National Grid 2008 Annual Report Download - page 650

Download and view the complete annual report

Please find page 650 of the 2008 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424 -

425

425 -

426

426 -

427

427 -

428

428 -

429

429 -

430

430 -

431

431 -

432

432 -

433

433 -

434

434 -

435

435 -

436

436 -

437

437 -

438

438 -

439

439 -

440

440 -

441

441 -

442

442 -

443

443 -

444

444 -

445

445 -

446

446 -

447

447 -

448

448 -

449

449 -

450

450 -

451

451 -

452

452 -

453

453 -

454

454 -

455

455 -

456

456 -

457

457 -

458

458 -

459

459 -

460

460 -

461

461 -

462

462 -

463

463 -

464

464 -

465

465 -

466

466 -

467

467 -

468

468 -

469

469 -

470

470 -

471

471 -

472

472 -

473

473 -

474

474 -

475

475 -

476

476 -

477

477 -

478

478 -

479

479 -

480

480 -

481

481 -

482

482 -

483

483 -

484

484 -

485

485 -

486

486 -

487

487 -

488

488 -

489

489 -

490

490 -

491

491 -

492

492 -

493

493 -

494

494 -

495

495 -

496

496 -

497

497 -

498

498 -

499

499 -

500

500 -

501

501 -

502

502 -

503

503 -

504

504 -

505

505 -

506

506 -

507

507 -

508

508 -

509

509 -

510

510 -

511

511 -

512

512 -

513

513 -

514

514 -

515

515 -

516

516 -

517

517 -

518

518 -

519

519 -

520

520 -

521

521 -

522

522 -

523

523 -

524

524 -

525

525 -

526

526 -

527

527 -

528

528 -

529

529 -

530

530 -

531

531 -

532

532 -

533

533 -

534

534 -

535

535 -

536

536 -

537

537 -

538

538 -

539

539 -

540

540 -

541

541 -

542

542 -

543

543 -

544

544 -

545

545 -

546

546 -

547

547 -

548

548 -

549

549 -

550

550 -

551

551 -

552

552 -

553

553 -

554

554 -

555

555 -

556

556 -

557

557 -

558

558 -

559

559 -

560

560 -

561

561 -

562

562 -

563

563 -

564

564 -

565

565 -

566

566 -

567

567 -

568

568 -

569

569 -

570

570 -

571

571 -

572

572 -

573

573 -

574

574 -

575

575 -

576

576 -

577

577 -

578

578 -

579

579 -

580

580 -

581

581 -

582

582 -

583

583 -

584

584 -

585

585 -

586

586 -

587

587 -

588

588 -

589

589 -

590

590 -

591

591 -

592

592 -

593

593 -

594

594 -

595

595 -

596

596 -

597

597 -

598

598 -

599

599 -

600

600 -

601

601 -

602

602 -

603

603 -

604

604 -

605

605 -

606

606 -

607

607 -

608

608 -

609

609 -

610

610 -

611

611 -

612

612 -

613

613 -

614

614 -

615

615 -

616

616 -

617

617 -

618

618 -

619

619 -

620

620 -

621

621 -

622

622 -

623

623 -

624

624 -

625

625 -

626

626 -

627

627 -

628

628 -

629

629 -

630

630 -

631

631 -

632

632 -

633

633 -

634

634 -

635

635 -

636

636 -

637

637 -

638

638 -

639

639 -

640

640 -

641

641 -

642

642 -

643

643 -

644

644 -

645

645 -

646

646 -

647

647 -

648

648 -

649

649 -

650

650 -

651

651 -

652

652 -

653

653 -

654

654 -

655

655 -

656

656 -

657

657 -

658

658 -

659

659 -

660

660 -

661

