NetFlix 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DEAR FELLOW SHAREHOLDERS:

2006 was a noteworthy year for Netflix. We added a record number of new

subscribers, invested in the development of our Internet delivery feature, and

signifi cantly exceeded our goals for earnings. And for the second consecutive year

we were independently ranked number one in online retail customer satisfaction by

Foresee Results.

We also faced the challenges of a renewed offensive from a determined online

competitor as well as a rapidly changing array of alternatives for accessing video

content online.

We take these challenges very seriously. But we believe our achievements in 2006,

together with the outstanding growth potential of our market and the strength of

our business model, leave us well positioned to reach our long-term objective of

leading the online subscription movie rental business.

2006 RESULTS

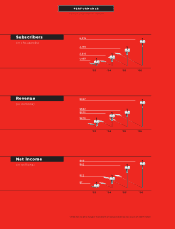

In 2006, aggressive investment in growth enabled us to increase our subscriber

base 51 percent, from 4.2 million to 6.3 million subscribers. We achieved 15.7 percent

household penetration in the San Francisco Bay Area market, our fi rst overnight

market, and penetration in our newer markets continues to follow the Bay Area

growth curve. Churn, a measure of subscriber turnover, was lower in each quarter of

2006 than it had been in the comparable quarter in 2005 and declined to a record-

low 3.9 percent in the fourth quarter.

The scale effi ciencies made possible by our large subscriber base allowed us to invest

in growth and product enhancements at the same time that we exceeded our profi t

goals, with pretax profi ts up from $8.3 million in 2005 to $80.3 million in 2006 and

GAAP net income increasing to $49.1 million or $0.71 per diluted share.

NETFLIX 2006 ANNUAL REPORT

LETTER TO SHAREHOLDERS