NVIDIA 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

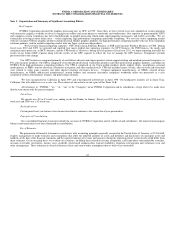

Rent Expense

We recognize rent expense on a straight-line basis over the lease period and accrue for rent expense incurred, but not paid.

Product Warranties

We generally offer limited warranty to end-users that ranges from one to three years for products in order to repair or replace products for any

manufacturing defects or hardware component failures. Cost of revenue includes the estimated cost of product warranties that are calculated at the point of

revenue recognition. Under limited circumstances, we may offer an extended limited warranty to customers for certain products. We also accrue for known

warranty and indemnification issues if a loss is probable and can be reasonably estimated.

Stock-based Compensation

We measure stock-based compensation expense at the grant date of the related equity awards, based on the estimated fair value of the awards, and

recognize the expense using the straight-line attribution method over the requisite employee service period. We estimate the fair value of employee stock

options on the date of grant using a binomial model and we use the closing trading price of our common stock on the date of grant as the fair value of awards

of restricted stock units, or RSUs. We calculate the fair value of our employee stock purchase plan using the Black-Scholes model. Our stock based

compensation for employee stock purchase plan is expensed using an accelerated amortization model.

Litigation, Investigation and Settlement Costs

From time to time, we are involved in legal actions and/or investigations by regulatory bodies. We are aggressively defending our current litigation

matters for which we are responsible. However, there are many uncertainties associated with any litigation or investigation, and we cannot be certain that

these actions or other third-party claims against us will be resolved without costly litigation, fines and/or substantial settlement payments. If that occurs, our

business, financial condition and results of operations could be materially and adversely affected. If information becomes available that causes us to determine

that a loss in any of our pending litigation, investigations or settlements is probable, and we can reasonably estimate the loss associated with such events, we

will record the loss in accordance with U.S.GAAP. However, the actual liability in any such litigation or investigations may be materially different from our

estimates, which could require us to record additional costs.

Foreign Currency Translation

We use the United States dollar as our functional currency for all of our subsidiaries. Foreign currency monetary assets and liabilities are remeasured

into United States dollars at end-of-period exchange rates. Non-monetary assets and liabilities such as property and equipment, and equity are remeasured at

historical exchange rates. Revenue and expenses are remeasured at average exchange rates in effect during each period, except for those expenses related to

the previously noted balance sheet amounts, which are remeasured at historical exchange rates. Gains or losses from foreign currency remeasurement are

included in “Other income (expense), net” in our Consolidated Financial Statements and to date have not been significant.

The impact of net foreign currency transaction loss included in determining net income (loss) for fiscal years 2011, 2010 and 2009 was $2.4 million,

$0.9 million and $2.0 million, respectively.

64