NetFlix 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The increase in gain on disposal of DVDs in absolute dollars in 2007 as compared to 2006 was primarily

attributable to an increase in the volume of DVDs sold, offset in part by an increase in the cost of DVD sales.

In the first quarter of 2009, we discontinued retail sales of previously viewed DVD’s to subscribers.

However, we will continue to sell previously viewed DVDs through wholesale channels.

Gain on Legal Settlement

On June 25, 2007, we resolved a pending patent litigation with Blockbuster, Inc. As part of the settlement,

we received a one-time payment of $7.0 million during the second quarter of 2007.

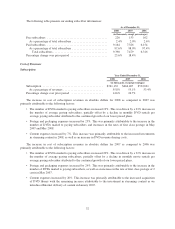

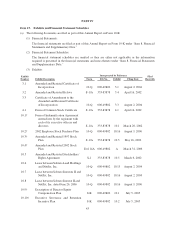

Interest Expense on Lease Financing Obligations

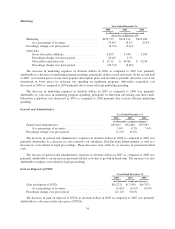

Year Ended December 31,

2008 2007 2006

(in thousands, except percentages)

Interest expense on lease financing obligations ................. $2,458 $1,188 $1,210

As a percentage of revenues ............................ 0.2% 0.1% 0.1%

Percentage change over prior period ......................... 106.9% (1.8)%

In June 2004 and June 2006, we entered into two separate lease arrangements whereby we leased a building

that was constructed by a third party. As discussed in Note 1 of the condensed consolidated financial statements,

we have accounted for these leases in accordance with Emerging Issues Task Force (“EITF”) No. 97-10, The

Effect of Lessee Involvement in Asset Construction (“EITF 97-10”), and SFAS No. 98, Accounting for Leases:

Sale-Leaseback Transactions Involving Real Estate, Sales-Type Leases of Real Estate, Definition of the Lease

Term, and Initial Direct Costs of Direct Financing Leases; an amendment of FASB Statements No. 13, 66, and 91

and a rescission of FASB Statement No. 26 and Technical Bulletin No. 79-11 (“SFAS 98”), which causes Netflix

to be considered the owner (for accounting purposes) of the two buildings.

Accordingly, we have recorded assets on our balance sheet for the costs paid by our lessor to construct our

headquarters facilities, along with corresponding financing liabilities for amounts equal to these lessor-paid

construction costs. The monthly rent payments we make to our lessor under our lease agreements are recorded in

our financial statements as land lease expense and principal and interest on the financing liabilities. Interest

expense on lease financing obligations reflects the portion of our monthly lease payments that is allocated to

interest expense.

Interest and Other Income (Expense)

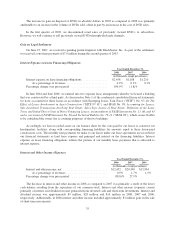

Year Ended December 31,

2008 2007 2006

(in thousands, except percentages)

Interest and other income, net .............................. $12,452 $20,340 $15,904

As a percentage of revenues ............................ 0.9% 1.7% 1.5%

Percentage change over prior period ......................... (38.8)% 27.9%

The decrease in interest and other income in 2008 as compared to 2007 was primarily a result of the lower

cash balance resulting from the repurchase of our common stock. Interest and other income (expense) consist

primarily of interest and dividend income generated from invested cash and short-term investments. Interest and

dividend income was approximately $9 million, $20 million and $16 million in 2008, 2007 and 2006,

respectively. Additionally, in 2008 interest and other income included approximately $3 million gain on the sale

of short-term investments.

35