NetFlix 2006 Annual Report Download - page 64

Download and view the complete annual report

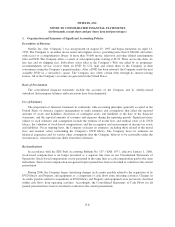

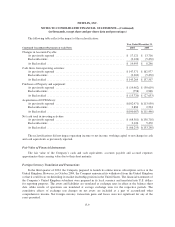

Please find page 64 of the 2006 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

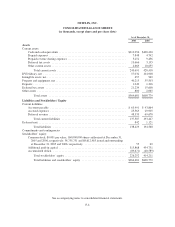

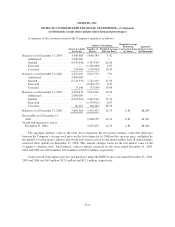

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

Capitalized Software Costs

The Company capitalizes costs related to developing or obtaining internal-use software. Capitalization of

costs begins after the conceptual formulation stage has been completed. Capitalized software costs are included

in property and equipment, net and are amortized over the estimated useful life of the software, which is

generally one year.

Revenue Recognition

Subscription revenues are recognized ratably over each subscriber’s monthly subscription period. Refunds

to subscribers are recorded as a reduction of revenues. Revenues from sales of advertising are recognized upon

completion of the campaign. Revenues are presented net of the taxes that are collected from customers and

remitted to governmental authorities. Deferred revenue consists of subscriptions revenues billed to subscribers

that have not been recognized.

Cost of Revenues

Subscription. Cost of subscription consists of revenue sharing expenses, amortization of the DVD library,

amortization of intangible assets related to equity instruments issued to studios and postage and packaging

expenses related to DVDs provided to paying subscribers. Revenue sharing expenses are recorded as DVDs

subject to revenue sharing agreements are shipped to subscribers.

The terms of some revenue sharing agreements with studios obligate the Company to make minimum

revenue sharing payments for certain titles. The Company amortizes minimum revenue sharing prepayments (or

accretes an amount payable to studios if the payment is due in arrears) as revenue sharing obligations are

incurred. A provision for estimated shortfall, if any, on minimum revenue sharing payments is made in the period

in which the shortfall becomes probable and can be reasonably estimated. Additionally, the terms of some

revenue-sharing agreements with studios provide for rebates based on achieving specified performance levels.

The Company accrues for these rebates as earned based on historical title performance and estimates of demand

for the titles over the remainder of the title term. Actual rebates may vary which could result in an increase or

reduction in the estimated amounts previously accrued.

Fulfillment Expenses. Fulfillment expenses represent those costs incurred in operating and staffing the

Company’s fulfillment and customer service centers, including costs attributable to receiving, inspecting and

warehousing the Company’s DVD library. Fulfillment expenses also include credit card fees.

Technology and Development

Technology and development expenses consist of payroll and related costs incurred in testing, maintaining

and modifying the Company’s Web Site, its recommendation service, developing solutions for the online

delivery of content to subscribers, telecommunications systems and infrastructure and other internal-use software

systems. Technology and development expenses also include depreciation on computer hardware and capitalized

software.

Marketing

Marketing expenses consist of payroll and related expenses and advertising expenses. Advertising expenses

include marketing program expenditures and other promotional activities, including revenue sharing expenses,

postage and packaging expenses and library amortization related to free trial periods. Advertising costs are

F-11