NetFlix 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

expenses will continue to be significant in future periods, which will have an adverse impact on our operating

results. The Black-Scholes option-pricing model, used by us, requires the input of highly subjective assumptions,

including the option’s expected life and the price volatility of the underlying stock. If factors change and we

employ different assumptions for estimating stock-based compensation expense in future periods or if we decide

to use a different valuation model, the future periods may differ significantly from what we have recorded in the

current period and could materially affect the fair value estimate of stock-based payments, our operating income,

net income and net income per share.

Financial forecasting by us and financial analysts who may publish estimates of our performance may

differ materially from actual results.

Given the dynamic nature of our business and the inherent limitations in predicting the future, forecasts of

our revenues, gross margin, operating expenses, number of paying subscribers, number of DVDs shipped per day

and other financial and operating data may differ materially from actual results. Such discrepancies could cause a

decline in the trading price of our common stock.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

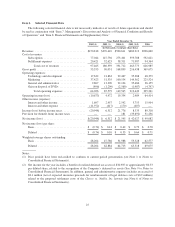

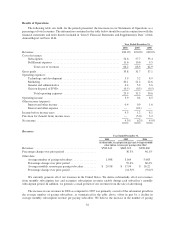

We do not own any real estate. The following table sets forth the location, approximate square footage, lease

expiration and the primary use of each of our principal properties:

Location

Estimated

Square

Footage

Lease

Expiration Date Primary Use

Los Gatos, California ...... 81,000 December 2012 Corporate Office, general and administrative,

marketing and technology and development

Beverly Hills, California .... 18,000 August 2009 Content acquisition, general and administrative

Sunnyvale, California ...... 115,000 April 2009 Receiving and storage center, processing and

shipping center for San Francisco Bay Area

Hillsboro, Oregon ......... 27,000 November 2009 Customer service center

Burbank, California ....... 18,000 April 2012 Encoding

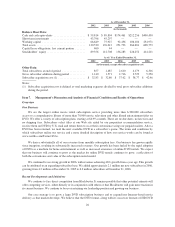

We operate a nationwide network of distribution centers that serve major metropolitan areas throughout the

United States. These fulfillment centers are under lease agreements that expire at various dates through October

2011. We also operate a datacenter in a leased third-party facility in Santa Clara, California.

In March 2006, we exercised our option to lease a building adjacent to our headquarters in Los Gatos,

California. The building will comprise approximately 80,000 square feet of office space and have an initial term

of 5 years. The building is expected to be completed in the first quarter of 2008.

We believe our properties are suitable and adequate for our present needs, and we periodically evaluate

whether additional facilities are necessary.

Item 3. Legal Proceedings

Information with respect to this item may be found in Note 6 of the Notes to the Consolidated Financial

Statements in Item 8, which information is incorporated herein by reference.

Item 4. Submission of Matters to a Vote of Securities Holders

None.

22