NetFlix 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and Blu-Ray, will continue to be the main vehicle for watching movies in the home for the foreseeable future and

that by growing a large DVD subscription business, we will be well positioned to transition our subscribers and

our business to Internet-based movie delivery as it becomes a mainstream method for movie distribution. To this

end, we introduced a new feature in January 2007 that allows subscribers to instantly watch movies and

television series on their personal computers. We expect to roll out this instant-viewing feature to all subscribers

within six months from the date of launch, and we will continue to improve its quality, content and functionality.

We intend to broaden the distribution capability of this service to multiple platforms over time.

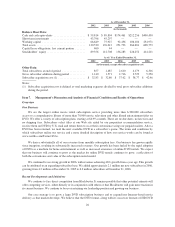

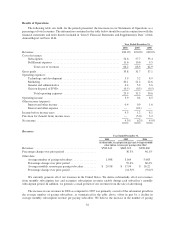

Key Business Metrics

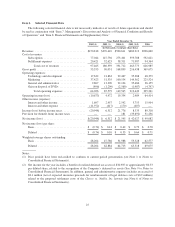

Management periodically reviews certain key business metrics, within the context of our articulated

performance goals, in order to evaluate the effectiveness of our operational strategies, allocate resources and

maximize the financial performance of our business. The key business metrics include the following:

•Churn: Churn is a monthly measure defined as customer cancellations in the quarter divided by the

sum of beginning subscribers and gross subscriber additions, then divided by three months. Management

reviews this metric to evaluate whether we are retaining our existing subscribers in accordance with our

business plans.

•Subscriber Acquisition Cost: Subscriber acquisition cost is defined as total marketing expense divided

by total gross subscriber additions. Management reviews this metric to evaluate how effective our

marketing programs are in acquiring new subscribers on an economical basis in the context of estimated

subscriber lifetime value.

•Gross Margin: Management reviews gross margin to monitor variable costs and operating efficiency.

Management believes it is useful to monitor these metrics together and not individually as it does not make

business decisions based upon any single metric.

Critical Accounting Policies and Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally

accepted in the United States requires estimates and assumptions that affect the reported amounts of assets and

liabilities, revenues and expenses and related disclosures of contingent assets and liabilities in our consolidated

financial statements and accompanying notes. The Securities and Exchange Commission has defined a

company’s critical accounting policies as the ones that are most important to the portrayal of a company’s

financial condition and results of operations, and which require a company to make its most difficult and

subjective judgments. Based on this definition, we have identified the critical accounting policies and judgments

addressed below. Although we believe that our estimates, assumptions and judgments are reasonable, they are

based upon information presently available. Actual results may differ significantly from these estimates under

different assumptions, judgments or conditions.

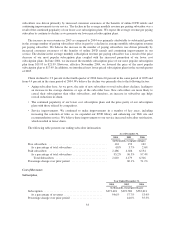

Amortization of DVD Library and Upfront Costs

We acquire DVDs from studios and distributors through either direct purchases or revenue sharing

agreements. We acquire DVDs for the purpose of renting them to our subscribers and earning subscription rental

revenues and as such, we consider our DVD library to be a productive asset, and classify our DVD Library as a

non-current asset. Additionally, in accordance with Statement of Financial Accounting Standards 95 “Statement

of Cash Flows” (“SFAS 95”), we classify cash outflows for the acquisition of the DVD Library, net of changes in

related Accounts payable, as cash flows from investing activities on our Consolidated Statements of Cash Flows.

This is inclusive of any upfront non-refundable payments required under revenue sharing agreements.

We amortize our DVD library, less estimated salvage value, on a “sum-of-the-months” accelerated basis

over its estimated useful life. The useful life of the new-release DVDs and back-catalog DVDs is estimated to be

1 year and 3 years, respectively. In estimating the useful life of our DVD library, we take into account library

utilization as well as an estimate for lost or damaged DVDs. Volume purchase discounts received from studios

on the purchase of titles are recorded as a reduction of DVD library inventory when earned.

27