NetFlix 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

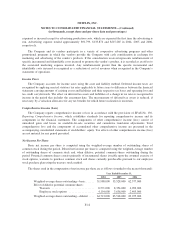

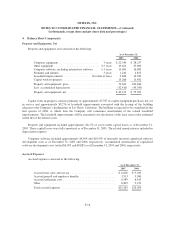

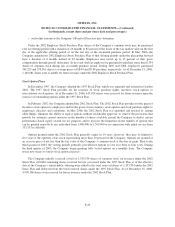

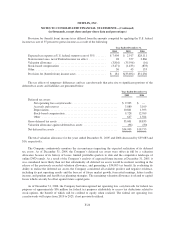

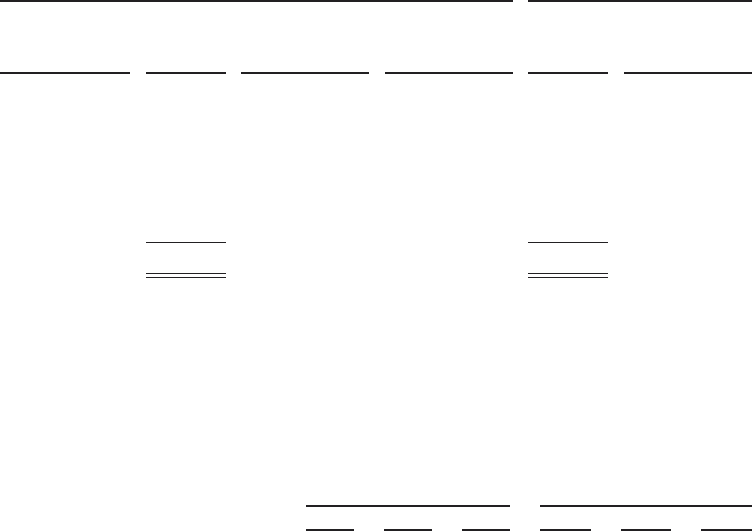

The following table summarizes information on outstanding and exercisable options as of December 31,

2006:

Options Outstanding Options Exercisable

Exercise Price

Number of

Options

Weighted-Average

Remaining

Contractual Life

(Years)

Weighted-Average

Exercise Price

Number of

Options

Weighted-Average

Exercise Price

$0.08 – $1.50 1,842,664 4.77 $ 1.50 1,842,664 $ 1.50

$1.51 – $10.83 523,949 6.84 8.19 522,740 8.18

$10.84 – $14.27 578,649 7.52 12.03 574,960 12.04

$14.28 – $19.34 454,633 7.83 16.70 454,633 16.70

$19.35 – $22.81 467,019 8.89 21.00 467,019 21.00

$22.82 – $27.42 765,895 8.06 26.63 765,895 26.63

$27.43 – $36.37 820,644 7.94 31.45 820,644 31.45

5,453,453 6.81 14.23 5,448,555 14.24

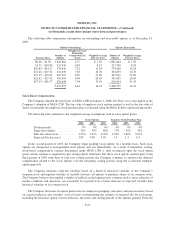

Stock-Based Compensation

The Company adopted the provisions of SFAS 123R on January 1, 2006. See Note 1 for a description of the

Company’s adoption of SFAS 123R. The fair value of employee stock options granted as well as the fair value of

shares issued under the employee stock purchase plan is estimated using the Black-Scholes option pricing model.

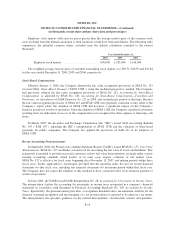

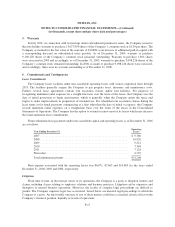

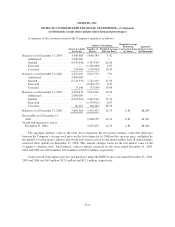

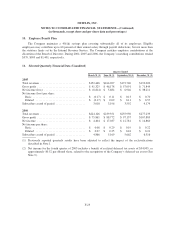

The following table summarizes the weighted-average assumptions used to value option grants:

Stock Options Employee Stock Purchase Plan

2004 2005 2006 2004 2005 2006

Dividend yield ............... 0% 0% 0% 0% 0% 0%

Expected volatility ............ 78% 59% 48% 77% 45% 39%

Risk-free interest rate .......... 2.23% 3.67% 4.76% 1.83% 3.80% 5.07%

Expected life (in years) ........ 1.85 3.08 3.93 1.3 1.3 0.5

In the second quarter of 2003, the Company began granting stock options on a monthly basis. Such stock

options are designated as non-qualified stock options and vest immediately. As a result of immediate vesting,

stock-based compensation expense determined under SFAS 123R is fully recognized upon the stock option

grants and no estimate is required for pre-vesting option forfeitures. For those stock options granted prior to the

third quarter of 2003 with three to four-year vesting periods, the Company continues to amortize the deferred

compensation related to the stock options over the remaining vesting periods using the accelerated multiple-

option approach.

The Company estimates expected volatility based on a blend of historical volatility of the Company’s

common stock and implied volatility of tradable forward call options to purchase shares of its common stock.

The Company believes that implied volatility of publicly traded options in its common stock is more reflective of

market conditions and, therefore, can reasonably be expected to be a better indicator of expected volatility than

historical volatility of its common stock.

The Company bifurcates its option grants into two employee groupings (executive and non-executive) based

on exercise behavior and considers several factors in determining the estimate of expected life for each group,

including the historical option exercise behavior, the terms and vesting periods of the options granted. From the

F-22