NetFlix 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

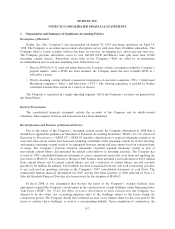

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

amortization of content and revenue sharing expenses. Revenue sharing expenses are recorded when either DVDs

are shipped to subscribers or streaming content is viewed by subscribers. Costs related to free-trial periods are

allocated to marketing expenses.

Fulfillment Expenses. Fulfillment expenses represent those costs incurred in operating and staffing the

Company’s fulfillment and customer service centers, including costs attributable to receiving, inspecting and

warehousing the Company’s content library. Fulfillment expenses also include credit card fees.

Technology and Development

Technology and development expenses consist of payroll and related costs incurred in testing, maintaining

and modifying the Company’s Web site, its recommendation service, developing solutions for the streaming of

content to subscribers, telecommunications systems and infrastructure and other internal-use software systems.

Technology and development expenses also include depreciation of the computer hardware and capitalized

software used to run its Web site and store its data.

Marketing

Marketing expenses consist primarily of advertising expenses. Advertising expenses include marketing

program expenditures and other promotional activities, including allocated costs of revenues related to free trial

periods. Also included in marketing expenses are payments made to our consumer electronics partners to

generate new subscribers for the Company’s service, and payroll related expenses. Advertising costs are

expensed as incurred except for advertising production costs, which are expensed the first time the advertising is

run. Advertising expense totaled approximately $181.4 million, $207.9 million, and $215.3 million in 2008,

2007, and 2006, respectively.

The Company and its vendors participate in a variety of cooperative advertising programs and other

promotional programs in which the vendors provide the Company with cash consideration in exchange for

marketing and advertising of the vendor’s products. If the consideration received represents reimbursement of

specific incremental and identifiable costs incurred to promote the vendor’s product, it is recorded as an offset to

the associated marketing expense incurred. Any reimbursement greater than the specific incremental and

identifiable costs incurred is recognized as a reduction of cost of revenues when recognized in the Company’s

consolidated statements of operations.

Income Taxes

The Company accounts for income taxes using the asset and liability method. Deferred income taxes are

recognized by applying enacted statutory tax rates applicable to future years to differences between the financial

statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and

tax credit carryforwards. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in

income in the period that includes the enactment date. The measurement of deferred tax assets is reduced, if

necessary, by a valuation allowance for any tax benefits for which future realization is uncertain. There was no

valuation allowance as of December 31, 2008 or 2007.

During 2007, the Company adopted the Financial Accounting Standard Board’s (“FASB”) Financial

Interpretation No. (“FIN”) 48, Accounting for Uncertainty in Income Taxes—an interpretation of FASB

Statement No. 109 (“FIN 48”). FIN 48 changes the accounting for uncertainty in income taxes by creating a new

framework for how companies should recognize, measure, present and disclose uncertain tax positions in their

financial statements. Under FIN 48, the Company may recognize the tax benefit from an uncertain tax position

only if it is more likely than not the tax position will be sustained on examination by the taxing authorities, based

F-11