NetFlix 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

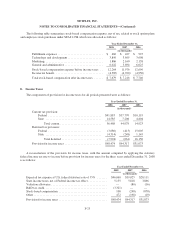

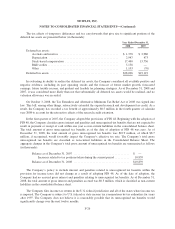

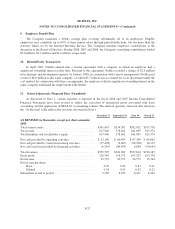

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

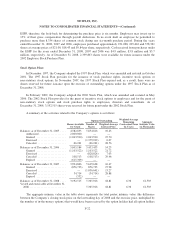

ESPP, therefore, the look-back for determining the purchase price is six months. Employees may invest up to

15% of their gross compensation through payroll deductions. In no event shall an employee be permitted to

purchase more than 8,334 shares of common stock during any six-month purchase period. During the years

ended December 31, 2008, 2007 and 2006, employees purchased approximately 231,068, 205,416 and 378,361

shares at average prices of $21.00, $18.43 and $9.84 per share, respectively. Cash received from purchases under

the ESPP for the years ended December 31, 2008, 2007 and 2006 was $4.9 million, $3.8 million and $3.7

million, respectively. As of December 31, 2008, 2,399,863 shares were available for future issuance under the

2002 Employee Stock Purchase Plan.

Stock Option Plans

In December 1997, the Company adopted the 1997 Stock Plan, which was amended and restated in October

2001. The 1997 Stock Plan provides for the issuance of stock purchase rights, incentive stock options or

non-statutory stock options. In November 2007, the 1997 Stock Plan expired and, as a result, there were no

shares reserved for future issuance upon the exercise of outstanding options under the 1997 Stock Plan as of

December 31, 2008.

In February 2002, the Company adopted the 2002 Stock Plan, which was amended and restated in May

2006. The 2002 Stock Plan provides for the grant of incentive stock options to employees and for the grant of

non-statutory stock options and stock purchase rights to employees, directors and consultants. As of

December 31, 2008, 3,192,515 shares were reserved for future grant under the 2002 Stock Plan.

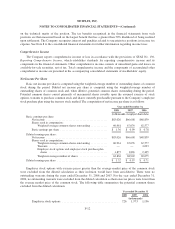

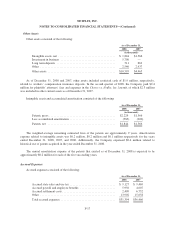

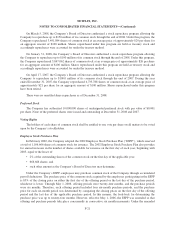

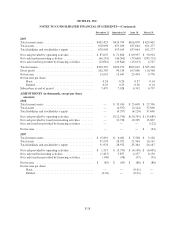

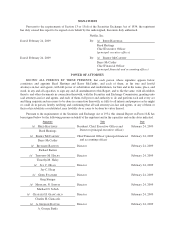

A summary of the activities related to the Company’s options is as follows:

Shares Available

for Grant

Options Outstanding Weighted-Average

Remaining

Contractual Term

(in Years)

Aggregate

Intrinsic Value

(in Thousands)

Number of

Shares

Weighted-Average

Exercise Price

Balances as of December 31, 2005 .... 4,582,833 5,854,816 10.43

Authorized ................... 2,000,000 — —

Granted ..................... (1,043,910) 1,043,910 25.70

Exercised .................... — (1,379,012) 6.07

Canceled .................... 66,261 (66,261) 28.56

Balances as of December 31, 2006 .... 5,605,184 5,453,453 14.23

Granted ..................... (1,103,522) 1,103,522 21.72

Exercised .................... — (828,824) 7.03

Canceled .................... 108,513 (108,513) 29.46

Expired ..................... (615,309) — —

Balances as of December 31, 2007 .... 3,994,866 5,619,638 16.47

Granted ..................... (856,733) 856,733 27.98

Exercised .................... — (1,056,641) 13.27

Canceled .................... 54,714 (54,714) 28.88

Expired ..................... (332) — —

Balances as of December 31, 2008 .... 3,192,515 5,365,016 18.81 6.36 61,503

Vested and exercisable at December 31,

2008 .......................... 5,365,016 18.81 6.36 61,503

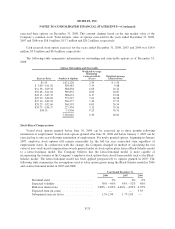

The aggregate intrinsic value in the table above represents the total pretax intrinsic value (the difference

between the Company’s closing stock price on the last trading day of 2008 and the exercise price, multiplied by

the number of in-the-money options) that would have been received by the option holders had all option holders

F-22