NetFlix 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

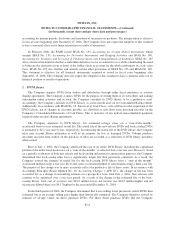

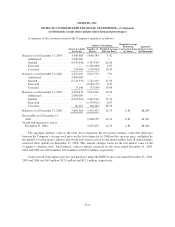

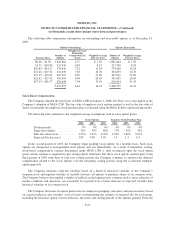

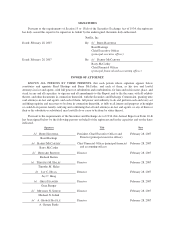

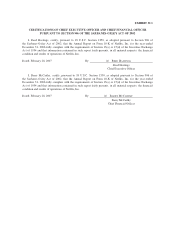

Provision for (benefit from) income taxes differed from the amounts computed by applying the U.S. federal

income tax rate of 35 percent to pretax income as a result of the following:

Year Ended December 31,

2004 2005 2006

Expected tax expense at U.S. federal statutory rate of 35% ....... $7,404 $ 2,917 $28,111

State income taxes, net of Federal income tax effect ............ 28 377 3,866

Valuation allowance ..................................... (3,816) (35,596) (16)

Stock-based compensation ................................ (3,471) (1,433) (878)

Other ................................................. 36 43 153

Provision for (benefit from) income taxes ..................... $ 181 $(33,692) $31,236

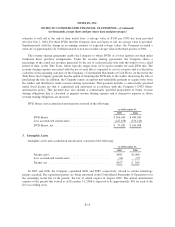

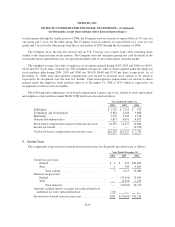

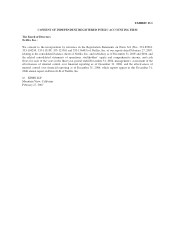

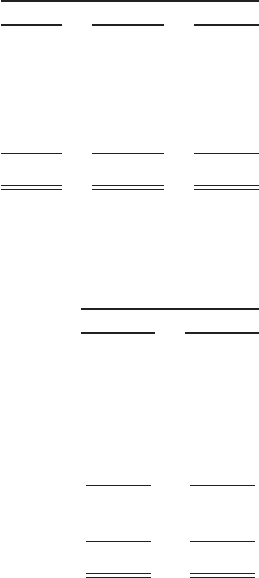

The tax effects of temporary differences and tax carryforwards that give rise to significant portions of the

deferred tax assets and liabilities are presented below:

Year Ended December 31,

2005 2006

Deferred tax assets:

Net operating loss carryforwards ................................ $ 9,905 $ —

Accruals and reserves ........................................ 3,880 3,109

Depreciation ................................................ 10,841 1,393

Stock-based compensation ..................................... 9,728 12,769

Other ..................................................... 647 1,564

Gross deferred tax assets .......................................... 35,001 18,835

Valuation allowance against deferred tax assets ........................ (96) (80)

Net deferred tax assets ............................................ $34,905 $18,755

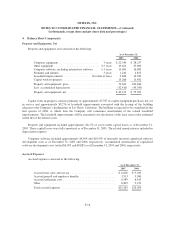

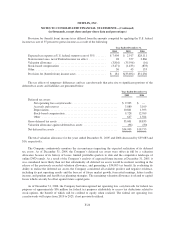

The total valuation allowance for the years ended December 31, 2005 and 2006 decreased by $39,083 and

$16, respectively.

The Company continuously monitors the circumstances impacting the expected realization of its deferred

tax assets. As of December 31, 2004, the Company’s deferred tax assets were offset in full by a valuation

allowance because of its history of losses, limited profitable quarters to date and the competitive landscape of

online DVD rentals. As a result of the Company’s analysis of expected future income at December 31, 2005, it

was considered more likely than not that substantially all deferred tax assets would be realized, resulting in the

release of the previously recorded valuation allowance, and generating a $34,905 tax benefit. In evaluating its

ability to realize the deferred tax assets, the Company considered all available positive and negative evidence,

including its past operating results and the forecast of future market growth, forecasted earnings, future taxable

income, and prudent and feasible tax planning strategies. The remaining valuation allowance is related to capital

losses which can only be offset against future capital gains.

As of December 31, 2006, the Company had unrecognized net operating loss carryforwards for federal tax

purposes of approximately $56 million for federal tax purposes attributable to excess tax deductions related to

stock options, the benefit of which will be credited to equity when realized. The federal net operating loss

carryforwards will expire from 2019 to 2025, if not previously utilized.

F-24