NetFlix 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

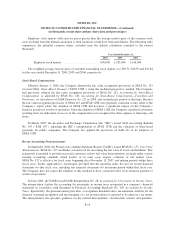

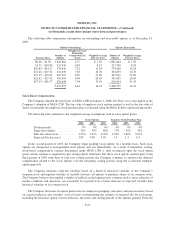

Company’s subscribers have paid artificially inflated subscription prices because potential competitors were

allegedly deterred from entering the online DVD rental market by the Company’s patents. The complaint

purports to be on behalf of existing and past subscribers who allegedly would have paid lower subscription rates

but for the alleged anticompetitive conduct. The complaint seeks injunctive relief, restitution and damages in an

unspecified amount.

7. Guarantees—Intellectual Property Indemnification Obligations

In the ordinary course of business, the Company has entered into contractual arrangements under which it

has agreed to provide indemnification of varying scope and terms to business partners and other parties with

respect to certain matters, including, but not limited to, losses arising out of the Company’s breach of such

agreements and out of intellectual property infringement claims made by third parties. In these circumstances,

payment by the Company is conditional on the other party making a claim pursuant to the procedures specified in

the particular contract, which procedures typically allow the Company to challenge the other party’s claims.

Further, the Company’s obligations under these agreements may be limited in terms of time and/or amount, and

in some instances, the Company may have recourse against third parties for certain payments made by it under

these agreements. In addition, the Company has entered into indemnification agreements with its directors and

certain of its officers that will require it, among other things, to indemnify them against certain liabilities that

may arise by reason of their status or service as directors or officers. The terms of such obligations vary.

It is not possible to make a reasonable estimate of the maximum potential amount of future payments under

these or similar agreements due to the conditional nature of the Company’s obligations and the unique facts and

circumstances involved in each particular agreement. No amount has been accrued in the accompanying financial

statements with respect to these indemnification guarantees.

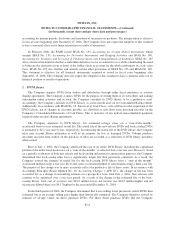

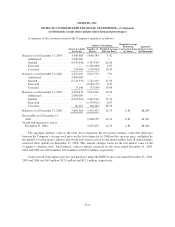

8. Stockholders’ Equity

On May 3, 2006, the Company issued 3.5 million shares of common stock upon the closing of a secondary

public offering for net proceeds of $101.1 million.

Preferred Stock

The Company has authorized 10 million shares of undesignated preferred stock with par value of $0.001 per

share. None of the preferred shares were issued and outstanding at December 31, 2005 and 2006.

Voting Rights

The holders of each share of common stock shall be entitled to one vote per share on all matters to be voted

upon by the Company’s stockholders.

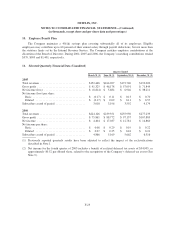

Employee Stock Purchase Plan

In February 2002, the Company adopted the 2002 Employee Stock Purchase Plan, which reserved a total of

1,166,666 shares of common stock for issuance. The 2002 Employee Stock Purchase Plan also provides for

annual increases in the number of shares available for issuance on the first day of each year, beginning with

2003, equal to the lesser of:

• 2 percent of the outstanding shares of the common stock on the first day of the applicable year;

• 666,666 shares; and

F-19