NVIDIA 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

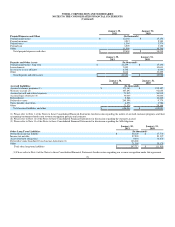

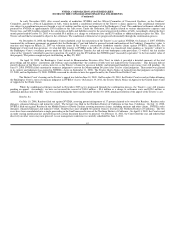

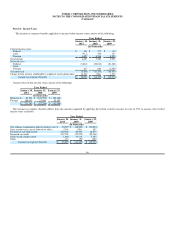

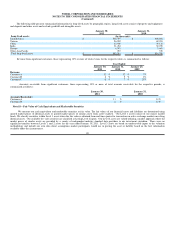

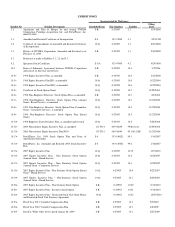

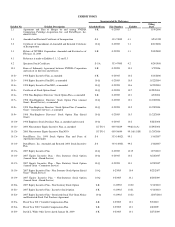

A reconciliation of unrecognized tax benefits is as follows:

January 30,

2011 January 31,

2010 January 25,

2009

(In thousands)

Balance at beginning of period $ 109,765 $ 95,319 $ 77,791

Increases in tax positions for prior years - 351 6,297

Decreases in tax positions for prior years (3,585) (131) (272)

Increases in tax positions for current year 18,628 18,342 13,622

Settlements (358) - (181)

Lapse in statute of limitations (3,416) (4,116) (1,938)

Balance at end of period $ 121,034 $ 109,765 $ 95,319

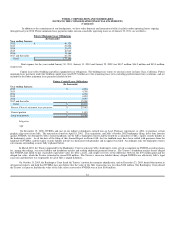

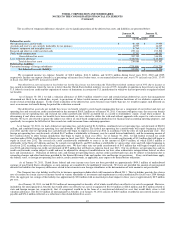

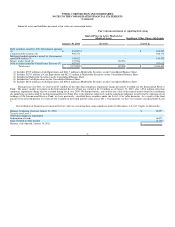

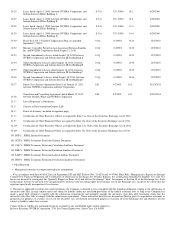

We classify an unrecognized tax benefit as a current liability, or as a reduction of the amount of a net operating loss carryforward or amount

refundable, to the extent that we anticipate payment or receipt of cash for income taxes within one year. Likewise, the amount is classified as a long-term

liability if we anticipate payment or receipt of cash for income taxes during a period beyond a year.

Our policy is to include interest and penalties related to unrecognized tax benefits as a component of income tax expense. As of January 30, 2011 and

January 31, 2010, and January 25, 2009, we had accrued $11.2 million, $11.2 million, and $11.8 million, respectively, for the payment of interest and

penalties related to unrecognized tax benefits, which is not included as a component of our unrecognized tax benefits. As of January 30, 2011, non-current

income taxes payable of $57.6 million consists of unrecognized tax benefits of $46.4 million and the related interest and penalties of $11.2 million.

While we believe that we have adequately provided for all tax positions, amounts asserted by tax authorities could be greater or less than our accrued

position. Accordingly, our provisions on federal, state and foreign tax-related matters to be recorded in the future may change as revised estimates are made or

the underlying matters are settled or otherwise resolved. As of January 30, 2011, we do not believe that our estimates, as otherwise provided for, on such tax

positions will significantly increase or decrease within the next twelve months.

We are subject to taxation by a number of taxing authorities both in the United States and throughout the world. As of January 30, 2011, the material

tax jurisdictions that are subject to examination include the United States, Hong Kong, Taiwan, China, India, and Germany and include our fiscal years 2004

through 2011. As of January 30, 2011, the material tax jurisdiction for which we are currently under examination include India for fiscal years 2003 through

2007.

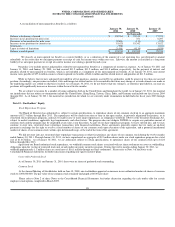

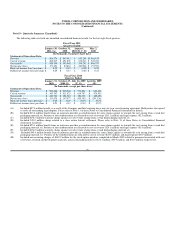

Note 15 - Stockholders’ Equity

Stock Repurchase Program

Our Board of Directors has authorized us, subject to certain specifications, to repurchase shares of our common stock up to an aggregate maximum

amount of $2.7 billion through May 2013. The repurchases will be made from time to time in the open market, in privately negotiated transactions, or in

structured stock repurchase programs, and may be made in one or more larger repurchases, in compliance with Rule 10b-18 of the Securities Exchange Act,

subject to market conditions, applicable legal requirements, and other factors. The program does not obligate NVIDIA to acquire any particular amount of

common stock and the program may be suspended at any time at our discretion. As part of our share repurchase program, we have entered into, and we may

continue to enter into, structured share repurchase transactions with financial institutions. These agreements generally require that we make an up-front

payment in exchange for the right to receive a fixed number of shares of our common stock upon execution of the agreement, and a potential incremental

number of shares of our common stock, within a pre-determined range, at the end of the term of the agreement.

We did not enter into any structured share repurchase transactions or otherwise purchase any shares of our common stock during the twelve months

ended January 30, 2011. Through January 30, 2011, we have repurchased an aggregate of 90.9 million shares under our stock repurchase program for a total

cost of $1.46 billion. As of January 30, 2011, we are authorized, subject to certain specifications, to repurchase shares of our common stock up to $1.24

billion through May 2013.

Apart from our Board authorized stock repurchases, we withhold common stock shares associated with net share settlements to cover tax withholding

obligations upon the vesting of restricted stock unit awards under our equity incentive program. During the twelve months ending January 30, 2011, we

withheld approximately 1.1 million shares at a total cost of $16.1 million through net share settlements. Please refer to Note 3 of the Notes to the

Consolidated Financial Statements for further discussion regarding our equity incentive plans.

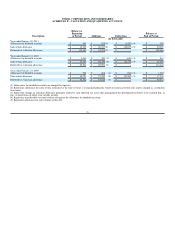

Convertible Preferred Stock

As of January 30, 2011 and January 31, 2010, there were no shares of preferred stock outstanding.

Common Stock

At the Annual Meeting of Stockholders held on June 19, 2008, our stockholders approved an increase in our authorized number of shares of common

stock to 2,000,000,000. The par value of our common stock remained unchanged at $0.001 per share.

Please refer to Note 2 of these Notes to the Consolidated Financial Statements for further discussion regarding the cash tender offer for certain

employee stock options completed in March 2009.

88