NetFlix 2006 Annual Report Download - page 67

Download and view the complete annual report

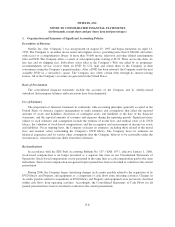

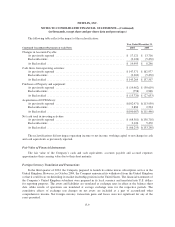

Please find page 67 of the 2006 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

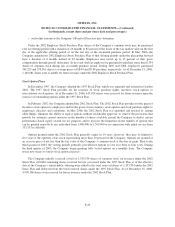

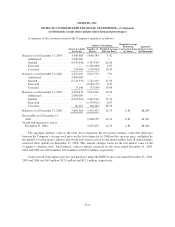

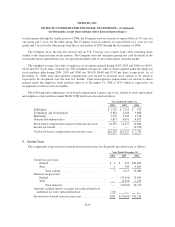

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

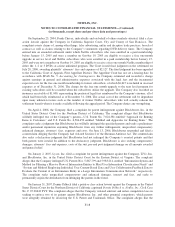

accounting for interim periods, disclosure and transition of uncertain tax positions. The interpretation is effective

for fiscal years beginning after December 15, 2006. The Company does not expect the adoption of this standard

to have a material effect on its financial position or results of operations.

In February 2006, the FASB issued SFAS No. 155, Accounting for Certain Hybrid Instruments which

amends SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities and SFAS No. 140,

Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities. SFAS No. 155

allows financial instruments that have embedded derivatives to be accounted for as a whole (eliminating the need

to bifurcate the derivative from its host) if the holder elects to account for the whole instrument on a fair value

basis. SFAS No. 155 also clarifies and amends certain other provisions of SFAS No. 133 and SFAS No. 140.

This statement is effective for all financial instruments acquired or issued in fiscal years beginning after

September 15, 2006. The Company does not expect the adoption of this standard to have a material effect on its

financial position or results of operations.

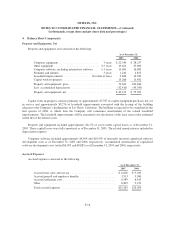

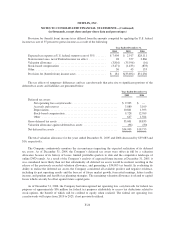

2. DVD Library

The Company acquires DVDs from studios and distributors through either direct purchases or revenue

sharing agreements. The Company acquires DVDs for the purpose of renting them to its subscribers and earning

subscription rental revenues and as such, the Company considers its DVD library to be a productive asset.

Accordingly, the Company classifies its DVD Library as a non-current asset on its Consolidated Balance Sheet.

Additionally, in accordance with SFAS No. 95, Statement of Cash Flows, cash outflows for the acquisition of the

DVD Library, net of changes in Accounts payable, are classified as cash flows from investing activities on the

Company’s Consolidated Statements of Cash Flows. This is inclusive of any upfront non-refundable payments

required under revenue sharing agreements.

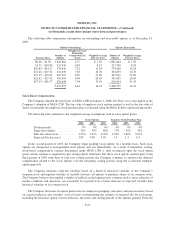

The Company amortizes its DVD library, less estimated salvage value, on a “sum-of-the-months”

accelerated basis over its estimated useful life. The useful life of the new-release DVDs and back-catalog DVDs

is estimated to be 1 year and 3 years, respectively. In estimating the useful life of the DVD library, the Company

takes into account library utilization as well as an estimate for lost or damaged DVDs. Volume purchase

discounts received from studios on the purchase of titles are recorded as a reduction of DVD library inventory

when earned.

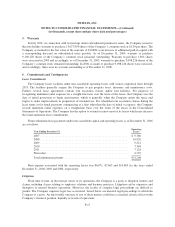

Prior to July 1, 2004, the Company amortized the cost of its entire DVD library, including the capitalized

portion of the initial fixed license fee, on a “sum-of-the-months” accelerated basis over one year. However, based

on a periodic evaluation of both new release and back-catalog utilization for amortization purposes, the Company

determined that back-catalog titles have a significantly longer life than previously estimated. As a result, the

Company revised the estimate of useful life for the back-catalog DVD library from a “sum of the months”

accelerated method using a one year life to the same accelerated method of amortization using a three-year life.

The purpose of this change was to more accurately reflect the productive life of these assets. In accordance with

Accounting Principles Board Opinion No. 20, Accounting Changes (“APB 20”), the change in life has been

accounted for as a change in accounting estimate on a prospective basis from July 1, 2004. New releases will

continue to be amortized over a one year period. As a result of the change in the estimated life of the back-

catalog library, total cost of revenues was $10.9 million lower, net income was $10.9 million higher and net

income per diluted share was $0.17 higher for the year ended December 31, 2004.

In the third quarter of 2004, the Company determined that it was selling fewer previously rented DVDs than

estimated but at an average selling price higher than historically estimated. The Company therefore revised its

estimate of salvage values on direct purchase DVDs. For those direct purchase DVDs that the Company

F-14