NetFlix 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

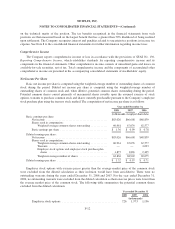

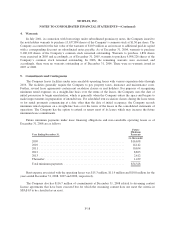

Company did not meet the “sale-leaseback” criteria under SFAS No. 98, Accounting for Leases: Sale-Leaseback

Transactions Involving Real Estate, Sales-Type Leases of Real Estate, Definition of the Lease Term, and Initial

Direct Costs of Direct Financing Leases; an amendment of FASB Statements No. 13, 66, and 91 and a rescission

of FASB Statement No. 26 and Technical Bulletin No. 79-11, and therefore should have treated the leases as

financing obligations and the assets and corresponding liabilities would not be derecognized. Previously these

arrangements were accounted for as operating leases. The Company has revised its 2007 and 2006 consolidated

financial statements to correct immaterial errors in the historical accounting treatment. Specifically, total assets

were increased by $36.5 million inclusive of $35.9 million for property and equipment, net and total liabilities

were increased by $37.4 million for lease financing obligations at December 31, 2007. Net operating expenses

were reduced by $0.6 million and $0.8 million in 2007 and 2006, respectively and interest expense on lease

financing obligations was recorded in the amount of $1.2 million for both 2007 and 2006 in the consolidated

statements of operations. Diluted net income per share remained unchanged for the years ended December 31,

2007 and 2006. Additionally, $0.4 million and $0.3 million, for 2007 and 2006 were reclassified from net cash

provided by operating activities to net cash used in financing activities in the consolidated statements of cash

flows. The summarized interim financial information for 2007 and the first quarter of 2008 reflected in Note 11,

Selected Quarterly Financial Data has also been revised for the adoption of EITF 97-10.

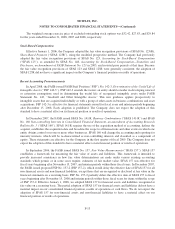

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial

statements, and the reported amounts of revenues and expenses during the reporting periods. Significant items

subject to such estimates and assumptions include the estimate of useful lives and residual value of its content

library; the valuation of stock-based compensation; and the recognition and measurement of income tax assets

and liabilities. The Company bases its estimates on historical experience and on various other assumptions that

the Company believes to be reasonable under the circumstances. Actual results may differ from these estimates.

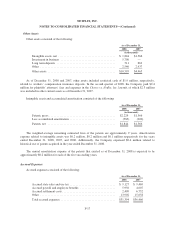

Cash Equivalents and Short-term Investments

The Company classifies cash equivalents and short-term investments in accordance with SFAS No. 115,

Accounting for Certain Investments in Debt and Equity Securities (“SFAS 115”). The Company considers

investments in instruments purchased with an original maturity of 90 days or less to be cash equivalents. The

Company classifies short-term investments, which consist of marketable securities with original maturities in

excess of 90 days as available-for-sale. Short-term investments are reported at fair value with unrealized gains

and losses included in accumulated other comprehensive income within stockholders’ equity in the consolidated

balance sheet. The amortization of premiums and discounts on the investments, realized gains and losses, and

declines in value judged to be other-than-temporary on available-for-sale securities are included in interest and

other income in the consolidated statements of operations. The Company uses the specific identification method

to determine cost in calculating realized gains and losses upon the sale of short-term investments.

Short-term investments are reviewed periodically to identify possible other-than-temporary impairment.

When evaluating the investments, the Company reviews factors such as the length of time and extent to which

fair value has been below cost basis, the financial condition of the issuer and the Company’s ability and intent to

hold the investment for a period of time which may be sufficient for anticipated recovery in market value.

F-8