National Grid 2008 Annual Report Download - page 662

Download and view the complete annual report

Please find page 662 of the 2008 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424 -

425

425 -

426

426 -

427

427 -

428

428 -

429

429 -

430

430 -

431

431 -

432

432 -

433

433 -

434

434 -

435

435 -

436

436 -

437

437 -

438

438 -

439

439 -

440

440 -

441

441 -

442

442 -

443

443 -

444

444 -

445

445 -

446

446 -

447

447 -

448

448 -

449

449 -

450

450 -

451

451 -

452

452 -

453

453 -

454

454 -

455

455 -

456

456 -

457

457 -

458

458 -

459

459 -

460

460 -

461

461 -

462

462 -

463

463 -

464

464 -

465

465 -

466

466 -

467

467 -

468

468 -

469

469 -

470

470 -

471

471 -

472

472 -

473

473 -

474

474 -

475

475 -

476

476 -

477

477 -

478

478 -

479

479 -

480

480 -

481

481 -

482

482 -

483

483 -

484

484 -

485

485 -

486

486 -

487

487 -

488

488 -

489

489 -

490

490 -

491

491 -

492

492 -

493

493 -

494

494 -

495

495 -

496

496 -

497

497 -

498

498 -

499

499 -

500

500 -

501

501 -

502

502 -

503

503 -

504

504 -

505

505 -

506

506 -

507

507 -

508

508 -

509

509 -

510

510 -

511

511 -

512

512 -

513

513 -

514

514 -

515

515 -

516

516 -

517

517 -

518

518 -

519

519 -

520

520 -

521

521 -

522

522 -

523

523 -

524

524 -

525

525 -

526

526 -

527

527 -

528

528 -

529

529 -

530

530 -

531

531 -

532

532 -

533

533 -

534

534 -

535

535 -

536

536 -

537

537 -

538

538 -

539

539 -

540

540 -

541

541 -

542

542 -

543

543 -

544

544 -

545

545 -

546

546 -

547

547 -

548

548 -

549

549 -

550

550 -

551

551 -

552

552 -

553

553 -

554

554 -

555

555 -

556

556 -

557

557 -

558

558 -

559

559 -

560

560 -

561

561 -

562

562 -

563

563 -

564

564 -

565

565 -

566

566 -

567

567 -

568

568 -

569

569 -

570

570 -

571

571 -

572

572 -

573

573 -

574

574 -

575

575 -

576

576 -

577

577 -

578

578 -

579

579 -

580

580 -

581

581 -

582

582 -

583

583 -

584

584 -

585

585 -

586

586 -

587

587 -

588

588 -

589

589 -

590

590 -

591

591 -

592

592 -

593

593 -

594

594 -

595

595 -

596

596 -

597

597 -

598

598 -

599

599 -

600

600 -

601

601 -

602

602 -

603

603 -

604

604 -

605

605 -

606

606 -

607

607 -

608

608 -

609

609 -

610

610 -

611

611 -

612

612 -

613

613 -

614

614 -

615

615 -

616

616 -

617

617 -

618

618 -

619

619 -

620

620 -

621

621 -

622

622 -

623

623 -

624

624 -

625

625 -

626

626 -

627

627 -

628

628 -

629

629 -

630

630 -

631

631 -

632

632 -

633

633 -

634

634 -

635

635 -

636

636 -

637

637 -

638

638 -

639

639 -

640

640 -

641

641 -

642

642 -

643

643 -

644

644 -

645

645 -

646

646 -

647

647 -

648

648 -

649

649 -

650

650 -

651

651 -

652

652 -

653

653 -

654

654 -

655

655 -

656

656 -

657

657 -

658

658 -

659

659 -

660

660 -

661

661 -

662

662 -

663

663 -

664

664 -

665

665 -

666

666 -

667

667 -

668

668 -

669

669 -

670

670 -

671

671 -

672

672 -

673

673 -

674

674 -

675

675 -

676

676 -

677

677 -

678

678 -

679

679 -

680

680 -

681

681 -

682

682 -

683

683 -

684

684 -

685

685 -

686

686 -

687

687 -

688

688 -

689

689 -

690

690 -

691

691 -

692

692 -

693

693 -

694

694 -

695

695 -

696

696 -

697

697 -

698

698 -

699

699 -

700

700 -

701

701 -

702

702 -

703

703 -

704

704 -

705

705 -

706

706 -

707

707 -

708

708 -

709

709 -

710

710 -

711

711 -

712

712 -

713

713 -

714

714 -

715

715 -

716

716 -

717

717 -

718

718

|

|

BOWNE INTEGRATED TYPESETTING SYSTEM

CRC: 43541

Name: NATIONAL GRID

Date: 17-JUN-2008 03:10:51.35Operator: BNY99999TPhone: (212)924-5500Site: BOWNE OF NEW YORK

Y59930.SUB, DocName: EX-15.1, Doc: 16, Page: 135

Description: EXHIBIT 15.1

0/5331.00.00.00Y59930BNY

[E/O] EDGAR 2 *Y59930/331/5*

BOWNE INTEGRATED TYPESETTING SYSTEM

CRC: 43541

Name: NATIONAL GRID

Date: 17-JUN-2008 03:10:51.35Operator: BNY99999TPhone: (212)924-5500Site: BOWNE OF NEW YORK

