NetFlix 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

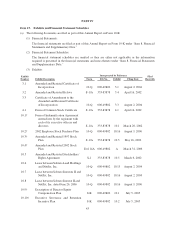

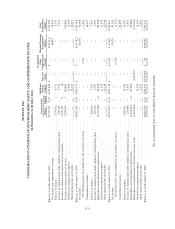

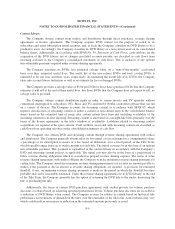

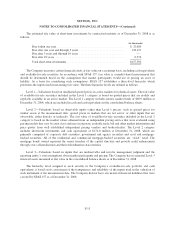

NETFLIX, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY AND COMPREHENSIVE INCOME

(in thousands, except share data)

Additional

Paid-in

Capital

Treasury

Stock

Accumulated

Other

Comprehensive

Income

Retained Earnings

(Accumulated

Deficit)

Total

Stockholders’

Equity

Common Stock

Shares Amount

Balances as of December 31, 2005 ................................... 54,755,731 $ 55 $315,868 $ — $ — $ (90,021) $ 225,902

Net income and comprehensive income ............................. — — — — — 48,839 48,839

Exercise of options ............................................. 1,379,012 2 8,372 — — — 8,374

Issuance of common stock under employee stock purchase plan .......... 378,361 — 3,724 — — — 3,724

Issuance of common stock upon exercise of warrants .................. 8,599,359 8 (8) — — — —

Issuance of common stock, net of costs ............................. 3,500,000 4 100,862 — — — 100,866

Stock-based compensation expense ................................ — — 12,696 — — — 12,696

Stock option income tax benefits .................................. — — 13,217 — — — 13,217

Balances as of December 31, 2006 ................................... 68,612,463 $ 69 $454,731 $ — $ — $ (41,182) $ 413,618

Net income ................................................... — — — — — 66,608 66,608

Net unrealized gains on available-for-sale securities, net of tax ........ — — — — 1,611 — 1,611

Comprehensive income .......................................... — — — — — — 68,219

Exercise of options ............................................. 828,824 — 5,822 — — — 5,822

Issuance of common stock under employee stock purchase plan .......... 205,416 — 3,787 — — — 3,787

Repurchases and retirement of common stock ........................ (4,733,788) (4) (99,854) — (99,858)

Stock-based compensation expense ................................ — — 11,976 — — — 11,976

Stock option income tax benefits .................................. — — 26,248 — — — 26,248

Balances as of December 31, 2007 ................................... 64,912,915 $ 65 $402,710 $ — $ 1,611 $ 25,426 $ 429,812

Net income ................................................... — — — — — 83,026 83,026

Net unrealized loss on available-for-sale securities, net of tax .......... — — — — (1,527) — (1,527)

Comprehensive income .......................................... — — — — — — 81,499

Exercise of options ............................................. 1,056,641 — 14,019 — — — 14,019

Issuance of common stock under employee stock purchase plan .......... 231,068 — 4,853 — — — 4,853

Repurchases and retirement of common stock ........................ (3,847,062) (3) (99,881) — — — (99,884)

Repurchases of common stock to be held as treasury stock .............. (3,491,084) — — (100,020) — — (100,020)

Stock-based compensation expense ................................ — — 12,264 — — — 12,264

Stock option income tax benefits .................................. — — 4,612 — — — 4,612

Balances as of December 31, 2008 ................................... 58,862,478 $ 62 $338,577 $(100,020) $ 84 $108,452 $ 347,155

See accompanying notes to consolidated financial statements.

F-5