661 -

662

662 -

663

663 -

664

664 -

665

665 -

666

666 -

667

667 -

668

668 -

669

669 -

670

670 -

671

671 -

672

672 -

673

673 -

674

674 -

675

675 -

676

676 -

677

677 -

678

678 -

679

679 -

680

680 -

681

681 -

682

682 -

683

683 -

684

684 -

685

685 -

686

686 -

687

687 -

688

688 -

689

689 -

690

690 -

691

691 -

692

692 -

693

693 -

694

694 -

695

695 -

696

696 -

697

697 -

698

698 -

699

699 -

700

700 -

701

701 -

702

702 -

703

703 -

704

704 -

705

705 -

706

706 -

707

707 -

708

708 -

709

709 -

710

710 -

711

711 -

712

712 -

713

713 -

714

714 -

715

715 -

716

716 -

717

717 -

718

718

|

|

BOWNE INTEGRATED TYPESETTING SYSTEM

CRC: 6418

Name: NATIONAL GRID

Date: 17-JUN-2008 03:10:51.35Operator: BNY99999TPhone: (212)924-5500Site: BOWNE OF NEW YORK

Y59930.SUB, DocName: EX-15.1, Doc: 16, Page: 123

Description: EXHIBIT 15.1

0/7319.00.00.00Y59930BNY

[E/O] EDGAR 2 *Y59930/319/7*

BOWNE INTEGRATED TYPESETTING SYSTEM

CRC: 6418

Name: NATIONAL GRID

Date: 17-JUN-2008 03:10:51.35Operator: BNY99999TPhone: (212)924-5500Site: BOWNE OF NEW YORK

Y59930.SUB, DocName: EX-15.1, Doc: 16, Page: 123

Description: EXHIBIT 15.1

0/7319.00.00.00Y59930BNY

[E/O] EDGAR 2 *Y59930/319/7*

Table of Contents

Annual Report and Accounts 2007/08

131

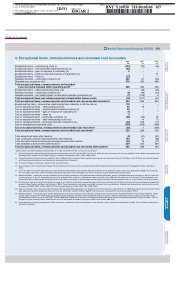

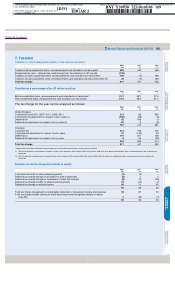

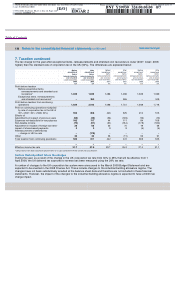

4. Exceptional items, remeasurements and stranded cost recoveries

2008 2007 2006

£m £m £m

Exce

p

tional items

–

restructurin

g

costs

(

i

)

(

133

)

(

22

)

(

55

)

Exce

p

tional items

–

environmental related

p

rovisions

(

ii

)

(

92

)

–

–

Exceptional items – gain on disposal of subsidiary (iii) 6 – –

Exce

p

tional items

–

p

rofit on sale and reversal of im

p

airment

(

iv

)

–

–

21

Exce

p

tional items

–

other

(

v

)

(

23

)

–

–

Remeasurements

–

commodit

y

contracts

(

vi

)

232 81

(

49

)

Stranded cost recoveries (vii)* 379 423 489

Total exceptional items, remeasurements and stranded

cost recoveries included within o

p

eratin

g

p

rofit* 369 482 406

Exce

p

tional items

–

debt restructurin

g

costs

(

viii

)

–

(

45

)

(

49

)

Remeasurements

–

commodit

y

contracts

(

vi

)

(

9

)

(

19

)

(

14

)

Remeasurements – net (losses)/gains on derivative financial instruments (ix) (7) (153) 6

Total exce

p

tional items and remeasurements included within finance costs

(

16

)

(

217

)

(

57

)

Total exce

p

tional items, remeasurements and stranded cost recoveries before taxation* 353 265 349

Exce

p

tional tax item

–

deferred tax credit arisin

g

from reduction in UK tax rate

(

x

)

170

–

–

Tax on exceptional items – restructuring costs (i) 49 12 7

Tax on exce

p

tional items

–

environmental related

p

rovisions

(

ii

)

20

–

–

Tax on exce

p

tional items

–

g

ain on dis

p

osal of subsidiar

y

(

iii

)

(

4

)

