NetFlix 2008 Annual Report Download - page 35

Download and view the complete annual report

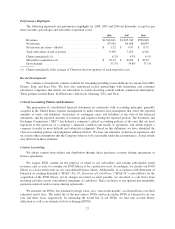

Please find page 35 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cost of Revenues

Subscription

Cost of subscription revenues consists of postage and packaging costs related to shipping DVDs to

subscribers as well as content related expenses. Costs related to free-trial periods are allocated to marketing

expenses.

Postage and Packaging. Postage and packaging expenses consist of the postage costs to mail DVDs to and

from our paying subscribers and the packaging and label costs for the mailers. Between January 8, 2006 and

May 13, 2007, the rate for first-class postage was $0.39. The U.S. Postal Service increased the rate of first class

postage by 2 cents to $0.41 effective May 14, 2007 and by one cent to $0.42 effective May 12, 2008. We receive

discounts on outbound postage costs related to our mail preparation practices.

Content Expenses. We obtain titles from studios and distributors through direct purchases, revenue sharing

agreements or license agreements. Direct purchases of DVDs normally result in higher upfront costs than titles

obtained through revenue sharing agreements. Content related expenses consist of costs incurred in obtaining

titles such as amortization of content and revenue sharing expense.

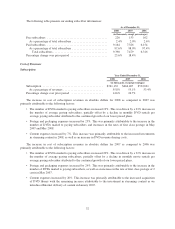

Fulfillment expenses

Fulfillment expenses represent those expenses incurred in operating and staffing our shipping and customer

service centers, including costs attributable to receiving, inspecting and warehousing our content library.

Fulfillment expenses also include credit card fees.

Operating Expenses

Technology and Development. Technology and development expenses consist of payroll and related costs

incurred in testing, maintaining and modifying our Web site, our recommendation service, developing solutions

for streaming content to subscribers, telecommunications systems and infrastructure and other internal-use

software systems. Technology and development expenses also include depreciation of the computer hardware

and capitalized software we use to run our Web site and store our data.

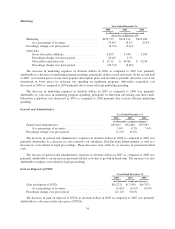

Marketing. Marketing expenses consist primarily of advertising expenses. Advertising expenses include

marketing program expenditures and other promotional activities, including allocated costs of revenues relating

to free trial periods Also included in marketing expense are payments made to our consumer electronics partners

to generate new subscribers for our service as well as payroll related expenses.

General and Administrative. General and administrative expenses consist of payroll and related expenses

for executive, finance, content acquisition and administrative personnel, as well as recruiting, professional fees

and other general corporate expenses.

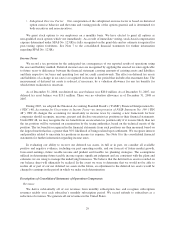

Stock-Based Compensation. Effective January 1, 2006, we adopted the fair value recognition provisions of

SFAS No. 123(R) using the modified prospective method.

We grant stock options to our employees on a monthly basis. We have elected to grant all options as

non-qualified stock options which vest immediately. As a result of immediate vesting, stock-based compensation

expense determined under SFAS No. 123(R) is fully recognized on the grant date, and no estimate is required for

post-vesting option forfeitures.

Gain on disposal of DVDs. Gain on disposal of DVDs represents the difference between proceeds from

sales of DVDs and associated cost of DVD sales. Cost of DVD sales includes the net book value of the DVDs

sold, shipping charges and, where applicable, a contractually specified fee for the DVDs that are subject to

revenue sharing agreements.

30