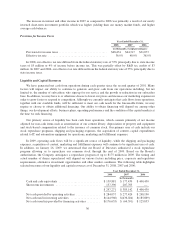

NetFlix 2008 Annual Report Download - page 44

Download and view the complete annual report

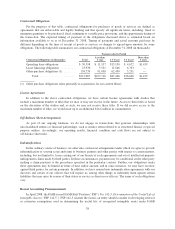

Please find page 44 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Statement No. 142, Goodwill and Other Intangible Assets. This new guidance applies prospectively to intangible

assets that are acquired individually or with a group of other assets in business combinations and asset

acquisitions. FSP 142-3 is effective for financial statements issued for fiscal years and interim periods beginning

after December 15, 2008. Early adoption is prohibited. We do not expect the adoption of this standard to have a

material effect on our financial position or results of operations.

In December 2007, the FASB issued SFAS No. 141-R, Business Combinations (“SFAS 141-R”) and SFAS

160, Non-controlling Interests in Consolidated Financial Statement, an amendment of Accounting Research

Bulletin No. 5 (“SFAS 160”). SFAS 141-R requires the use of the acquisition method of accounting, defines the

acquirer, establishes the acquisition date and broadens the scope to all transactions and other events in which one

entity obtains control over one or more other businesses. SFAS 160 will change the accounting and reporting for

minority interests, which will be re-characterized as non-controlling interests and classified as a component of

equity. These statements are effective for financial statements issued for fiscal years beginning on or after

December 15, 2008. We do not expect the adoption of this standard to have a material effect on our financial

position or results of operations.

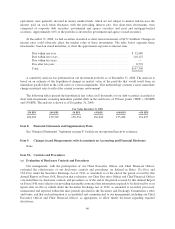

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (“SFAS 157”).

SFAS No. 157 establishes a framework for measuring the fair value of assets and liabilities. This framework is

intended to provide increased consistency in how fair value determinations are made under various existing

accounting standards which permit, or in some cases require, estimates of fair market value. SFAS 157 was

effective for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. In

February 2008, the FASB issued FSP No. 157-2 (FSP 157-2), which would delay the effective date of SFAS

No. 157 for all non-financial assets and non-financial liabilities, except those that are recognized or disclosed at

fair value in the financial statements on a recurring basis. FSP 157-2 partially defers the effective date of SFAS

157 to fiscal years beginning after November 15, 2008 and interim periods within those fiscal years for items

within the scope of FSP 157-2. Effective January 1, 2008, we adopted SFAS 157 for financial assets and

liabilities recognized at fair value on a recurring basis. The partial adoption of SFAS 157 for financial assets and

liabilities did not have a material impact on our consolidated financial position, results of operations or cash

flows. We do not expect the adoption of SFAS 157 for non-financial assets and non-financial liabilities to have a

material effect on our financial position or results of operations.

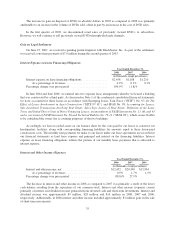

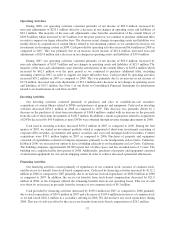

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

The primary objective of our investment activities is to preserve principal, while at the same time

maximizing income we receive from investments without significantly increased risk. To achieve this objective,

we follow an established investment policy and set of guidelines to monitor and help mitigate our exposure to

interest rate and credit risk. The policy sets forth credit quality standards and limits our exposure to any one

issuer, as well as our maximum exposure to various asset classes. We maintain a portfolio of cash equivalents

and short-term investments in a variety of securities. These securities are classified as available-for-sale and are

recorded at fair value with unrealized gains and losses, net of tax, included in accumulated other comprehensive

income within stockholders equity in the consolidated balance sheet.

As a result of current adverse financial market conditions, investments in some financial instruments, such

as structured investment vehicles, sub-prime mortgage-backed securities and collateralized debt obligations, may

pose risks arising from recent market liquidity and credit concerns. As of December 31, 2008, we had no material

impairment charges associated with our short-term investment portfolio relating to such adverse financial market

conditions. Although we believe our current investment portfolio has very little risk of material impairment, we

cannot predict future market conditions or market liquidity and can provide no assurance that our investment

portfolio will remain materially unimpaired. Some of the securities we invest in may be subject to market risk

due to changes in prevailing interest rates which may cause the principal amount of the investment to fluctuate.

For example, if we hold a security that was issued with a fixed interest rate at the then-prevailing rate and the

prevailing interest rate later rises, the value of our investment will decline. At December 31, 2008, our cash

39