NetFlix 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

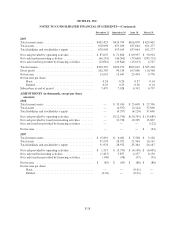

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

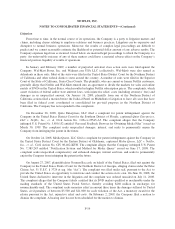

On December 28, 2007, Parallel Networks, LLC filed a complaint for patent infringement against the

Company in the United States District Court for the Eastern District of Texas, captioned Parallel Networks, LLC

v. Netflix, Inc., et. al , Civil Action No 2:07-cv-562-LED. The complaint alleges that the Company infringed U.S.

Patent Nos. 5,894,554 and 6,415,335 B1 entitled “System For Managing Dynamic Web Page Generation

Requests by Intercepting Request at Web Server and Routing to Page Server Thereby Releasing Web Server to

Process Other Requests” and “System and Method for Managing Dynamic Web Page Generation Requests”,

issued on April 13, 1999 and July 2, 2002, respectively. The complaint seeks unspecified compensatory and

enhanced damages, interest and fees, and seeks to permanently enjoin the Company from infringing the patent in

the future.

On January 3, 2007, Lycos, Inc. filed a complaint for patent infringement against the Company, TiVo, Inc.

and Blockbuster, Inc. in the United States District Court for the Eastern District of Virginia. The complaint

alleges that the Company infringed U.S. Patents Nos. 5,867,799 and 5,983,214, entitled “Information System and

Method for Filtering a Massive Flow of Information Entities to Meet User Information Classification Needs” and

“System and Method Employing Individual User Content-Based Data and User Collaboration Feedback Data to

Evaluate the Content of an Information Entity in a Large Information Communication Network”, respectively.

The complaint seeks unspecified compensatory and enhanced damages, interest and fees and seeks to

permanently enjoin the defendants from infringing the patents in the future. On August 6, 2007, the case was

transferred to the District of Massachusetts. On June 27, 2008, TiVo, Inc. was dismissed from the litigation

pursuant to a stipulation with the plaintiff. On November 21, 2008, the Company filed a motion for summary

judgment of non-infringement based on limited issues. The motion is scheduled to be heard on May 21, 2009.

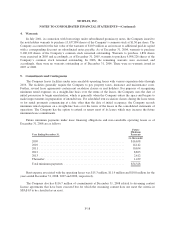

6. Guarantees—Intellectual Property Indemnification Obligations

In the ordinary course of business, the Company has entered into contractual arrangements under which it

has agreed to provide indemnification of varying scope and terms to business partners and other parties with

respect to certain matters, including, but not limited to, losses arising out of the Company’s breach of such

agreements and out of intellectual property infringement claims made by third parties.

The Company’s obligations under these agreements may be limited in terms of time or amount, and in some

instances, the Company may have recourse against third parties for certain payments. In addition, the Company

has entered into indemnification agreements with its directors and certain of its officers that will require it,

among other things, to indemnify them against certain liabilities that may arise by reason of their status or service

as directors or officers. The terms of such obligations vary.

It is not possible to make a reasonable estimate of the maximum potential amount of future payments under

these or similar agreements due to the conditional nature of the Company’s obligations and the unique facts and

circumstances involved in each particular agreement. No amount has been accrued in the accompanying financial

statements with respect to these indemnification guarantees.

7. Stockholders’ Equity

On May 3, 2006, the Company issued 3,500,000 shares of common stock upon the closing of a secondary

public offering for net proceeds of $101.1 million.

On January 26, 2009, the Company announced that its Board of Directors authorized a stock repurchase

program for 2009. Based on the Board’s authorization, the Company anticipates a repurchase program of up to

$175 million in 2009. The timing and actual number of shares repurchased will depend on various factors

including price, corporate and regulatory requirements, alternative investment opportunities and other market

conditions.

F-20