NetFlix 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

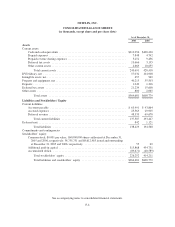

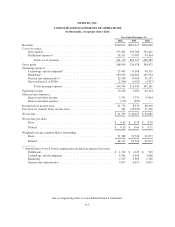

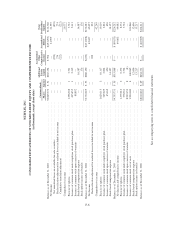

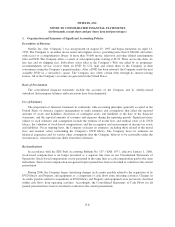

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data and percentages)

1. Organization and Summary of Significant Accounting Policies

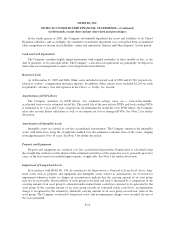

Description of Business

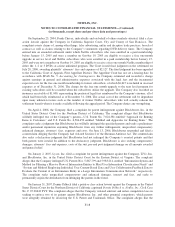

Netflix, Inc. (the “Company”) was incorporated on August 29, 1997 and began operations on April 14,

1998. The Company is an online movie rental subscription service, providing more than 6,300,000 subscribers

with access to a comprehensive library of more than 70,000 movie, television and other filmed entertainment

titles on DVD. The Company offers a variety of subscription plans starting at $4.99. There are no due dates, no

late fees and no shipping fees. Subscribers select titles at the Company’s Web site aided by its proprietary

recommendation service, receive them on DVD by U.S. mail and return them to the Company at their

convenience using the Company’s prepaid mailers. After a DVD has been returned, the Company mails the next

available DVD in a subscriber’s queue. The Company also offers certain titles through its instant-viewing

feature. All of the Company’s revenues are generated in the United States.

Basis of Presentation

The consolidated financial statements include the accounts of the Company and its wholly-owned

subsidiary. Intercompany balances and transactions have been eliminated.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial

statements, and the reported amounts of revenues and expenses during the reporting periods. Significant items

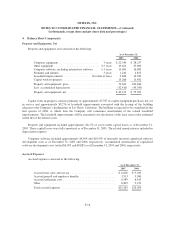

subject to such estimates and assumptions include the estimate of useful lives and residual value of its DVD

library; the valuation of stock-based compensation; and the recognition and measurement of income tax assets

and liabilities. On an ongoing basis, the Company evaluates its estimates, including those related to the useful

lives and residual values surrounding the Company’s DVD library. The Company bases its estimates on

historical experience and on various other assumptions that the Company believes to be reasonable under the

circumstances. Actual results may differ from these estimates.

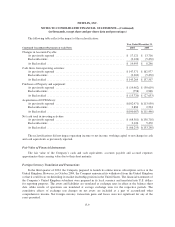

Reclassifications

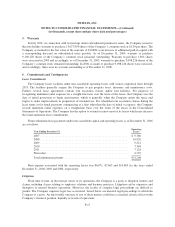

In accordance with the SEC Staff Accounting Bulletin No. 107 (“SAB 107”), effective January 1, 2006,

stock-based compensation is no longer presented as a separate line item on our Consolidated Statements of

Operations. Stock-based compensation is now presented in the same lines as cash compensation paid to the same

individuals. Stock-based compensation recognized in prior periods has been reclassified to conform to the current

presentation.

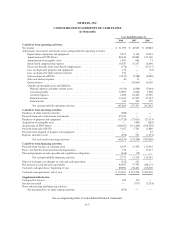

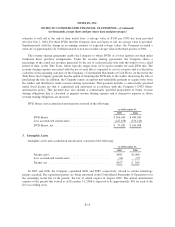

During 2006, the Company began classifying changes in Accounts payable related to the acquisition of its

DVD library and Property and equipment as a component of cash flows from investing activities. Changes in

Accounts payable related to acquisitions of DVD library and Property and equipment were previously classified

within cash flows from operating activities. Accordingly, the Consolidated Statements of Cash Flows for all

periods presented have been reclassified to conform to the current presentation.

F-8