NetFlix 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

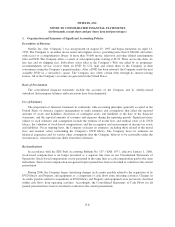

estimates it will sell at the end of their useful lives, a salvage value of $3.00 per DVD has been provided

effective July 1, 2004. For those DVDs that the Company does not expect to sell, no salvage value is provided.

Simultaneously with the change in accounting estimate of expected salvage values, the Company recorded a

write-off of approximately $1.9 million related to non-recoverable salvage value in the third quarter of 2004.

The revenue sharing agreements enable the Company to obtain DVDs at a lower upfront cost than under

traditional direct purchase arrangements. Under the revenue sharing agreements, the Company shares a

percentage of the actual net revenues generated by the use of each particular title with the studios over a fixed

period of time, or the Title Term, which typically ranges from six to twelve months for each DVD title. The

revenue sharing expense associated with the use of each title is expensed to cost of revenues and is reflected in

cash flows from operating activities on the Company’s Consolidated Statements of Cash Flows. At the end of the

Title Term, the Company generally has the option of returning the DVD title to the studio, destroying the title or

purchasing the title. In addition, the Company remits an upfront non-refundable payment to acquire titles from

the studios and distributors under revenue sharing agreements. This payment includes a contractually specified

initial fixed license fee that is capitalized and amortized in accordance with the Company’s DVD library

amortization policy. This payment may also include a contractually specified prepayment of future revenue

sharing obligations that is classified as prepaid revenue sharing expense and is charged to expense as future

revenue sharing obligations are incurred.

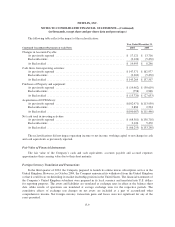

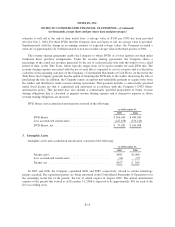

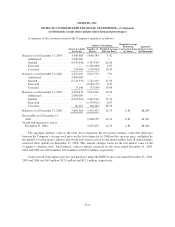

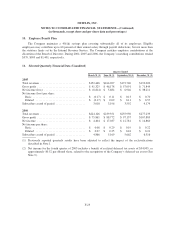

DVD library and accumulated amortization consisted of the following:

As of December 31,

2005 2006

DVD library .......................................... $304,490 $ 484,034

Less accumulated amortization ........................... (247,458) (379,126)

DVD library, net ....................................... $ 57,032 $ 104,908

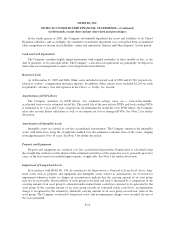

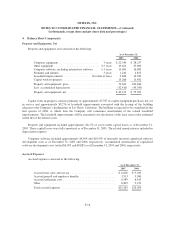

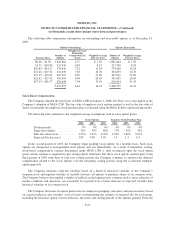

3. Intangible Assets

Intangible assets and accumulated amortization consisted of the following:

As of December 31,

2005 2006

Patents, gross ......................................... $481 $1,066

Less accumulated amortization ........................... (24) (97)

Patents, net ........................................... $457 $ 969

In 2005 and 2006, the Company capitalized $481 and $585, respectively, related to certain technology

patents acquired. The capitalized patents are being amortized in the Consolidated Statements of Operations over

the remaining useful life of the patents, the last of which expires in August 2020. The annual amortization

expense of the patents that existed as of December 31, 2006 is expected to be approximately $99 for each of the

five succeeding years.

F-15