NetFlix 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

exercised their options on December 31, 2008. This amount changes based on the fair market value of the

Company’s common stock. Total intrinsic value of options exercised for the years ended December 31, 2008,

2007 and 2006 was $18.9 million, $13.7 million and $29.2 million, respectively.

Cash received from option exercises for the years ended December 31, 2008, 2007 and 2006 was $14.0

million, $5.8 million and $8.4 million, respectively.

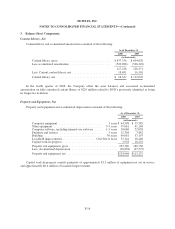

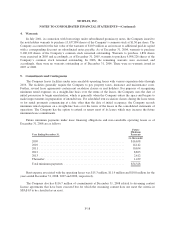

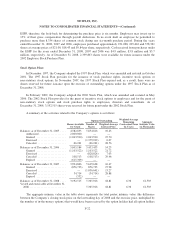

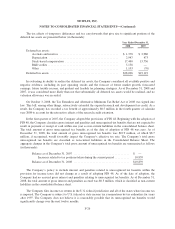

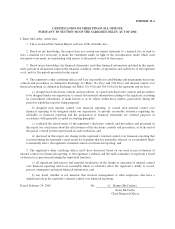

The following table summarizes information on outstanding and exercisable options as of December 31,

2008:

Options Outstanding and Exercisable

Exercise Price Number of Options

Weighted-Average

Remaining

Contractual Life

(Years)

Weighted-Average

Exercise Price

$1.50 1,021,220 2.59 $ 1.50

$ 3.00 – $11.92 598,583 5.54 9.88

$12.38 – $19.34 588,838 6.66 16.41

$19.48 – $22.04 589,835 8.06 20.87

$22.15 – $25.35 588,033 8.17 23.26

$25.39 – $26.90 572,297 7.61 26.28

$27.10 – $29.22 566,277 7.42 27.72

$29.23 – $32.60 560,593 8.01 30.54

$34.75 – $36.37 227,434 5.11 35.56

$36.51 51,906 9.25 36.51

5,365,016 6.36 18.81

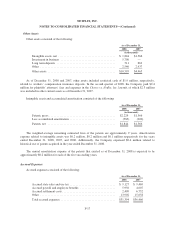

Stock-Based Compensation

Vested stock options granted before June 30, 2004 can be exercised up to three months following

termination of employment. Vested stock options granted after June 30, 2004 and before January 1, 2007 can be

exercised up to one year following termination of employment. For newly granted options, beginning in January

2007, employee stock options will remain exercisable for the full ten year contractual term regardless of

employment status. In conjunction with this change, the Company changed its method of calculating the fair

value of new stock-based compensation awards granted under its stock option plans from a Black-Scholes model

to a lattice-binomial model. The Company believes that the lattice-binomial model is more capable of

incorporating the features of the Company’s employee stock options than closed-form models such as the Black-

Scholes model. The lattice-binomial model has been applied prospectively to options granted in 2007. The

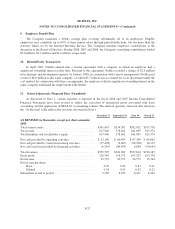

following table summarizes the assumptions used to value option grants using the Black-Scholes model in 2006

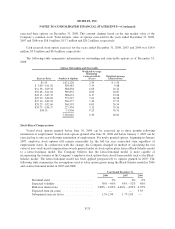

and a lattice-binomial model in 2007 and 2008:

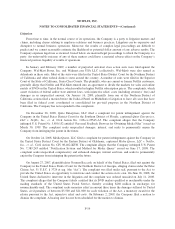

Year Ended December 31,

2008 2007 2006

Dividend yield ............................. 0% 0% 0%

Expected volatility .......................... 50%–60% 43%–52% 48%

Risk-free interest rate ....................... 3.68% – 4.00% 4.40% – 4.92% 4.76%

Expected term (in years) ..................... — — 3.93

Suboptimal exercise factor ................... 1.76-2.04 1.77-2.09 —

F-23