NetFlix 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

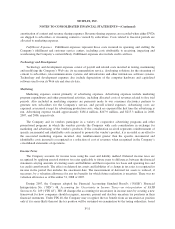

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

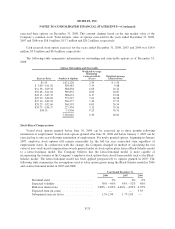

The weighted average exercise price of excluded outstanding stock options was $32.42, $27.83, and $29.84

for the years ended December 31, 2008, 2007 and 2006, respectively.

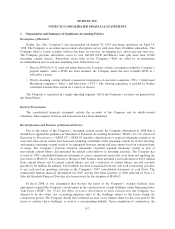

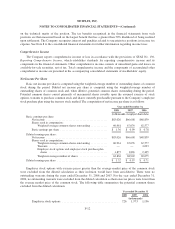

Stock-Based Compensation

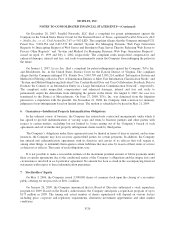

Effective January 1, 2006, the Company adopted the fair value recognition provisions of SFAS No. 123(R),

Share-Based Payment (“SFAS 123R”), using the modified prospective method. The Company had previously

adopted the fair value recognition provisions of SFAS No. 123, Accounting for Stock-Based Compensation

(“SFAS 123”),as amended by SFAS No. 148, Accounting for Stock-Based Compensation—Transition and

Disclosure, an Amendment of FASB Statement No. 123 in 2003, and restated prior periods at that time. Because

the fair value recognition provisions of SFAS 123 and SFAS 123R were generally consistent, the adoption of

SFAS 123R did not have a significant impact on the Company’s financial position or results of operations.

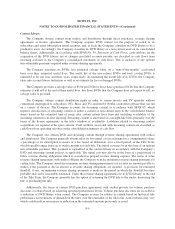

Recent Accounting Pronouncements

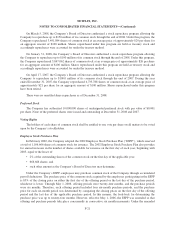

In April 2008, the FASB issued FASB Staff Position (“FSP”) No. 142-3, Determination of the Useful Life of

Intangible Assets (“FSP 142-3”). FSP 142-3 amends the factors an entity should consider in developing renewal

or extension assumptions used in determining the useful life of recognized intangible assets under FASB

Statement No. 142, “Goodwill and Other Intangible Assets.” This new guidance applies prospectively to

intangible assets that are acquired individually or with a group of other assets in business combinations and asset

acquisitions. FSP 142-3 is effective for financial statements issued for fiscal years and interim periods beginning

after December 15, 2008. Early adoption is prohibited. The Company does not expect the adoption of this

standard to have a material effect on its financial position or results of operations.

In December 2007, the FASB issued SFAS No. 141-R, Business Combinations (“SFAS 141-R”) and SFAS

No. 160 Non-controlling Interests in Consolidated Financial Statement, an amendment of Accounting Research

Bulletin No. 5 (“SFAS 160”). SFAS 141-R requires the use of the acquisition method of accounting, defines the

acquirer, establishes the acquisition date and broadens the scope to all transactions and other events in which one

entity obtains control over one or more other businesses. SFAS 160 will change the accounting and reporting for

minority interests, which will be re-characterized as non-controlling interests and classified as a component of

equity. These statements are effective for the Company in the first quarter of fiscal 2009. The Company does not

expect the adoption of this standard to have a material effect on its financial position or results of operations.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (“SFAS 157”). SFAS 157

establishes a framework for measuring the fair value of assets and liabilities. This framework is intended to

provide increased consistency in how fair value determinations are made under various existing accounting

standards which permit, or in some cases require, estimates of fair market value. SFAS 157 was effective for

fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. In December 2007,

the FASB issued proposed FSP No. 157-2 (FSP 157-2), which would delay the effective date of SFAS 157 for all

non-financial assets and non-financial liabilities, except those that are recognized or disclosed at fair value in the

financial statements on a recurring basis. FSP No. 157-2 partially defers the effective date of SFAS 157 to fiscal

years beginning after November 15, 2008 and interim periods within those fiscal years for items within the scope

of FSP 157-2. Effective January 1, 2008, we adopted SFAS 157 for financial assets and liabilities recognized at

fair value on a recurring basis. The partial adoption of SFAS 157 for financial assets and liabilities did not have a

material impact on our consolidated financial position, results of operations or cash flows. We do not expect the

adoption of SFAS 157 for non-financial assets and non-financial liabilities to have a material effect on our

financial position or results of operations.

F-13