NetFlix 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

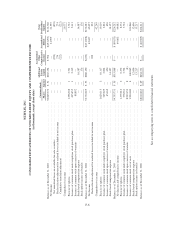

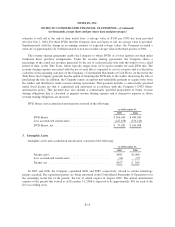

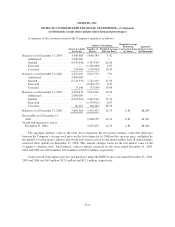

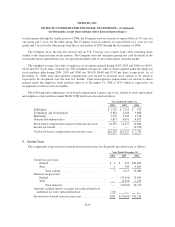

Employee stock options with exercise prices greater than the average market price of the common stock

were excluded from the diluted calculation as their inclusion would have been anti-dilutive. The following table

summarizes the potential common shares excluded from the diluted calculation (rounded to the nearest

thousand):

Year Ended December 31,

2004 2005 2006

Employee stock options ........................ 676,000 1,023,000 1,196,000

The weighted average exercise price of excluded outstanding stock options was $30.71, $28.39 and $29.84

for the years ended December 31, 2004, 2005 and 2006, respectively.

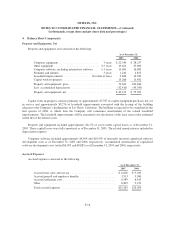

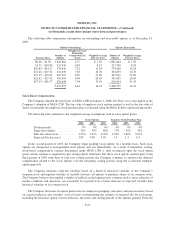

Stock-Based Compensation

Effective January 1, 2006, the Company adopted the fair value recognition provisions of SFAS No. 123

(revised 2004), Share-Based Payment (“SFAS 123R”), using the modified prospective method. The Company

had previously adopted the fair value recognition provisions of SFAS No. 123, Accounting for Stock-Based

Compensation, as amended by SFAS No. 148, Accounting for Stock-Based Compensation—Transition and

Disclosure, an Amendment of FASB Statement No. 123 in 2003, and restated prior periods at that time. Because

the fair value recognition provisions of SFAS 123 and SFAS 123R were generally consistent as they relate to the

Company’s equity plans, the adoption of SFAS 123R did not have a significant impact on the Company’s

financial position or results of operations. Upon the adoption of SFAS 123R, the Company classified tax benefits

resulting from tax deductions in excess of the compensation cost recognized for those options as financing cash

flows.

In March 2005, the Securities and Exchange Commission (the “SEC”) issued Staff Accounting Bulletin

No. 107 (“SAB 107”) regarding the SEC’s interpretation of SFAS 123R and the valuation of share-based

payments for public companies. The Company has applied the provisions of SAB 107 in its adoption of

SFAS 123R.

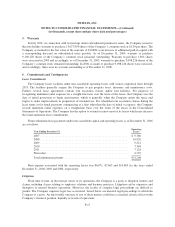

Recent Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 157, Fair Value

Measurements. SFAS No. 157 establishes a framework for measuring the fair value of assets and liabilities. This

framework is intended to provide increased consistency in how fair value determinations are made under various

existing accounting standards which permit, or in some cases require, estimates of fair market value.

SFAS No. 157 is effective for fiscal years beginning after November 15, 2007, and interim periods within those

fiscal years. Earlier application is encouraged, provided that the reporting entity has not yet issued financial

statements for that fiscal year, including any financial statements for an interim period within that fiscal year.

The Company does not expect the adoption of this standard to have a material effect on its financial position or

results of operations.

In June 2006, the FASB issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes.

The interpretation clarifies the accounting for uncertainty in income taxes recognized in a company’s financial

statements in accordance with Statement of Financial Accounting Standards No. 109, Accounting for Income

Taxes. Specifically, the pronouncement prescribes a recognition threshold and a measurement attribute for the

financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return.

The interpretation also provides guidance on the related derecognition, classification, interest and penalties,

F-13