Y59930.SUB, DocName: EX-15.1, Doc: 16, Page: 135

Description: EXHIBIT 15.1

0/5331.00.00.00Y59930BNY

[E/O] EDGAR 2 *Y59930/331/5*

Table of Contents

Annual Report and Accounts 2007/08

143

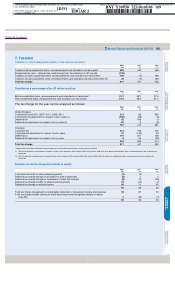

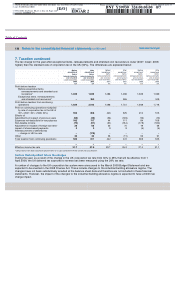

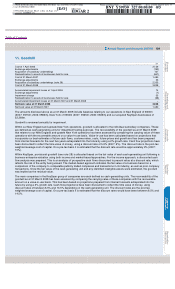

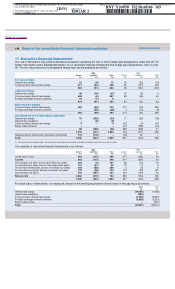

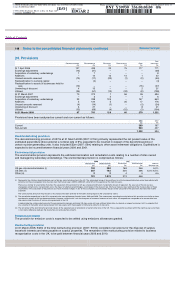

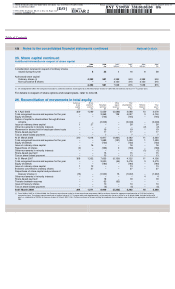

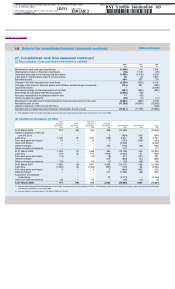

16. Deferred tax assets and liabilities

The following are the major deferred tax assets and liabilities recognised, and the movements thereon, during the current and

prior reporting periods:

Deferred tax (assets)/liabilities

(i) Deferred tax charged to the income statement includes a £1m tax credit (2007: £14m tax charge) reported within profit for the year from discontinued operations.

Deferred tax assets and liabilities are only offset where there is a legally enforceable right of offset and there is intention to

settle the balances net. As at 31 March 2008 and 2007 the deferred tax balances are liabilities after offset.

At the balance sheet date there were no material current deferred tax assets or liabilities (2007: £nil).

Deferred tax assets in respect of capital losses and non-trade deficits have not been recognised as their future recovery is

uncertain or not currently anticipated. The deferred tax assets not recognised are as follows:

The capital losses and non-trade deficits are available to carry forward indefinitely. The capital losses can be offset against

specific types of future capital gains and non-trade deficits can be offset against specific future non-trade profits.

The aggregate amount of temporary differences associated with the unremitted earnings of overseas subsidiaries and joint

ventures for which deferred tax liabilities have not been recognised at the balance sheet date is approximately £930m (2007:

£811m). No liability is recognised in respect of the differences because the Company and its subsidiaries are in a position to

control the timing of the reversal of the temporary differences and it is probable that such differences will not reverse in the

foreseeable future.

Pensions

and other

Accelerated Share- post- Other net

tax based retirement Financial temporary

depreciation payments benefits instruments differences Total

£m £m £m £m £m £m

Deferred tax assets at 31 March 2006 (5) (28) (397) (6) (835) (1,271)

Deferred tax liabilities at 31 March 2006 3,126

–

–

20 127 3,273

At 1 A

p

ril 2006 3,121

(

28

)

(

397

)

14

(

708

)

2,002

Exchange adjustments (90) – 13 – 91 14

Char

g

ed/

(

credited

)

to income statement

(

i

)

321 9 82

(

9

)

54 457

(

Credited

)

/char

g

ed to e

q

uit

y

–

(

11

)

70 11

–

70

Ac

q

uisition of subsidiar

y

undertakin

g

s

–

–

2

–

(

13

)

(

11

)

Reclassification to liabilities of businesses held for sale (129) 1 1 – 3 (124)

Other 63

–

(

238

)

5 151

(

19

)

At 31 March 2007 3,286

(

29

)

(

467

)

21

(

422

)

2,389

Deferred tax assets at 31 March 2007

(

4

)

(

29

)

(

532

)

(

9

)

(

452

)

(

1,026

)

Deferred tax liabilities at 31 March 2007 3,290

–

65 30 30 3,415

At 1 A

p

ril 2007 3,286

(

29

)

(

467

)

21

(

422

)

2,389

Exchan

g

e ad

j

ustments

(

1

)

–

–

–

11 10

Char

g

ed/

(

credited

)

to income statement

(

i

)

123

–

(

9

)

(

2

)

196 308

Charged/(credited) to equity – 12 98 (4) – 106

Ac

q

uisition of subsidiar

y

undertakin

g

s

(

note 28

)

289

–

(

60

)

(

3

)

365 591

Other

(

2

)

12

–

23

At 31 March 2008 3,695

(

16

)

(

436

)

12 152 3,407

Deferred tax assets at 31 March 2008

(

2

)

(

16

)

(

685

)

(

17

)

(

322

)

(

1,042

)

Deferred tax liabilities at 31 March 2008 3,697 – 249 29 474 4,449

3,695

(

16

)

(

436

)

12 152 3,407

2008 2007

£m £m

Ca

p

ital losses 220 216

Non-trade deficits 10 203

Trading losses – 3