NetFlix 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

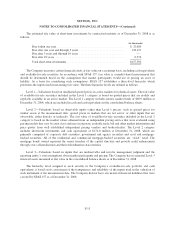

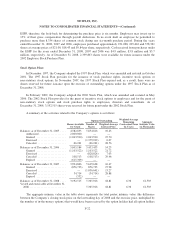

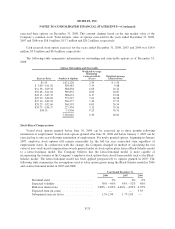

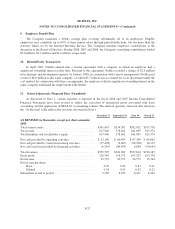

The following table summarizes stock-based compensation expense, net of tax, related to stock option plans

and employee stock purchases under SFAS 123R which was allocated as follows:

Year Ended December 31,

2008 2007 2006

(in thousands)

Fulfillment expenses ............................... $ 466 $ 427 $ 925

Technology and development ........................ 3,890 3,695 3,608

Marketing ....................................... 1,886 2,160 2,138

General and administrative .......................... 6,022 5,694 6,025

Stock-based compensation expense before income taxes . . 12,264 11,976 12,696

Income tax benefit ................................ (4,585) (4,760) (4,950)

Total stock-based compensation after income taxes ...... $ 7,679 $ 7,216 $ 7,746

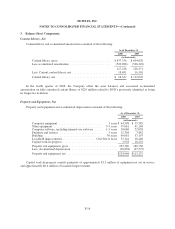

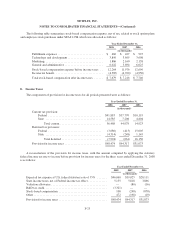

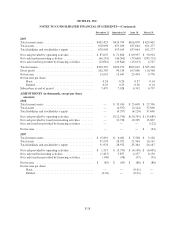

8. Income Taxes

The components of provision for income taxes for all periods presented were as follows:

Year Ended December 31,

2008 2007 2006

(in thousands)

Current tax provision:

Federal .................................... $41,883 $37,770 $10,119

State ...................................... 14,585 7,208 4,804

Total current ............................ 56,468 44,978 14,923

Deferred tax provision:

Federal .................................... (3,680) (413) 15,005

State ...................................... (4,314) (248) 1,145

Total deferred ........................... (7,994) (661) 16,150

Provision for income taxes ......................... $48,474 $44,317 $31,073

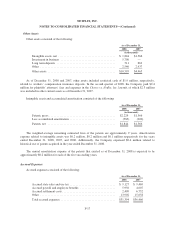

A reconciliation of the provision for income taxes, with the amount computed by applying the statutory

federal income tax rate to income before provision for income taxes for the three years ended December 31, 2008

is as follows:

Year Ended December 31,

2008 2007 2006

(in thousands)

Expected tax expense at U.S. federal statutory rate of 35% ....... $46,060 $39,025 $28,111

State income taxes, net of Federal income tax effect ............. 5,155 5,818 3,866

Valuation allowance ...................................... — (80) (16)

R&D tax credit .......................................... (3,321) — —

Stock-based compensation ................................. 108 (248) (878)

Other .................................................. 472 (198) (10)

Provision for income taxes ................................. $48,474 $44,317 $31,073

F-25