NetFlix 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

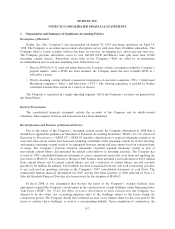

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Organization and Summary of Significant Accounting Policies

Description of Business

Netflix, Inc. (the “Company”) was incorporated on August 29, 1997 and began operations on April 14,

1998. The Company is an online movie rental subscription service with more than 10 million subscribers. The

Company offers a variety of plans, with no due dates, no late fees, no shipping fees, and no pay-per-view fees.

The Company provides subscribers access to over 100,000 DVD and Blu-ray titles plus more than 12,000

streaming content choices. Subscribers select titles at the Company’s Web site aided by its proprietary

recommendation service and merchandising tools. Subscribers can:

• Receive DVDs by U.S. mail and return them to the Company at their convenience using the Company’s

prepaid mailers. After a DVD has been returned, the Company mails the next available DVD in a

subscriber’s queue.

• Watch streaming content without commercial interruption on personal computers (“PCs”), Intel-based

Macintosh computers (“Macs”) and televisions (“TVs”). The viewing experience is enabled by Netflix

controlled software that can run on a variety of devices.

The Company is organized in a single operating segment. All of the Company’s revenues are generated in

the United States.

Basis of Presentation

The consolidated financial statements include the accounts of the Company and its wholly-owned

subsidiary. Intercompany balances and transactions have been eliminated.

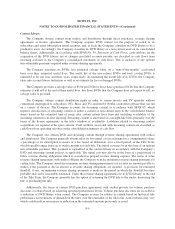

Reclassification and Revision of Immaterial Errors

Due to the nature of the Company’s streaming content model, the Company determined in 2008 that it

should have applied the guidance in Statement of Financial Accounting Standards (“SFAS”) No. 63, Financial

Reporting by Broadcasters (“SFAS 63”). SFAS 63 specifies classification of acquired streaming content as an

asset only after certain criteria have been met, including availability of the streaming content for its first showing,

and requires streaming content assets to be segregated between current and non-current based on estimated time

of usage. The Company’s previous financial statements classified acquired streaming content as part of

non-current content library and presented the related cash outflows as investing activities. The Company has

revised its 2007 consolidated financial statements to correct immaterial errors that arose from not applying the

provisions of SFAS 63. The revisions to the fiscal 2007 balance sheet included a reclassification of $16.3 million

from content library, net to current content library, net and a reduction of content library, net and accounts

payable by $4 million. In addition, $14.8 million has been reclassified from net cash used in investing activities

to net cash used in operating activities in the Company’s 2007 consolidated statements of cash flows. The

summarized interim financial information for 2007 and the first three quarters of 2008 reflected in Note 11,

Selected Quarterly Financial Data has also been revised for the adoption of SFAS 63.

In fiscal 2008, it was determined that because the terms of the Company’s original facilities lease

agreements required the Company’s involvement in the construction of certain buildings, under Emerging Issues

Task Force (“EITF”) No. 97-10, The Effect of Lessee Involvement in Asset Construction, the Company was

deemed to be the owner (for accounting purposes only) of the buildings subject to the leases during the

construction period. The Company should have reflected an asset on its balance sheet for the costs paid by the

lessor to construct these buildings, as well as a corresponding liability. Upon completion of construction, the

F-7