–

–

Tax on exce

p

tional items

–

other

(

v

)

5

–

–

Tax on remeasurements – commodity contracts (vi) (90) (25) 25

Tax on exce

p

tional items

–

debt restructurin

g

costs

(

viii

)

–

14 15

Tax on remeasurements

–

derivative financial instruments

(

ix

)

(

28

)

169

(

17

)

Tax on stranded cost recoveries

(

vii

)

*

(

150

)

(

169

)

(

196

)

Tax on exce

p

tional items, remeasurements and stranded cost recoveries*

(

28

)

1

(

166

)

Total exceptional items, remeasurements and stranded cost recoveries* 325 266 183

Total exce

p

tional items after taxation

(

2

)

(

41

)

(

61

)

Total commodity contract remeasurements after taxation 133 37 (38)

Total derivative financial instrument remeasurements after taxation

(

35

)

16

(

11

)

Total stranded cost recoveries after taxation* 229 254 293

Total exce

p

tional items, remeasurements and stranded cost recoveries after taxation* 325 266 183

*Comparatives have been adjusted to present items on a basis consistent with the current year classification

(i) Restructuring costs relate to planned cost reduction programmes in the UK and US (2007: UK and US; 2006: UK only) businesses. For the year ended 31 March 2008, restructuring costs

included pension related costs of £83m arising as a result of redundancies (2007: £10m; 2006: £25m).

(ii) The environmental charge for the year ended 31 March 2008 includes a charge of £44m resulting from revised cost estimates in the UK and £48m in the US. Costs incurred with respect

to US environmental provisions are substantially recoverable from customers.

(iii) The gain on disposal of subsidiary relates to the sale of Advantica.

(iv) Gain on disposal of an investment in Energis Polska of £8m and reversal of a prior year impairment of £13m related to National Grid’s investment in Copperbelt Energy Corporation

(CEC).

(v) A cost of £15m was incurred during the year ended 31 March 2008 relating to the potential disposal of National Grid’s property business which we subsequently decided not to proceed

with. In addition, there was a £4m amortisation charge on acquisition-related intangibles and a £4m increase in nuclear decommissioning provisions.

(vi) Remeasurements – commodity contracts represent mark-to-market movements on certain commodity contract obligations, primarily indexed-linked swap contracts, in the US. Under the

existing rate plans in the US, commodity costs are fully recovered from customers, although the pattern of recovery may differ from the pattern of costs incurred. These movements are

comprised of those impacting operating profit which are based on the change in the commodity contract liability and those impacting finance costs as a result of the time value of money.

(vii) Stranded cost recoveries capture the recovery of some of our historical investments in generating plants that were divested as part of the restructuring and wholesale power deregulation

process in New England and New York during the 1990s. These recoveries are no longer considered to be part of our core business. Stranded cost recoveries on a pre-tax basis consist

of revenue of £382m (2007: £426m; 2006: £517m) and operating costs of £3m (2007: £3m; 2006: £28m).

(viii) Debt restructuring costs in the year ended 31 March 2007 represent debt redemption costs related to the restructuring of our debt portfolio. For 2006 these related to costs incurred on the

early redemption of debt following the disposal of four gas distribution networks (£39m), together with issue costs associated with the B share scheme (£10m).

(ix) Remeasurements – net (losses)/gains on derivative financial instruments comprise losses and gains arising on derivative financial instruments reported in the income statement. These

exclude gains and losses for which hedge accounting has been effective, which have been recognised directly in equity or offset by adjustments to the carrying value of debt. These

remeasurements include a loss of £3m (2007: £126m; 2006: £nil) relating to pre-tax losses on investment related derivative financial instruments that offset on a post-tax basis. The tax

charge in the year ended 31 March 2008 includes an £11m adjustment in respect of prior years (2007: £56m credit; 2006: £nil).

(x) The exceptional tax credit in the period of £170m arose from a reduction in the UK corporation tax rate from 30% to 28% included in the Finance Act 2007. This resulted in a reduction in

deferred tax liabilities.