NetFlix 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

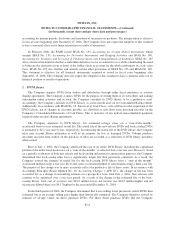

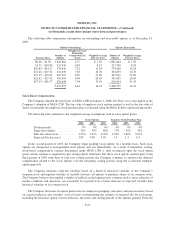

second quarter through the fourth quarter of 2006, the Company used an estimate of expected life of 4.5 years for

one group and 3 years for the other group. The Company used an estimate of expected life of 4 years for one

group and 3 years for the other group from the second quarter of 2005 through the first quarter of 2006.

The Company bases the risk-free interest rate on U.S. Treasury zero-coupon issues with remaining terms

similar to the expected term on the options. The Company does not anticipate paying any cash dividends in the

foreseeable future and therefore uses an expected dividend yield of zero in the option valuation model.

The weighted-average fair value of employee stock options granted during 2004, 2005 and 2006 was $8.45,

$6.16 and $10.76 per share, respectively. The weighted-average fair value of shares granted under the employee

stock purchase plan during 2004, 2005 and 2006 was $10.00, $6.68 and $7.49 per share, respectively. As of

December 31, 2006, total unrecognized compensation cost related to unvested stock options is $9 which is

expected to be recognized over the next five months. Total unrecognized compensation cost related to shares

granted under the employee stock purchase plan as of December 31, 2006 is $515 which is expected to be

recognized over the next eleven months.

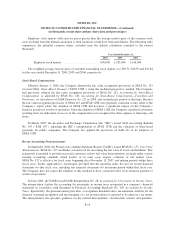

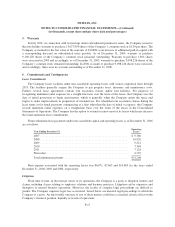

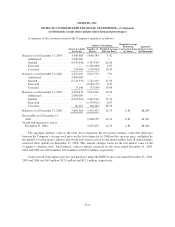

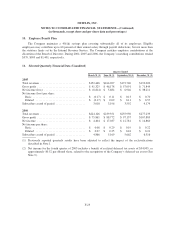

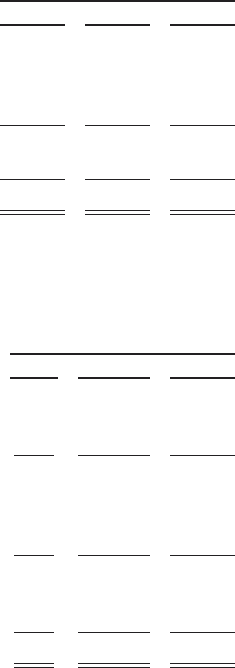

The following table summarizes stock-based compensation expense, net of tax, related to stock option plans

and employee stock purchases under SFAS 123R which was allocated as follows:

Year Ended December 31,

2004 2005 2006

Fulfillment ........................................ $ 1,702 $ 1,225 $ 925

Technology and development ......................... 6,561 4,446 3,608

Marketing ......................................... 2,507 2,565 2,138

General and administrative ........................... 5,817 6,091 6,025

Stock-based compensation expense before income taxes .... 16,587 14,327 12,696

Income tax benefit .................................. — — (4,937)

Total stock-based compensation after income-taxes ........ $16,587 $14,327 $ 7,759

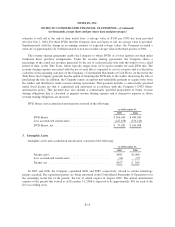

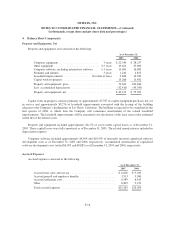

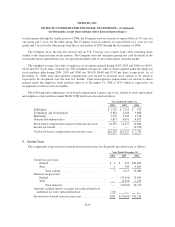

9. Income Taxes

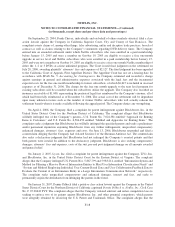

The components of provision for (benefit from) income taxes for all periods presented were as follows:

Year Ended December 31,

2004 2005 2006

Current tax provision:

Federal ........................................ $ 4 $ 633 $10,282

State .......................................... 1 580 4,804

Total current ................................ 5 1,213 15,086

Deferred tax provision:

Federal ........................................ — (31,453) 15,005

State .......................................... — (3,452) 1,145

Total deferred ............................... — (34,905) 16,150

Amounts credited directly to equity for realized benefit of

additional tax stock option deductions .................. 176 — —

Provision for (benefit from) income taxes ................. $181 $(33,692) $31,236

F-23