

equity-linked or debt securities, those securities may have rights, preferences or privileges senior to the rights of

our common stock, and our stockholders may experience dilution.

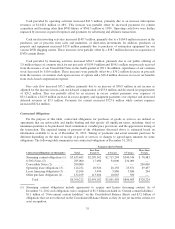

In November 2011, we issued $200.0 million of senior convertible notes (the “Convertible Notes”) and

raised an additional $200.0 million through a public offering of common stock. The Convertible Notes consist of

$200.0 million aggregate principal amount due on December 1, 2018 and do not bear interest. We intend to

exercise our option to cause the conversion of the Convertible Notes into shares of our common stock if the

specified conditions are satisfied, including that the daily volume weighted average price of our common stock is

equal or greater than $111.54 for at least 50 trading days during a 65 trading day period prior to the conversion

date.

In November 2009, we issued $200.0 million of our 8.50% senior notes due November 15, 2017 (the

“8.50% Notes”). Interest on the 8.50% Notes is payable semi-annually at a rate of 8.50% per annum on May 15

and November 15 of each year, commencing on May 15, 2010. See Note 4 of Item 8, Financial Statements and

Supplementary Data for additional information.

As of December 31, 2012, $42.5 million of cash and cash equivalents were held by our foreign subsidiaries.

If these funds are needed for our operations in the U.S., we would be required to accrue and pay U.S. income

taxes and foreign withholding taxes on a portion of these funds when repatriated back to the U.S. See Note 8 of

Item 8, Financial Statements and Supplementary Data for additional details.

On June 11, 2010, we announced that our Board of Directors authorized a stock repurchase program

allowing us to repurchase $300.0 million of our common stock through the end of 2012. Under this plan, we

repurchased $259.0 million. At December 31, 2012 this authorization expired and the remaining $41.0 million

was not used.

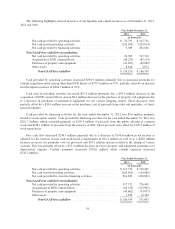

Free Cash Flow

We define free cash flow as cash provided by operating and investing activities excluding the non-

operational cash flows from purchases, maturities and sales of short-term investments. We believe free cash flow

is an important liquidity metric because it measures, during a given period, the amount of cash generated that is

available to repay debt obligations, make investments, and for certain other activities. Free cash flow is

considered a non-GAAP financial measure and should not be considered in isolation of, or as a substitute for, net

income, operating income, cash flow from operating activities, or any other measure of financial performance or

liquidity presented in accordance with GAAP.

In comparing free cash flow to net income, the major recurring differences are excess content payments

over expenses, stock-based compensation expense, deferred revenue, taxes and semi-annual interest payments on

the 8.50% Notes. Our receivables from customers settle quickly and deferred revenue is a source of cash flow.

For streaming content, we typically enter into multi-year licenses with various content providers that may result

in an increase in content library and a corresponding increase in liabilities on the Consolidated Balance Sheets.

The payment terms for these license fees may extend over the term of the license agreements, which typically

range from six months to five years.

33