NetFlix 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

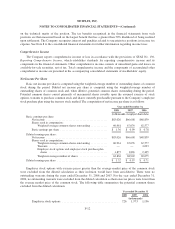

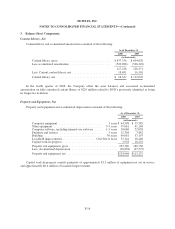

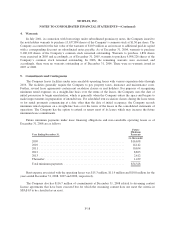

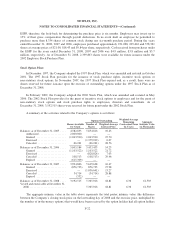

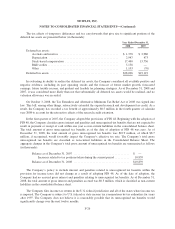

Other Assets

Other assets consisted of the following:

As of December 31,

2008 2007

(in thousands)

Intangible assets, net ....................................... $ 1,844 $1,366

Investment in business ..................................... 5,700 —

Long term deposits ........................................ 511 662

Other ................................................... 2,540 2,437

Other assets .............................................. $10,595 $4,465

As of December 31, 2008 and 2007, other assets included restricted cash of $1.9 million, respectively,

related to workers’ compensation insurance deposits. In the second quarter of 2008, the Company paid $2.4

million for plaintiffs’ attorneys’ fees and expenses in the Chavez vs. Netflix, Inc. lawsuit, of which $2.3 million

was included in other current assets as of December 31, 2007.

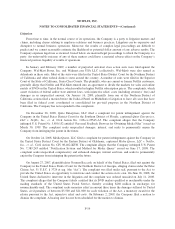

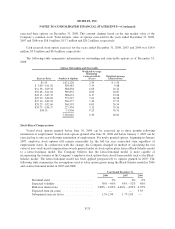

Intangible assets and accumulated amortization consisted of the following:

As of December 31,

2008 2007

(in thousands)

Patents, gross ............................................. $2,229 $1,566

Less accumulated amortization ............................... (385) (200)

Patents, net .............................................. $1,844 $1,366

The weighted-average remaining estimated lives of the patents are approximately 9 years. Amortization

expense related to intangible assets was $0.2 million, $0.2 million and $0.1 million respectively for the years

ended December 31, 2008, 2007, and 2006. Additionally, the Company expensed $0.4 million related to

historical use of patents acquired in the year ended December 31, 2008.

The annual amortization expense of the patents that existed as of December 31, 2008 is expected to be

approximately $0.2 million for each of the five succeeding years.

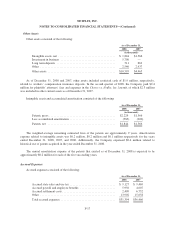

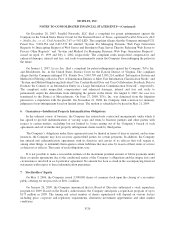

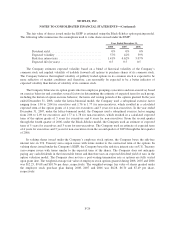

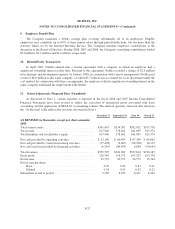

Accrued Expenses

Accrued expenses consisted of the following:

As of December 31,

2008 2007

Accrued state sales and use tax ............................... $ 9,127 $ 9,469

Accrued payroll and employee benefits ........................ 5,956 4,607

Accrued settlement costs .................................... 2,409 6,732

Other ................................................... 13,902 15,658

Total accrued expenses ..................................... $31,394 $36,466

F-17