NetFlix 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

on the technical merits of the position. The tax benefits recognized in the financial statements from such

positions are then measured based on the largest benefit that has a greater than 50% likelihood of being realized

upon settlement. The Company recognizes interest and penalties related to uncertain tax positions in income tax

expense. See Note 8 to the consolidated financial statements for further information regarding income taxes

Comprehensive Income

The Company reports comprehensive income or loss in accordance with the provisions of SFAS No. 130,

Reporting Comprehensive Income, which establishes standards for reporting comprehensive income and its

components in the financial statements. Other comprehensive income consists of unrealized gains and losses on

available-for-sale securities, net of tax. Total comprehensive income and the components of accumulated other

comprehensive income are presented in the accompanying consolidated statements of stockholders’ equity.

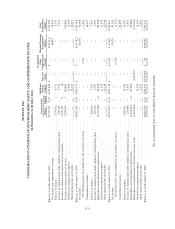

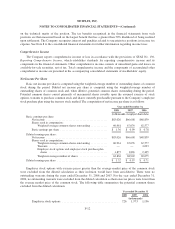

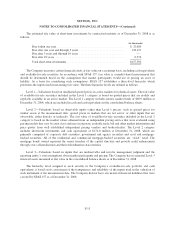

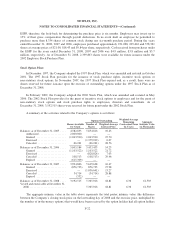

Net Income Per Share

Basic net income per share is computed using the weighted-average number of outstanding shares of common

stock during the period. Diluted net income per share is computed using the weighted-average number of

outstanding shares of common stock and, when dilutive, potential common shares outstanding during the period.

Potential common shares consist primarily of incremental shares issuable upon the assumed exercise of stock

options, warrants to purchase common stock and shares currently purchasable pursuant to the Company’s employee

stock purchase plan using the treasury stock method. The computation of net income per share is as follows:

Year ended December 31,

2008 2007 2006

(in thousands, except per share data)

Basic earnings per share:

Net income ............................................ $83,026 $66,608 $48,839

Shares used in computation:

Weighted-average common shares outstanding ............ 60,961 67,076 62,577

Basic earnings per share .................................. $ 1.36 $ 0.99 $ 0.78

Diluted earnings per share:

Net income ............................................ $83,026 $66,608 $48,839

Shares used in computation:

Weighted-average common shares outstanding ............ 60,961 67,076 62,577

Warrants .......................................... — — 4,093

Employee stock options and employee stock purchase plan

shares .......................................... 1,875 1,826 2,405

Weighted-average number of shares .................... 62,836 68,902 69,075

Diluted earnings per share .................................... $ 1.32 $ 0.97 $ 0.71

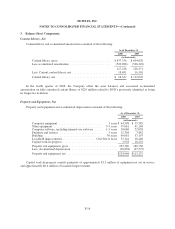

Employee stock options with exercise prices greater than the average market price of the common stock

were excluded from the diluted calculation as their inclusion would have been anti-dilutive. There were no

outstanding warrants during the years ended December 31, 2008 and 2007. For the year ended December 31,

2006, no outstanding warrants were excluded from the diluted calculation as their exercise prices were lower than

the average market price of the common stock. The following table summarizes the potential common shares

excluded from the diluted calculation:

Year ended December 31

2008 2007 2006

(in thousands)

Employee stock options ...................................... 726 1,973 1,196

F-12