NetFlix 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

equivalents were generally invested in money market funds, which are not subject to market risk because the

interest paid on such funds fluctuates with the prevailing interest rate. Our short-term investments were

comprised of corporate debt securities, government and agency securities and asset and mortgage-backed

securities. Approximately 60% of the portfolio is invested in government and agency issued securities.

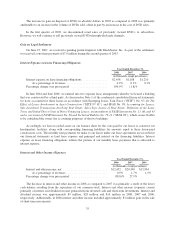

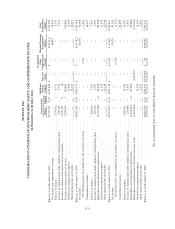

At December 31, 2008, we had securities classified as short-term investments of $157.4 million. Changes in

interest rates could adversely affect the market value of these investments. The table below separates these

investments, based on stated maturities, to show the approximate exposure to interest rates.

Due within one year ................................................ $ 32,689

Due within five years ............................................... 118,127

Due within ten years ................................................ —

Due after ten years ................................................. 6,574

Total ............................................................ $157,390

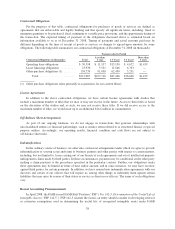

A sensitivity analysis was performed on our investment portfolio as of December 31, 2008. The analysis is

based on an estimate of the hypothetical changes in market value of the portfolio that would result from an

immediate parallel shift in the yield curve of various magnitudes. This methodology assumes a more immediate

change in interest rates to reflect the current economic environment.

The following tables present the hypothetical fair values (in $ thousands) of our debt securities classified as

short term investments assuming immediate parallel shifts in the yield curve of 50 basis points (“BPS”), 100 BPS

and 150 BPS. The analysis is shown as of December 31, 2008:

Fair Value December 31, 2008

-150 BPS -100 BPS -50 BPS +50 BPS +100 BPS +150 BPS

160,283 159,319 158,354 156,426 155,462 154,497

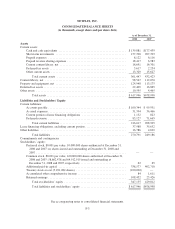

Item 8. Financial Statements and Supplementary Data

See “Financial Statements” beginning on page F-1 which are incorporated herein by reference.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

(a) Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer,

evaluated the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and

15d-15(e) under the Securities Exchange Act of 1934, as amended) as of the end of the period covered by this

Annual Report on Form 10-K. Based on that evaluation, our Chief Executive Officer and Chief Financial Officer

concluded that our disclosure controls and procedures as of the end of the period covered by this Annual Report

on Form 10-K were effective in providing reasonable assurance that information required to be disclosed by us in

reports that we file or submit under the Securities Exchange Act of 1934, as amended, is recorded, processed,

summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules

and forms, and that such information is accumulated and communicated to our management, including our Chief

Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required

disclosures.

40